ENERGY INSIGHTS: JULY 18, 2012

Today above normal temperatures and nuclear outages drove prices close to $3.00/MMBtu. The imbalance between supply and demand continues to tighten, so be sure to contact your Acclaim representative to evaluate your current situation.

NATURAL GAS

Prices rose sharply today, 7/18/12, ahead of EIA’s weekly storage report. Besides current supporting weather conditions, nuclear outages were reported in the Northeast. Therefore near term demand is expected to increase.

Since 7/6/12, NG had traded within a range between $2.70/MMBtu and $3.00/MMBtu. We have seen significant support and resistance at these levels respectively. On one hand, defensive buying around the $2.70 level shows that there is a perception that NG is undervalued at this price, on the other, around the high side of the range, economics favor the burning of coal for power generation.

Since the second half of June 2012, a high pressure system has contributed to record high temperatures, which have caused an increase in natural gas-fired electricity demand. Moderate to extreme drought conditions have enhanced heat spikes across the eastern half of the US. Likewise, such demand has trimmed inventory injections. Prevailing warm temperatures in the Central states will cause this trend to continue. Even though there is still a supply overhang, concerns about reaching storage capacity are dwindling.

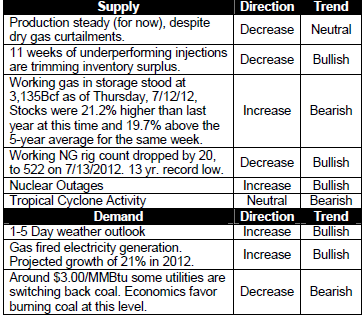

The table below show a list of factors that are affecting the trend of supply and demand:

Technical Analysis: Fig. 4 shows that today, 7/18/12, the August- 12 contract price broke resistance and momentum is pushing toward $3.00/MMBtu. This is the third time this month that it has tested this resistance level. A close above $2.98/MMBtu, would suggest a move up that could extend to new highs ~$3.08/MMBtu. We do expect to see a pullback; however, there is a bullish sentiment that has not allowed prices to go below the 200 day

moving average price.

Summary: We will continue to monitor the dropping natural gas rig count as this decline will eventually bring production numbers down. We believe this will happen in the coming months since there is a lag between dropping rig count and actual production. We expect to see high volatility in the coming weeks, so we recommend taking advantage of price dips. We currently have a neutral outlook for the near term and we are starting to have a more bullish outlook for the second half of 2013 and beyond.

ERCOT Heat Rates

August 2012 Heat Rates has trended slightly higher in the past couple of days, and 2013 and 2014 summer (July & August) heat rates have come off slightly.

The U.S. Court of Appeals for the D.C. Circuit is expected to make a decision on EPA’s Cross State Air Pollution Rule. Even if the rule is upheld EPA might not be able to implement it until late 2013 or 2014, so an increase in forward market implied heat rates is possible.

Contact your Acclaim representative to further discuss your current situation.