It is concerning to observe a pattern of financial executives unaware of the terms of their own company’s energy supply agreements; particularly when to me it is so clear this is a necessity. These commitments represent substantial financial exposure that are arranged, in some cases, outside the company’s risk management policy and processes for financial commitments. Another very important reason for financial executives to have knowledge of their energy supply agreements is their treatment in the event of Chapter 11 bankruptcy. Obviously, no business plans for bankruptcy, but prudent financial executives should understand the potentially substantive risks that might arise in this unlikely event.

Why Don’t More Financial Execs Oversee Their Energy Supply Agreements

Posted by Richard Zdunkewicz on Jun 6, 2016 6:23:53 PM

Topics: Acclaim Energy Advisors, energy, energy savings, energy blog, electricity markets

Oil & Gas Industry's Challenges And Potential Impact On Power Supply Agreements

Posted by Richard Zdunkewicz on Jun 1, 2016 5:06:15 PM

Even as crude oil and natural gas prices begin to rebound from their recent lows, we are seeing continued financial stress in the oil & gas sector. In recent months, Linn Energy, Chaparral Energy, Penn Virginia, Halcón Resources, and Breitburn Energy Partners have all filed Chapter 11. Financial concerns are not confined to the Upstream segment as Midstream players such as Plains All America Pipeline and Azure Midstream have seen their bonds downgraded by the rating agencies.

Topics: energy management, energy blog, NG

Opportunistic Low Energy Price Environment- Excellent Long Term Savings Potential

Posted by Alberto Rios on Apr 15, 2015 9:50:00 AM

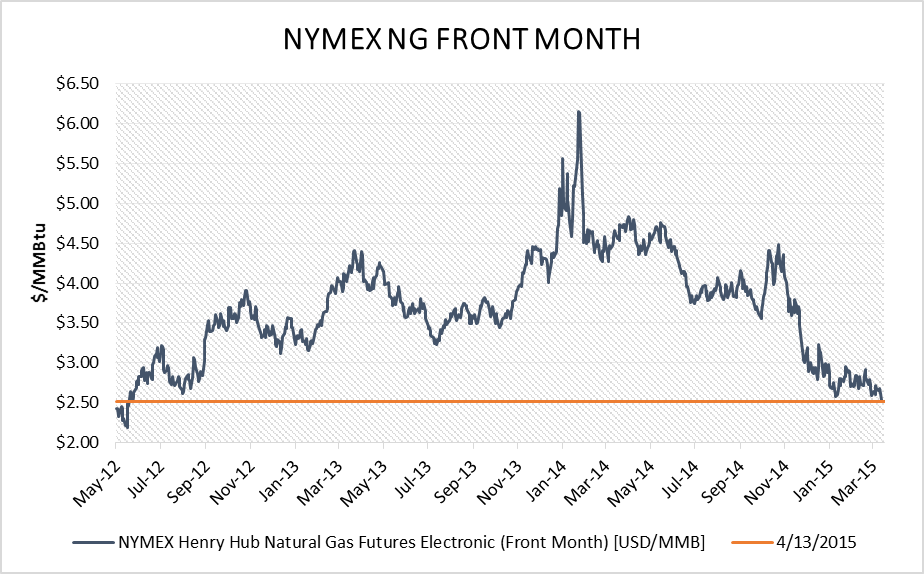

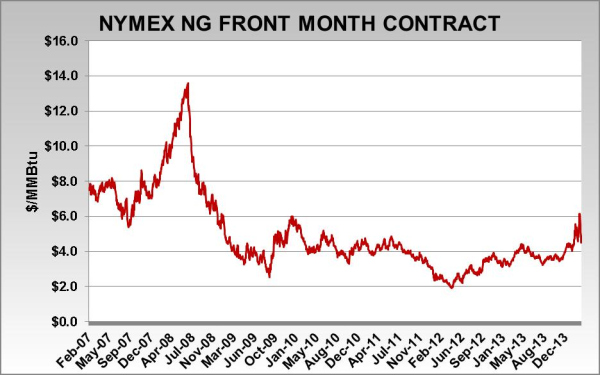

Depressed gas and electricity markets present one of the best buying environments in many years, even for terms as far out as 2020. This is particularly noteworthy considering the much higher price levels and prevailing market anxiety as we emerged from the Polar Vortex a year earlier.

