It is concerning to observe a pattern of financial executives unaware of the terms of their own company’s energy supply agreements; particularly when to me it is so clear this is a necessity. These commitments represent substantial financial exposure that are arranged, in some cases, outside the company’s risk management policy and processes for financial commitments. Another very important reason for financial executives to have knowledge of their energy supply agreements is their treatment in the event of Chapter 11 bankruptcy. Obviously, no business plans for bankruptcy, but prudent financial executives should understand the potentially substantive risks that might arise in this unlikely event.

Why Don’t More Financial Execs Oversee Their Energy Supply Agreements

Posted by Richard Zdunkewicz on Jun 6, 2016 6:23:53 PM

Topics: Acclaim Energy Advisors, energy, energy savings, energy blog, electricity markets

Opportunistic Low Energy Price Environment- Excellent Long Term Savings Potential

Posted by Alberto Rios on Apr 15, 2015 9:50:00 AM

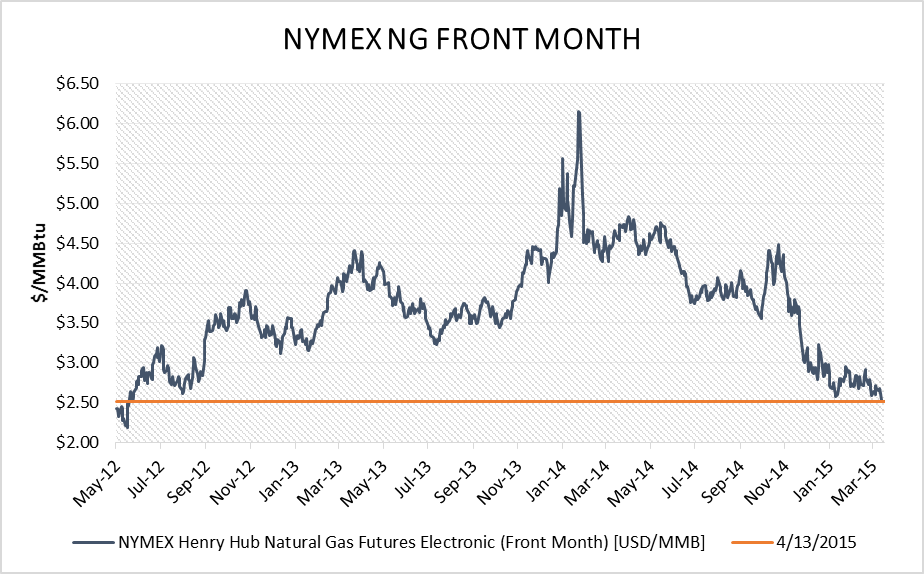

Depressed gas and electricity markets present one of the best buying environments in many years, even for terms as far out as 2020. This is particularly noteworthy considering the much higher price levels and prevailing market anxiety as we emerged from the Polar Vortex a year earlier.

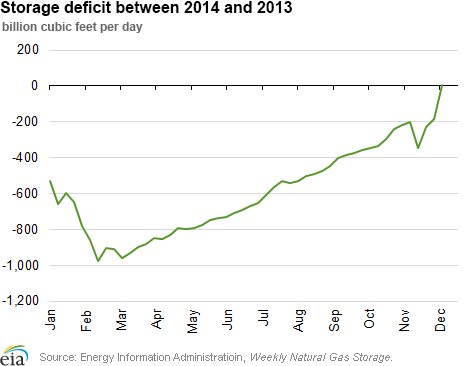

In March 2014, natural gas (NG) inventories fell to 822 Bcf after a brutally cold winter that boosted heating demand well above normal levels. The sharp decline in inventories kept natural gas and electricity prices higher through most of 2014. However, record natural gas production, especially from shale plays including Marcellus have slowly replenished storage. Currently natural gas production is between 5 -7 Bcf higher compared to last year, so supply could outweigh demand throughout 2015.

