Typically, in most deregulated markets, monthly Real-Time (“RT”) settlement price averages are lower compared to monthly forward electricity prices; however, due to high volatility, index (variable) prices can be very risky for commercial and industrial (“C&I”) consumers. Forward prices are higher because consumers or speculators are willing to pay a premium today for electricity that will be delivered in the future, rather than being exposed to price risk. Depending on the market and risk appetite, electricity consumers should be aware of the risk/reward profile (incremental cost vs. potential savings) of an electricity index product. In some markets, like ERCOT, being exposed to RT index prices could be a very risky proposition since the RT prices are now capped at $9,000/MWh (or $9.00/kWh). The risk of prices reaching such price cap could blow the annual budgeted electricity spend of any C&I consumer. The charts below shows calendar year RT price averages for the Houston Load Zone (“LZ”) since 2010.

Historical Ercot Real-Time Index Price Analysis - What Has Changed?

Posted by Alberto Rios on Sep 24, 2015 11:58:00 AM

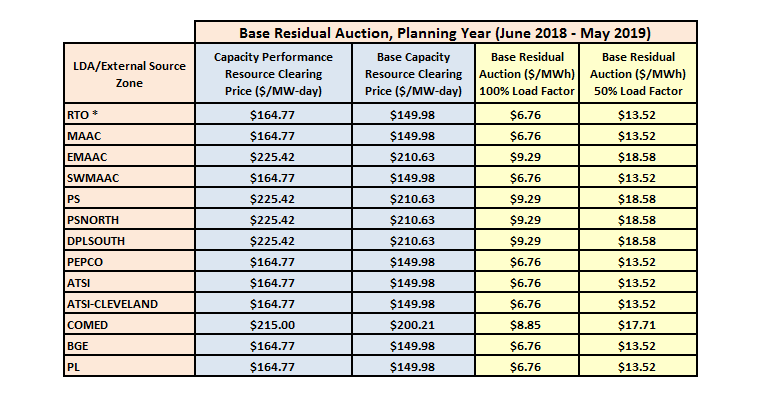

PJM Capacity Prices Jump in PJM - Hefty Reliability Cost

Posted by Alberto Rios on Sep 2, 2015 10:37:00 AM

Background

On Friday August 21, 2015, PJM released its annual capacity auction results for 2018/2019. The results were delayed 3 months to allow the Federal Energy Regulatory Commission (FERC) to review and approve the new Capacity Performance rules.

