At the Texas Public Power Association conference on July 24th, Trip Doggett, the CEO of the Electric Reliability Council of Texas (ERCOT) provided a tremendous amount of information and insight in to the state of the Texas wholesale power market. Some of the key areas he covered included:

-

The generation fuel mix in ERCOT;

-

Concerns about future resource adequacy in ERCOT; and

-

The potential for demand response programs to impact the ERCOT market.

All of these factors impact the development and implementation of sound energy risk management strategies.

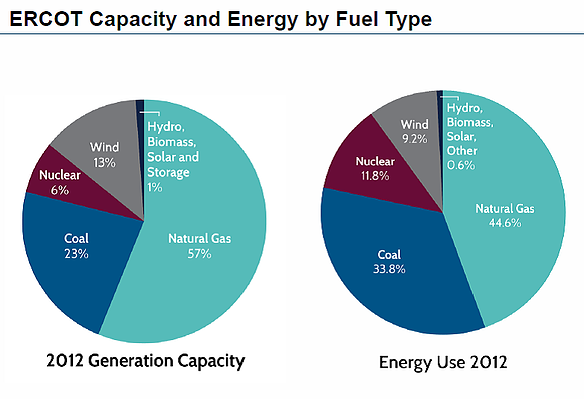

Generation Fuel Mix

Anyone familiar with the ERCOT market knows that natural gas is the primary fuel source for generation in Texas. As seen in pie charts below, natural gas generation accounts for 57% of the installed generation capacity in ERCOT, but provides just roughly 45% of the actual energy consumed. The reason that natural gas provides less than half of the actual energy consumed is due to the base load nature of coal and nuclear plants. Base load means, that these plants run most of the time and do not shut down except for maintenance or forced outages. Natural Gas fired combined-cycle plants typically used to have base load operations; however, power plant operators currently cycle these plants to optimize operations. Therefore, combined cycle plants are very competitive in covering intermediate load. The fact that ERCOT is so dependent on natural gas fired generation explains why power prices in ERCOT are so tied to natural gas prices.

The explosion in shale production in the Marcellus, Permian Basin and the Eagle Ford Shales have created a situation where plentiful natural gas has served to depress natural gas and power prices over the past several years in markets where natural gas is the marginal fuel.

Resource Adequacy—What Does the Future Hold?

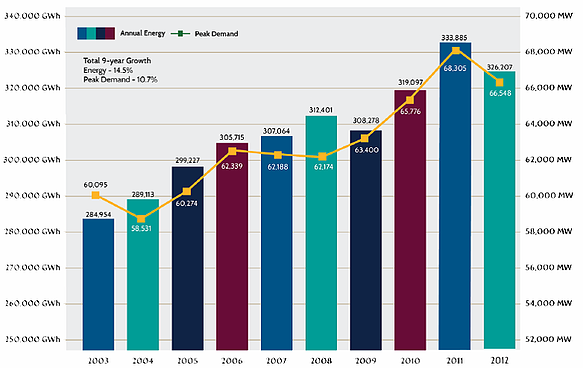

Resource adequacy is the industry term for making sure that there is sufficient generation capacity to meet expected generation demand. The chart below compares annual energy consumption (the left hand scale) with actual peak demand over the past decade.

This chart illustrates 2 key points:

1) Energy consumption has been on a steady upward trend over the past decade with the exception of 2009, when energy usage was down due to a slump in the economy; and

2) Peak demand, which is the highest demand at any instant in time, has grown approximately 10% over the past decade.

a) Load growth in Texas has been a function of population and Oil and NG E&P growth.

b) Peak demand is also a function of weather. In 2011 ERCOT set its maximum peak demand at 68,416MW due to record breaking temperature in August.