Topics: Polar Vortex, ERCOT, Acclaim Energy Advisors, demand response, energy savings, energy costs, natural gas, energy blog, energy supply, distributed generation, current outlook, heating demand, electricity markets, Energy Prices, Energy Trends, Fixed Prices, Weak Spot Prices

Natural Gas Supply Shortage Concerns Have Eased

Posted by Jennifer Chang on Dec 23, 2014 10:54:00 AM

Massive contrast between colder than normal temperatures in Nov-2014 and above normal temperatures in Dec-2014 have caused very high price volatility in the Natural Gas futures market. Shifts in weather forecasts and record production have been the main price action drivers during the first half of the winter.

Topics: system operators, Acclaim Energy Advisors, energy management consulting, risk management, energy procurement, weather outlook, reliable energy, demand response, energy regulations, energy savings, power generation, Weekly Energy Insights, natural gas, energy management, energy management consultants, strategic energy sourcing, reserve margin, energy price spikes, Price Spike, energy blog, power outages, Natural Gas Supply, NG Demand, energy supply, Winter Weather, demand, scarcity pricing, current outlook

Weather Effect on Regional Natural Gas Spot Prices

Posted by Jennifer Chang on Aug 29, 2014 11:08:00 AM

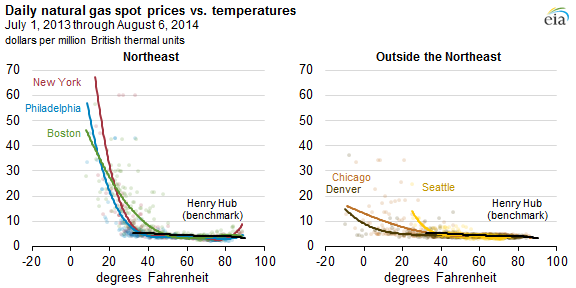

Multiple supply and demand factors affect seasonal natural gas and electricity spot [1]prices across the country:

Topics: Heating Season\, Polar Vortex, forward curve, winter strip, spot price, Heat Rate, black swan event, pipeline capacity, energy sourcing, Acclaim Energy Advisors, risk management, energy, energy procurement, weather outlook, demand response, energy regulations, energy reliability, energy savings, Weekly Energy Insights, natural gas, energy management, reserve margin, energy price spikes, Price Spike, energy blog, Natural Gas Supply, price volatility, NG Demand, Winter Weather, new england, NG

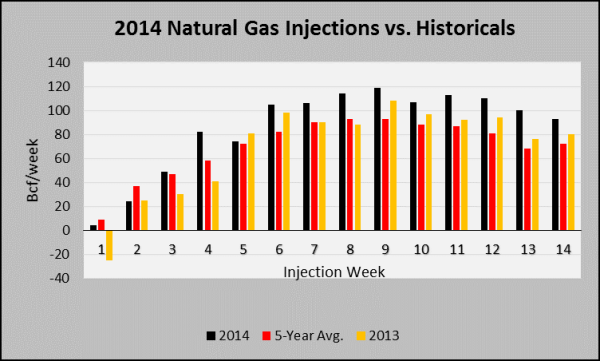

Natural gas inventories have recovered significantly after reaching an 11-year record low of 822Bcf in late March-2014. During the last nine weeks, natural gas injections into storage have outperformed historical levels, and eight of them exceeded 100Bcf/week. Moreover, the last nine injections have exceeded the five-year average gains by 24Bcf on average. The drivers behind these above normal injections are the following:

Topics: Texas Energy, tropical storm, hurricane, energy sourcing, Acclaim Energy Advisors, energy management consulting, risk management, energy, Energy Solutions, energy procurement, weather outlook, reliable energy, demand response, energy regulations, energy reliability, energy savings, Weekly Energy Insights, natural gas, energy management, Price Spike, energy blog, power outages, Natural Gas Supply, price volatility, mild weather, energy supply, Texas, load generators, Peak Demand, forecasting

Crude Oil and Natural Gas Top Commodity Performers in 2013: Natural Gas Price Action Recap

Posted by Jennifer Chang on Feb 14, 2014 8:43:00 AM

During this winter season, natural gas price volatility has been extreme as temperatures have fallen to unprecedented levels due to the breakdown of the polar vortex. Low temperature records were broken across the U.S., natural gas heating-related demand has risen and natural gas inventories have been depleted at a faster rate when compared to historical benchmarks. Nevertheless, natural gas has not been the most volatile commodity in recent years according to the U.S. Global Investors Periodic table of Commodities Returns. In the last 10 years, the most and the least volatile commodity returns have been registered in Nickel and Gold respectively. Crude Oil has been a top three performer in four of the last 10 years, while natural gas has only been in this category two out of the last 10 years.

