Every year the Energy Information Administration (EIA) provides an updated Energy Outlook that projects future supply and demand trends. In their latest outlook, released between April 15–May 2, 2013, the findings on natural gas were particularly instructive, especially for energy risk management professionals. While the Outlook goes through 2040, the confidence level in the projections obviously decreases over time. Following is a high level summary of the reports’ projections related to natural gas and some thoughts on the impact these trends could have on energy risk management strategies going forward.

Key Supply Drivers

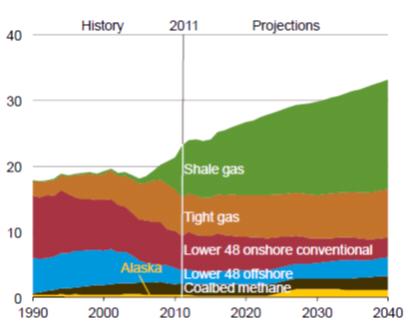

The natural gas supply picture is dominated by one word—fracking. As the graphic below illustrates, shale gas production started increasing around 2006 and is projected to increase by over 100% per year from 2013 through 2040. The increase in shale gas, combined with increases in off-shore, coal bed methane and production in Alaska starting after 2020, more than offset the production declines, along with conventional and off-shore production.

Natural Gas Production Sources (TCF) 1990-2040

Source: EIA 2013 Annual Energy Outlook at 79.

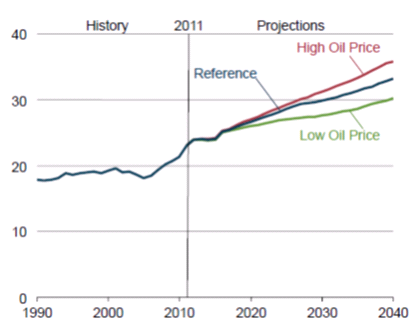

While fracking is the critical driver in natural gas supply, projected oil prices also have an impact on natural gas production.

The following graph estimates production of natural gas under three different oil price scenarios—high oil prices, the reference case and low oil prices.

Impact of Oil Prices on Projected Natural Gas Production.

Source: EIA Report at 78.

Intuitively, it makes sense that natural gas production moves in tandem with oil prices, since both resources can typically be extracted from the same well, meaning that as more oil wells are drilled as a result of higher prices, more natural gas is likely to be recovered as a by-product.

Key Demand Drivers

While the supply picture is dominated by new supplies available as a result of fracking, the demand picture is influenced by a variety of factors:

-

Increased use of natural gas in the power generation sector.

According to the EIA, consumption of natural gas as a generation fuel source increases by 0.8% annually during the study period. This increase is attributable to:

-

An increase in coal to natural gas switching due to lower natural gas prices. Generally, it is more economical to burn natural gas as opposed to coal, when natural gas prices are below $4.25/MMBtu. The breakeven price depends on the region due to differences in coal transportation costs.

-

Stricter power plant emission regulations from The Environmental Protection Agency (EPA) are making coal power less cost effective and will reduce the market share of coal in the generation sector.

-

Retirement of coal-fired power plants will far outpace new additions.

-

Growth of natural gas as a transportation fuel. As oil prices continue to climb, there will be an increasing shift to natural gas fired commercial and personal vehicles. According to the EIA, the use of natural gas as a transportation fuel is set to increase from 40 billion cubic feet annually to over 1 trillion cubic feet by 2040.

-

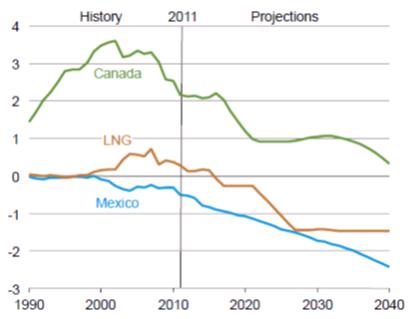

Exports. With the boom in natural gas production, the EIA expects a shift from the U.S. as a net importer of natural gas to a net exporter. While a lot of recent attention has focused on exports of liquefied natural gas (LNG), there will be a decrease in imports from Canada as well as a growth in exports to Mexico and of LNG as seen in the following graph.

-

U.S. Net Import of Natural Gas by Source, 1990-2040 (Trillion Cubic Feet)

Source: EIA Report at 78.

While the EIA report concludes that there will be sufficient domestic supply to meet domestic demand through 2040, the increase in demand for natural gas as a fuel for generation, transportation, and a shift from the position of net importer to a net exporter of natural gas will serve to increase demand.

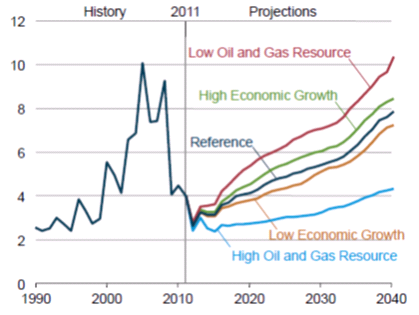

Key Price Drivers

While the supply/demand balance will be strongly positive in that supply is unlikely to keep pace with growing demand, the increased demand will likely drive up natural gas prices. As demand increases, cheap and easy to access natural gas reservoirs will dwindle, pushing up the production costs for incremental natural gas supply. While a variety of factors will impact future price of natural gas, such as economic growth and oil and natural gas recovery rates, the EIA reference case anticipates an increase in natural gas prices of roughly 2.5% per year starting in 2015, as seen in the graph below.

Annual Average Henry Hub Spot Prices for Natural Gas

Source: EIA Report at 77.

Potential Impacts on Energy Risk Management Strategies

Given the depth and scope of the EIA report, the natural question is what does all of this data mean for implementation of an energy risk management strategy? Looking at the EIA report at a holistic level, the future of natural gas is very bright. Supply is expected to continue to increase, although the costs to access this additional supply will likely climb as well. Demand will also increase as natural gas powers the economy more and more in terms of generation, transportation, and serves as an export.

Taking these factors in to consideration as well the anticipated reduction in coal fired power, the EIA projects that natural gas and power prices will increase starting in 2015. Given this backdrop, we recommend that end users contact their energy advisor to discuss how to develop a sound risk management strategy to not only protect against price increases, but also to take advantage of windows of opportunity.