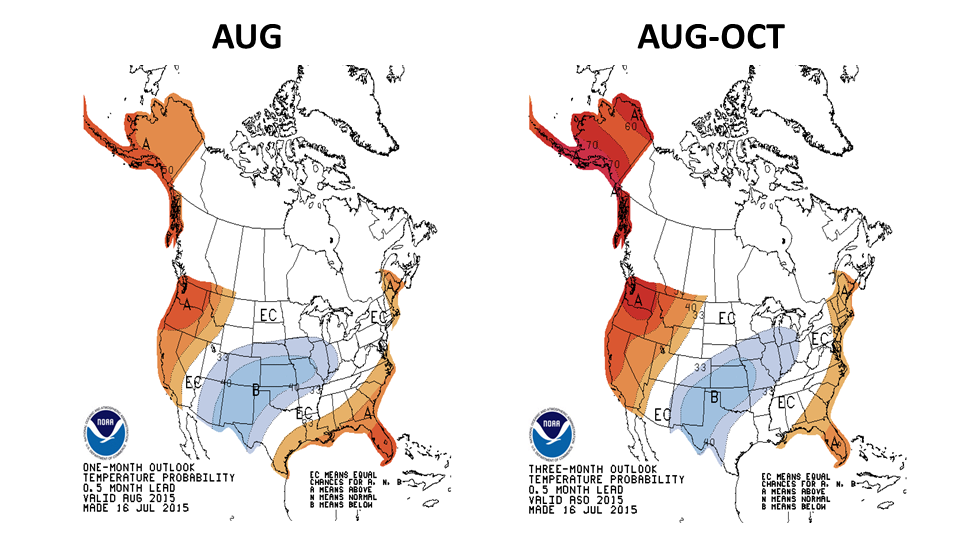

5 Drivers That Will Have An Effect On Energy Commodity Prices During the Second Half of the Summer

Posted by Alberto Rios on Aug 10, 2015 9:29:00 AM

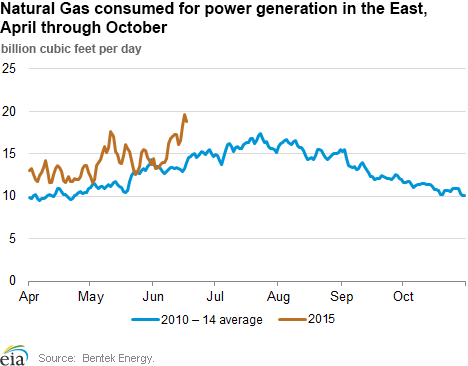

CAN INCREASING DEMAND FROM THE POWER SECTOR BALANCE AN OVERSUPPLIED NATURAL GAS MARKET?

Posted by Alberto Rios on Jul 31, 2015 1:18:20 PM

Natural gas use for power generation (“Power Burn”) has trended higher in 2015 compared to the 5-year average (2010-2014).

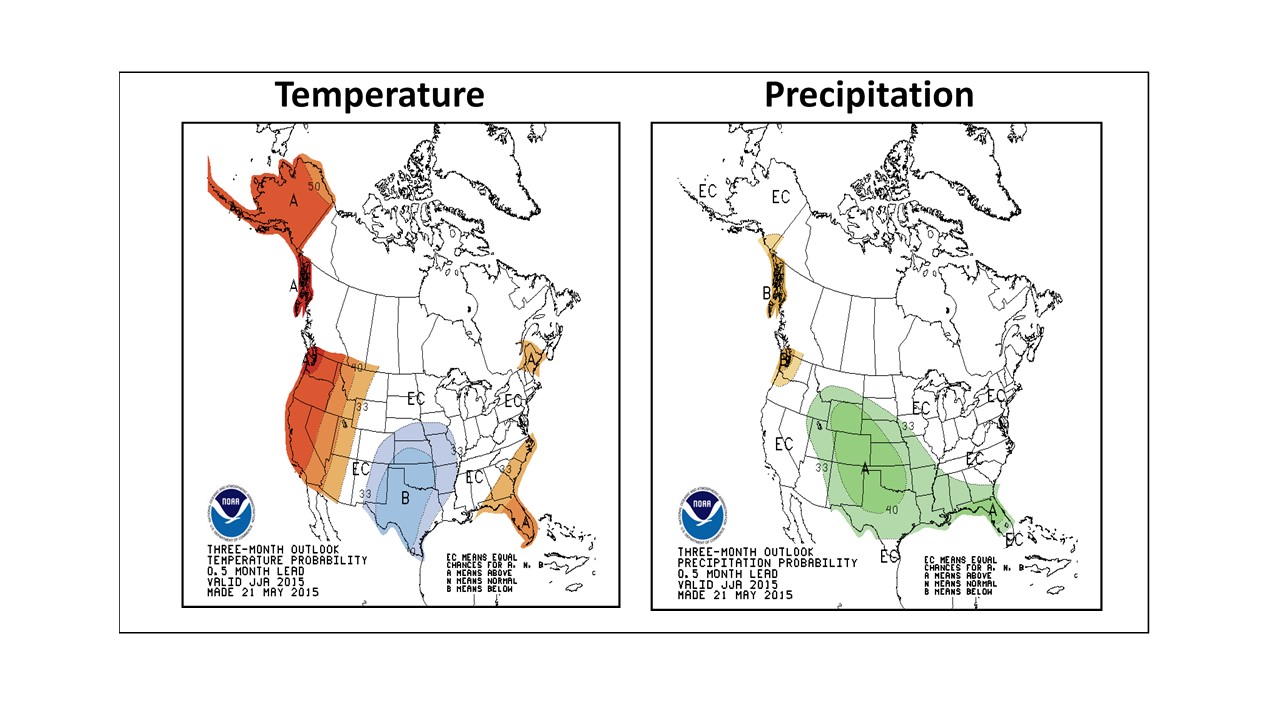

SUMMER WEATHER OUTLOOK AND NOAA 2015 ATLANTIC HURRICANE SEASON OUTLOOK – PRICE RISK MANAGEMENT AHEAD OF THE SUMMER

Posted by Alberto Rios on Jun 12, 2015 11:45:57 AM

Weather continues to be a major natural gas and electricity price driver, and recently has limited the downward move ahead of the summer. The latest near-term weather forecasts are calling for above normal in the West and the Eastern third of the country, boosting expectations of cooling demand. The Energy Information Administration projected that during the 2015 summer, average consumption of natural gas for power generation will likely reach 26.7 billion cubic feet per day (Bcf/d). The record for summer natural gas-fired power generation was set in 2012, when consumption averaged 27.9 Bcf/d. How close we get to such record will be a function of the low natural gas price environment and how much summer temperatures raise demand for gas-fired generation to provide air conditioning.