Topics: Polar Vortex, energy risk management, energy sourcing, Acclaim Energy Advisors, energy procurement, weather outlook, reliable energy, demand response, energy regulations, energy reliability, energy savings, energy costs, power generation, Weekly Energy Insights, natural gas, Event, energy management, energy management consultants, energy price spikes, Price Spike, energy blog, power outages, Natural Gas Supply, price volatility, Winter Weather, curtailment, Emergency, NG contract

Highest NYMEX Natural Gas Expiration in Four Years: Tough Risk Management Lesson for Some

Posted by Jennifer Chang on Jan 31, 2014 5:16:00 PM

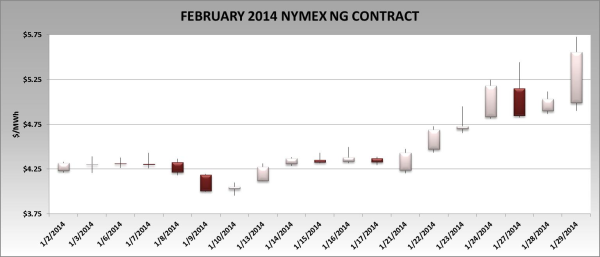

On January 2, 2014, the NYMEX Henry Hub NG February-2014 (front month) contract settled at $4.321/MMBtu, and on January 29, 2014, the contract expired at $5.557/MMBtu (see chart below). This was the highest expiration settlement price for the front month in four years. During the month of January, the front month contract rose $1.24/MMBtu, or 28.6%. The chart below shows that on expiration day (1/29/14) the front month price posted a $0.52/MMBtu or 10% gain for the day. The March 2014 contract followed suit and rallied almost 11%, settling at $5.465/MMBtu. During the expiration day, weather forecasts turned colder than previously expected, so market players that underestimated demand rushed to the market and were clobbered in a short squeeze.

Topics: energy risk management, energy sourcing, Acclaim Energy Advisors, energy, Energy Solutions, energy procurement, reliable energy, demand response, energy regulations, energy reliability, energy savings, energy costs, power generation, Weekly Energy Insights, natural gas, energy management, energy management consultants, energy price spikes, Price Spike, energy blog, Natural Gas Supply, price volatility, energy supply, U.S. energy, NG, curtailment, Emergency, gas gross production report, price direction, NG contract, NYMEX

