On Friday, February 28, ERCOT published its 2014 Capacity, Demand and Reserves (CDR) report. Resource adequacy has been at the forefront of ERCOT’s electricity policy debate. Forecasting future demand is critical for planning purposes to determine how much generation will be needed in future years to meet peak demand. Resource adequacy concerns have prompted the PUCT to approve mechanisms that increase the duration and frequency of scarcity pricing signals in ERCOT to support adequate generation development in the state. One measure, that has also encouraged some Commercial and Industrial customers to take advantage of higher prices through prices response (load shedding and Distributed Generation (DG) dispatch), is the October 2012 decision to increase the system-wide offer cap to the following levels, effective on the dates below:

- $5,000 on June 1, 2013

- $7,000 on June 1, 2014

- $9,000 on June 1, 2015

The combination of scarcity pricing measures, demand response, energy efficiency, growth of DG, growth of renewable generation and Commercial and Industrial price response make it almost impossible to correlate economic indicators to electric demand. ERCOT’s old forecasting model used economic indicators, such as non-farm employment, to forecast future electric demand. Because of the decoupling between economic growth indicators and electric demand, ERCOT will now use growth rates in customer accounts or premises to project future growth trends in each region served by the ERCOT grid.

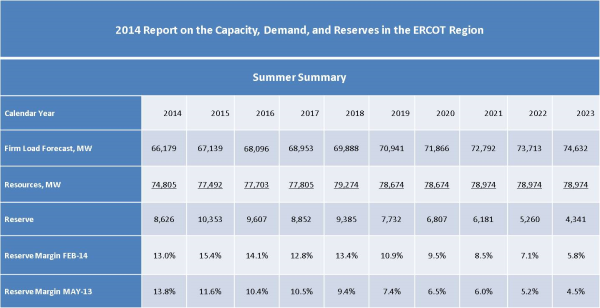

This is the first CDR report that has been developed using the new load forecast methodology. Peak loads and total annual customer demand will now be forecasted based on an average of the past 12 years of weather conditions. Likewise, the new model also accounts for energy efficiency impacts on the historical summer peaks. The February 2014 CDR report projects that peak demand will grow uniformly at 1.3% per year for the next 10 years. The old model growth also averaged 1.3%; however, accelerated growth was modeled in the front years (as high as 3% in 2015) and growth well below 1.3% in the back years.

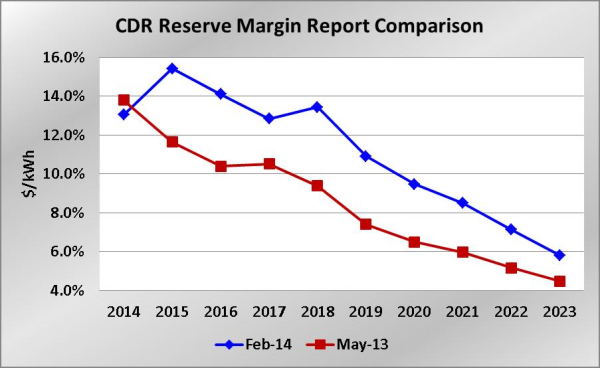

The table above also includes the reserve margin projections from both the February 2014 CDR report and the previous report, which was issued in May of 2013. It stands out that the latest report shows higher reserve margins in all years of the reporting period, except for 2014 where the reserve margin dropped from 13.8% to 13.0%. Reserve margins are higher on the February 2014 report by 28.3% on average over the 10-year outlook.

The May 2013 report projected that reserve margins would drop below ERCOT’s current reserve margin target of 13.75% starting in 2015, however, the new report shows that reserve margins will be above the target through 2016. Moreover, under the new assumptions reserve margins do not drop significantly below the target until 2019 (see chart below).

New Generation

New generation is expected later this year, so the 2014 planning reserve margin is expected to increase from 13% percent at the start of the 2014 summer season to 16% when the following natural gas combined-cycle power plants come online:

- Panda, Sherman - 720 MW

- Panda, Temple I- 717 MW

- LCRA, Ferguson - 510 MW

- Calpine, Deer Park Energy Center (expansion) - 165 MW

The commercial operations date for the Deer Park plant is currently July 1, 2014, while the date for the Panda and Ferguson plants is currently August 1, 2014. Besides these additions, ERCOT is evaluating if the grid can rely on more power from commercial wind farms during peak demand than the 8.7% of installed capacity included in the current outlook.

Next on the agenda

The next Summer Seasonal Assessment of Resource Adequacy (SARA) report will be released on March 5, 2014. This report covers a range of scenarios including extremely high load and generation forced outages.

The PUCT had delayed its workshop on resource adequacy from January to March, and has now delayed it to mid-May, which would leave less time for the PUCT to make any reform ahead of the next legislative session in 2014.

Conclusion

Improvements to load forecasting methodology were necessary due of the following:

- Growth in energy demand has slowed as energy efficiency has increased in households and commercial facilities

- Participation in demand response programs has increased

- Growth in Distributed Generation

- Increase in Commercial and Industrial price response

These changes have made trying to correlate economic indicators with load growth an impossible task.

The report comes at a time where significant market design plans are being scrutinized to improve reliability in ERCOT. The most contentious topic is whether Texas should shift its current “energy only” market design to an “energy & capacity” market, where power plants would get paid regardless if they generated electricity or not to maintain excess capacity.

The latest CDR report projects healthier planning reserve margins than previously expected. This impression could potentially delay the need to redesign the current market structure and table the capacity market discussion for now. It is possible, though, that regulators will continue to evaluate a future capacity market solution tailored to ERCOT.