CALIFORNIA DROUGHT AND ELECTRICITY FORWARD PRICES – HOW WILL IT AFFECT SUMMER 2015 PRICES?

Posted by Alberto Rios on May 29, 2015 3:55:00 PM

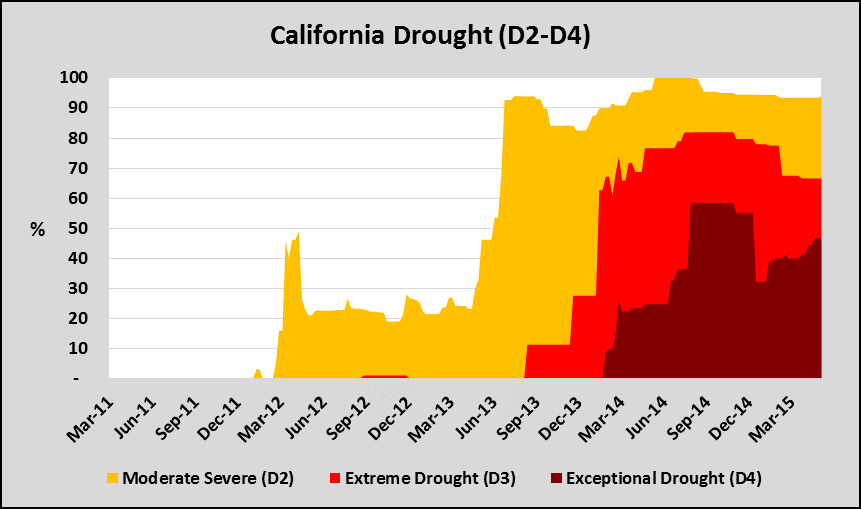

Historical Drought Picture

Drought Conditions: The latest U.S. Drought Monitor report, which was released on 5/21/2015 showed that following drought conditions by category :

IS NATURAL GAS PRODUCTION SLOWING DOWN – COULD PRICES BE AFFECTED?

Posted by Alberto Rios on Apr 29, 2015 1:04:24 PM

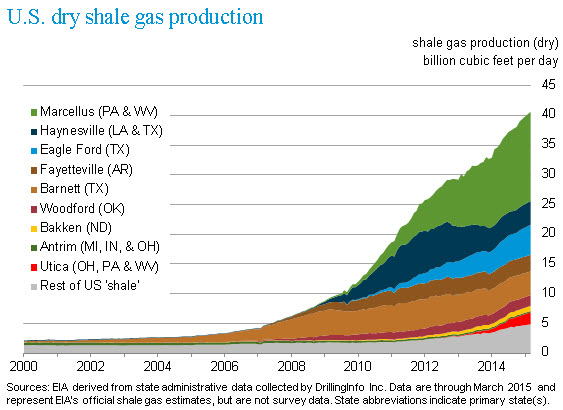

Natural gas production from shale began approximately 15 years ago, when it became a large scale commercial reality in North Texas. As more companies became aware of the commercial success and gained confidence in their ability to profit from hydraulic fracturing, shale production spread to other shale formations across the country. The chart below shows the significant increase in U.S. dry shale gas production through March 2015. Gas from shale now comprises nearly 50% of total U.S. production (Source: EIA)

Opportunistic Low Energy Price Environment- Excellent Long Term Savings Potential