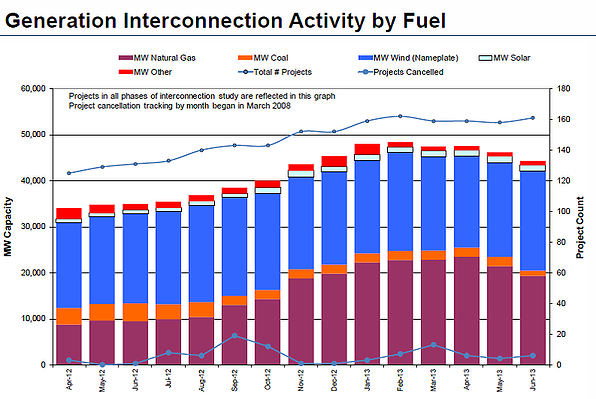

The growth in demand requires a comparable increase in the generation fleet to insure reliability. Given the relatively low energy prices in ERCOT over the past several years, however, revenues available to finance new generation projects has been insufficient. As a result, the gap between supply and demand is shrinking, creating conditions for higher power prices at times of peak demand and the potential for blackouts if power demand spikes unexpectedly. While there are justifiable concerns about the future resource adequacy in Texas, the chart below illustrates various power plants that are under study and could be built in ERCOT. As part of the process of providing power in ERCOT, new generation resources are required to go through an interconnection study to determine the impact that the new generator could have on power flows, before being able to sell power in ERCOT (note, this is not an economic analysis of the potential impact of a power plant on prices in ERCOT, but rather an engineering study of the impact of new generation on reliability and power flows in ERCOT).

The graph above appears to paint a very bright future for resource adequacy in ERCOT. However, there are two important caveats that explain why concerns about resource adequacy persist.

1) Simply because a generation project is undertaking an interconnection study does not mean that it will actually get built. The blue line at the bottom reflects the number of projects that have been cancelled by month since April of last year. While the number of projects cancelled is a useful metric, it could reveal even more if it included the actual number of megawatts that have been cancelled.

2) While natural gas fired generation (represented by the purple color) is a significant portion of the generation projects under study, there is a significant increase projected in wind capacity. While wind powered generation provides environmental and cost benefits, it does not do a lot to alleviate concerns about resource adequacy. For instance, during the hottest times of the year, which is when peak demand occurs and there is the greatest risk of price spikes and/or emergency events, the wind generation accounts for a small fraction of total capacity (~5.5% during July and August of 2012); meaning that wind powered generation is generally unavailable to meet power demand.

While there are a lot of potential generation projects being studied in the Texas market, the vast majority of them will never actually break ground, meaning that if demand continues to increase, the margin between supply and demand will shrink, further stressing the power grid and increasing the frequency of emergency events which could ultimately result in blackouts.

Demand Response—A key piece to the puzzle’

While a majority of the presentation focused on the generation/supply side of the equation, there was considerable discussion of demand response initiatives in ERCOT. Demand response occurs when end users decide to reduce their load during times of high demand and are paid for taking this action. Some observations about the role of demand response include:

1) A recognition that residential load is the key driver behind demand, accounting for just over half of the demand during peak Summer times. This mostly untapped market could provide significant reliability benefits for the power grid and ERCOT estimates that swimming pool pumps alone account for as much as 1,000 MW in demand. If pool pumps are not run during critical peak times, this could provide substantial reliability benefits to the ERCOT market.

2) The Public Utility Commission of Texas (PUCT) is looking at demand response to provide better price signals in the market, meaning that customers with demand response would have greater ability to earn money from curtailing their load. These new programs are designed to transform demand response from a mechanism which dampens the price signals in the ERCOT market to one where load participation actually helps determine the price. While these discussions are still in the early stages, this signals a fundamental paradigm shift in the role of demand response in maintaining energy reliability and price formation in the ERCOT market.

Conclusion

The ERCOT power market will contiue to grow and evolve over time. The wholesale power market is facing challenges of resource adequacy giving all a reason for concern. However, there is also growth in the market for demand response participation. Load will have to become much more proactive not only in relieving stress on the grid, but also in actively managing energy options (e.g. load shedding or back up generation) to reduce energy spend through the participation in demand response programs. To implement effective energy risk management strategies requires a comprehensive understanding of the likely impact of these trends on the future of the ERCOT wholesale power market.