NG Spot Prices Reach Record Levels and Boost Power Prices During January 2014

Posted by Jennifer Chang on Jan 24, 2014 5:17:00 PM

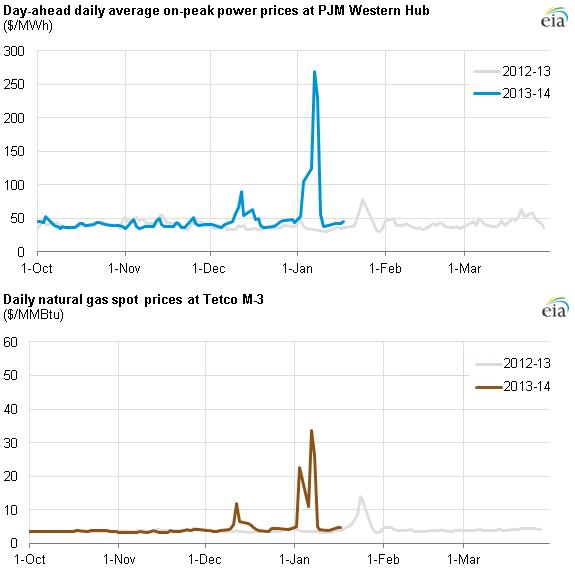

Two ruthless surges of arctic air, east of the Rockies, have taken over the eastern half of the country this month. The latest forecasts suggest that this weather pattern will continue to linger through the end of the month. Sub-zero temperatures are expected in the upper Midwest cities and the great lakes, including Chicago, Minneapolis and Detroit and possible below zero temperatures as far south as the Ohio River. Factoring in wind chill, temperatures are expected to be 20 or 30 degrees below zero. This weekend a couple of Canadian clippers will be followed by another arctic surge through mid-next week with conditions that could rival those from January 6, 2014. A Canadian clipper (a.k.a Alberta clipper) is a storm system during the winter months that originates from the Canadian Province of Alberta (or there close by). The term "clipper" originates from the quick speeds of clipper sailing ships. Thus, an Alberta clipper is a quick-moving winter storm system originating from Alberta, Canada. A clipper will usually bring smaller bursts of snow (generally 1-3 inches) along with colder temperatures and often times gusty winds (The National Oceanic and Atmospheric Administration).

Topics: energy risk management, Acclaim Energy Advisors, risk management, energy, Energy Solutions, energy procurement, weather outlook, reliable energy, demand response, energy regulations, energy reliability, energy savings, energy costs, power generation, Weekly Energy Insights, natural gas, Event, energy management, energy management consultants, energy price spikes, Price Spike, energy blog, energy supply, Winter Weather, U.S. energy, Peak Demand, mid-atlantic, new england, NG

Arctic Blast Shuts Down 20% of PJM's Installed Capacity-Conservation, Demand Response and Power Imports Save the Day

Posted by Jennifer Chang on Jan 12, 2014 10:49:00 AM

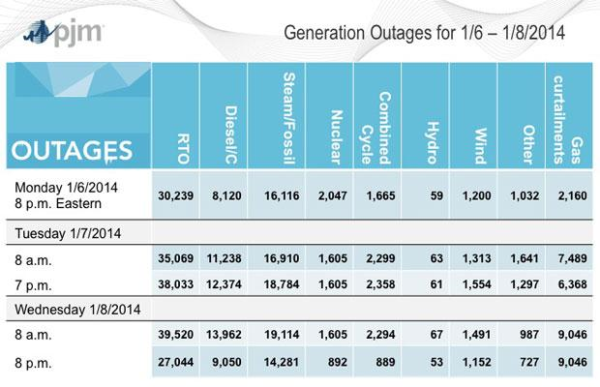

PJM is the largest regional transmission organization (RTO) in the U.S. and coordinates wholesale operations in all or parts of Delaware, Illinois, Indiana, Kentucky, Maryland, Michigan, New Jersey, North Carolina, Ohio, Pennsylvania, Tennessee, Virginia, West Virginia and the District of Columbia.

Topics: ERCOT, energy risk management, Acclaim Energy Advisors, energy management consulting, risk management, energy, Energy Solutions, energy procurement, weather outlook, reliable energy, energy regulations, energy reliability, PJM, energy savings, energy costs, Weekly Energy Insights, energy management, energy price spikes, energy blog, power outages, Winter Weather, U.S. energy, load generators, RTO

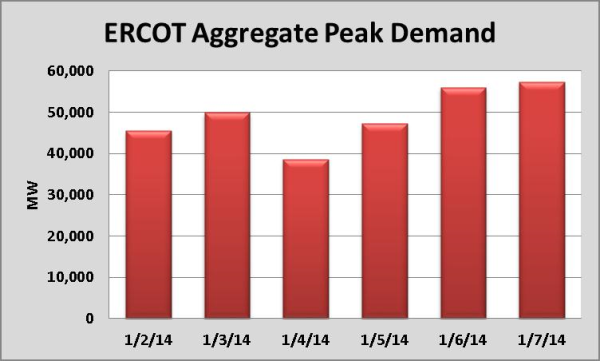

ERCOT Sets New Winter Peak Demand- Real Time Prices Hit $5,000/MWh Cap on January 6, 2014

Posted by Jennifer Chang on Jan 8, 2014 12:59:00 PM

Topics: Heat Rate, REP, ERCOT, Acclaim Energy Advisors, energy management consulting, risk management, energy, Energy Solutions, energy procurement, weather outlook, energy regulations, energy reliability, energy savings, energy costs, Weekly Energy Insights, Event, energy management, energy management consultants, energy price spikes, Price Spike, Winter Weather, U.S. energy, Peak Demand, Emergency