On October 10, 2007, the largest leveraged buy-out in American history was completed by Kohlberg Kravis Roberts, Texas Pacific Group and Goldman Sachs Capital Partners. Energy Future Holdings (EFH), executed a merger agreement to acquire all the shares of the publicly traded TXU Corp for $45 billion (32 billion plus $13billion in assumed debt). All parties agreed to the deal in February 2007, and in September 2007, TXU shareholders had approved the takeover. EFH ended up with a portfolio of competitive and regulated energy companies:

Energy Future Holdings-Is a Bankruptcy Filing Looming?

Posted by Jennifer Chang on Feb 28, 2014 12:48:00 PM

Topics: TXU, bankruptcy, Energy Future Holdings, TXU Energy, ERCOT, energy sourcing, Acclaim Energy Advisors, energy management consulting, energy, Energy Solutions, energy procurement, demand response, energy reliability, energy costs, Weekly Energy Insights, energy management, energy blog, DLO 365, U.S. energy, curtailment, NYMEX

Crude Oil and Natural Gas Top Commodity Performers in 2013: Natural Gas Price Action Recap

Posted by Jennifer Chang on Feb 14, 2014 8:43:00 AM

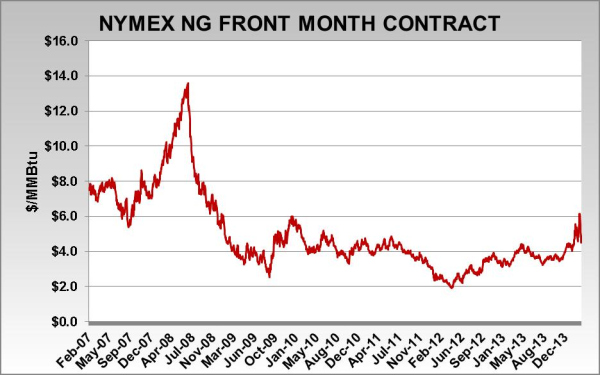

During this winter season, natural gas price volatility has been extreme as temperatures have fallen to unprecedented levels due to the breakdown of the polar vortex. Low temperature records were broken across the U.S., natural gas heating-related demand has risen and natural gas inventories have been depleted at a faster rate when compared to historical benchmarks. Nevertheless, natural gas has not been the most volatile commodity in recent years according to the U.S. Global Investors Periodic table of Commodities Returns. In the last 10 years, the most and the least volatile commodity returns have been registered in Nickel and Gold respectively. Crude Oil has been a top three performer in four of the last 10 years, while natural gas has only been in this category two out of the last 10 years.

Topics: Polar Vortex, energy risk management, energy sourcing, Acclaim Energy Advisors, energy procurement, weather outlook, reliable energy, demand response, energy regulations, energy reliability, energy savings, energy costs, power generation, Weekly Energy Insights, natural gas, Event, energy management, energy management consultants, energy price spikes, Price Spike, energy blog, power outages, Natural Gas Supply, price volatility, Winter Weather, curtailment, Emergency, NG contract

Highest NYMEX Natural Gas Expiration in Four Years: Tough Risk Management Lesson for Some

Posted by Jennifer Chang on Jan 31, 2014 5:16:00 PM

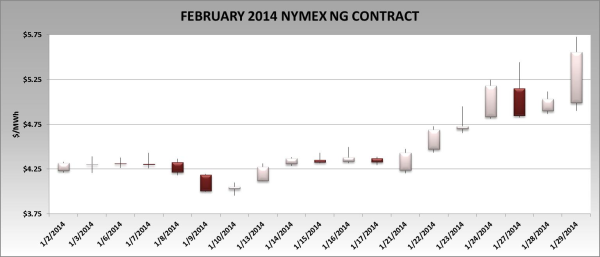

On January 2, 2014, the NYMEX Henry Hub NG February-2014 (front month) contract settled at $4.321/MMBtu, and on January 29, 2014, the contract expired at $5.557/MMBtu (see chart below). This was the highest expiration settlement price for the front month in four years. During the month of January, the front month contract rose $1.24/MMBtu, or 28.6%. The chart below shows that on expiration day (1/29/14) the front month price posted a $0.52/MMBtu or 10% gain for the day. The March 2014 contract followed suit and rallied almost 11%, settling at $5.465/MMBtu. During the expiration day, weather forecasts turned colder than previously expected, so market players that underestimated demand rushed to the market and were clobbered in a short squeeze.

Topics: energy risk management, energy sourcing, Acclaim Energy Advisors, energy, Energy Solutions, energy procurement, reliable energy, demand response, energy regulations, energy reliability, energy savings, energy costs, power generation, Weekly Energy Insights, natural gas, energy management, energy management consultants, energy price spikes, Price Spike, energy blog, Natural Gas Supply, price volatility, energy supply, U.S. energy, NG, curtailment, Emergency, gas gross production report, price direction, NG contract, NYMEX

The Negawatts Evolution: The Maturation of Demand Response

Posted by Jennifer Chang on Dec 9, 2013 12:06:00 PM

Several decades ago the term “negawatt” gained notoriety; however, as deregulated markets have developed and with the rise of Demand Response (DR) programs, the concept of reducing energy spend through the deployment of more energy efficient technologies has evolved into something larger. The negawatt concept has expanded from its foundation with the growth in utility and Independent System Operator (ISO) DR programs. Another important, and more recent, development has been the growth of economic price response, which is the ability to add capacity to the grid or shed load when real-time market conditions create financial incentives. The combination of flexible distributed generation, access to real-time price data, and ”structural incentives” in deregulated markets have enabled end-users to profit from these programs andactivities. In ERCOT for example, these incentives include price scarcity mechanisms (Operating Reserve Demand Curve) and system-wide offer caps that will increase to $9,000/MWh on June 1, 2015. Aside from generating revenues for end-users, these measures will contribute to improve balance between supply and demand, and support overall grid reliability.

Topics: Negawatt, ERCOT, energy risk management, Acclaim Energy Advisors, energy management consulting, energy, Energy Solutions, energy procurement, demand response, energy regulations, energy savings, energy costs, Weekly Energy Insights, energy management, dynamic load optimization 365, DLO 365, curtailment