Posted by Alberto Rios on Apr 15, 2015 9:50:00 AM

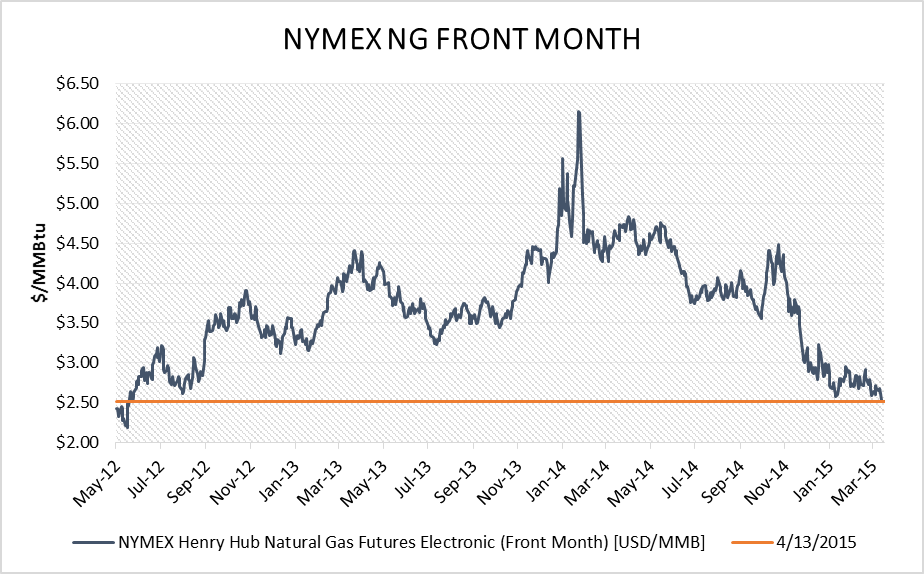

Depressed gas and electricity markets present one of the best buying environments in many years, even for terms as far out as 2020. This is particularly noteworthy considering the much higher price levels and prevailing market anxiety as we emerged from the Polar Vortex a year earlier.

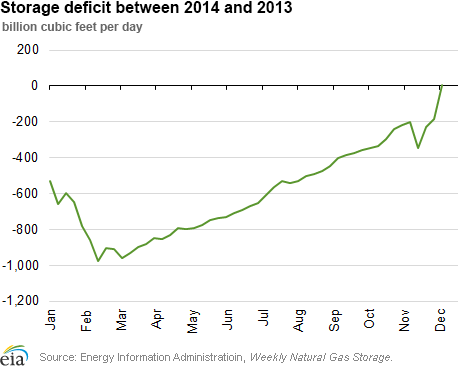

In March 2014, natural gas (NG) inventories fell to 822 Bcf after a brutally cold winter that boosted heating demand well above normal levels. The sharp decline in inventories kept natural gas and electricity prices higher through most of 2014. However, record natural gas production, especially from shale plays including Marcellus have slowly replenished storage. Currently natural gas production is between 5 -7 Bcf higher compared to last year, so supply could outweigh demand throughout 2015.

Topics: Polar Vortex, ERCOT, Acclaim Energy Advisors, demand response, energy savings, energy costs, natural gas, energy blog, energy supply, distributed generation, current outlook, heating demand, electricity markets, Energy Prices, Energy Trends, Fixed Prices, Weak Spot Prices

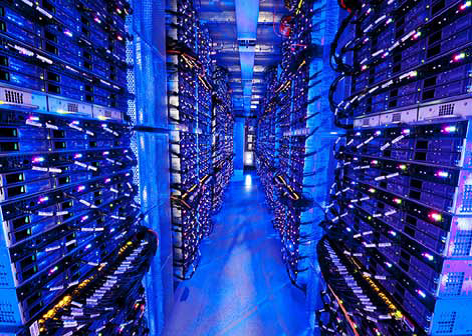

Data Centers: The Case for Energy Risk Management and Energy Reliability

Posted by Alberto Rios on Mar 11, 2015 9:30:00 AM

As the world has moved in to the 21st century, the amount of data being stored and communicated electronically continues to grow at an astronomical rate. Data centers are critical to today’s business world in that they allow everyday tasks such as email and email storage, provide back-up capability for many business, and are the technology hubs powering the data driven 21st century economy. Many data center companies are also involved in cloud computing which allows users to store and access their data anywhere in the world through a host of devices including laptops, tablets and smart-phones.

Natural Gas Supply Shortage Concerns Have Eased

Posted by Jennifer Chang on Dec 23, 2014 10:54:00 AM

Massive contrast between colder than normal temperatures in Nov-2014 and above normal temperatures in Dec-2014 have caused very high price volatility in the Natural Gas futures market. Shifts in weather forecasts and record production have been the main price action drivers during the first half of the winter.

Topics: system operators, Acclaim Energy Advisors, energy management consulting, risk management, energy procurement, weather outlook, reliable energy, demand response, energy regulations, energy savings, power generation, Weekly Energy Insights, natural gas, energy management, energy management consultants, strategic energy sourcing, reserve margin, energy price spikes, Price Spike, energy blog, power outages, Natural Gas Supply, NG Demand, energy supply, Winter Weather, demand, scarcity pricing, current outlook