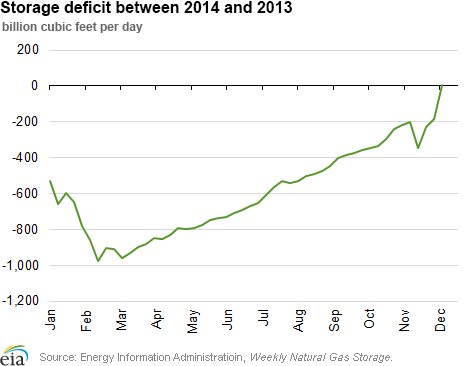

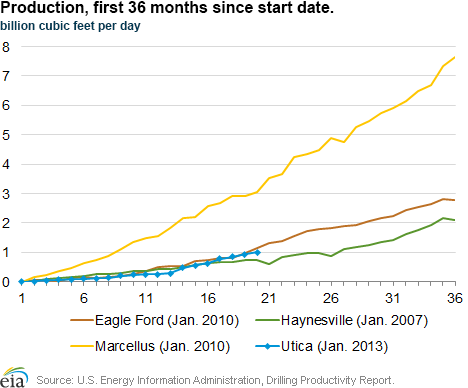

In March 2014, natural gas (NG) inventories fell to 822 Bcf after a brutally cold winter that boosted heating demand well above normal levels. The sharp decline in inventories kept natural gas and electricity prices higher through most of 2014. However, record natural gas production, especially from shale plays including Marcellus have slowly replenished storage. Currently natural gas production is between 5 -7 Bcf higher compared to last year, so supply could outweigh demand throughout 2015.

Topics: Polar Vortex, ERCOT, Acclaim Energy Advisors, demand response, energy savings, energy costs, natural gas, energy blog, energy supply, distributed generation, current outlook, heating demand, electricity markets, Energy Prices, Energy Trends, Fixed Prices, Weak Spot Prices

Natural Gas Supply Shortage Concerns Have Eased

Posted by Jennifer Chang on Dec 23, 2014 10:54:00 AM

Massive contrast between colder than normal temperatures in Nov-2014 and above normal temperatures in Dec-2014 have caused very high price volatility in the Natural Gas futures market. Shifts in weather forecasts and record production have been the main price action drivers during the first half of the winter.

Topics: system operators, Acclaim Energy Advisors, energy management consulting, risk management, energy procurement, weather outlook, reliable energy, demand response, energy regulations, energy savings, power generation, Weekly Energy Insights, natural gas, energy management, energy management consultants, strategic energy sourcing, reserve margin, energy price spikes, Price Spike, energy blog, power outages, Natural Gas Supply, NG Demand, energy supply, Winter Weather, demand, scarcity pricing, current outlook

During the fall, meteorologists sharpen their assumption to build their probability weighted winter weather forecast scenarios. From an energy perspective, this is also a critical time of the year. Since it is typically a period of low energy demand, there tend to be seasonal dips that provide good buying opportunities in natural and electricity. This year though, natural gas prices have been seesawing since mid-July 2014 due to the following reasons:

Topics: Heating Season\, Polar Vortex, Texas Energy, forward curve, winter strip, spot price, energy risk management, energy sourcing, Acclaim Energy Advisors, energy management consulting, energy, energy procurement, weather outlook, reliable energy, energy costs, power generation, Weekly Energy Insights, natural gas, Event, energy management, energy management consultants, strategic energy sourcing, reserve margin, Price Spike, energy blog, power outages, Natural Gas Supply, price volatility, reserve, report, energy storage, NG Demand, seasonal drought, energy supply, EIA, Texas, Winter Weather, U.S. energy, NG, forecasting, refueling season, NG contract

Weather Effect on Regional Natural Gas Spot Prices

Posted by Jennifer Chang on Aug 29, 2014 11:08:00 AM

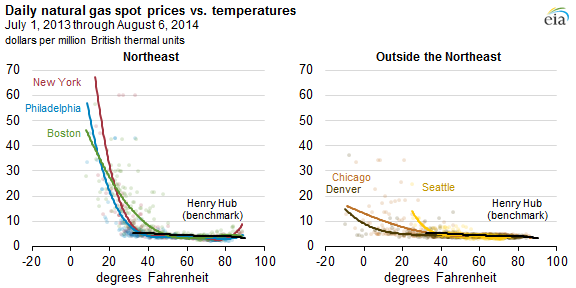

Multiple supply and demand factors affect seasonal natural gas and electricity spot [1]prices across the country:

Topics: Heating Season\, Polar Vortex, forward curve, winter strip, spot price, Heat Rate, black swan event, pipeline capacity, energy sourcing, Acclaim Energy Advisors, risk management, energy, energy procurement, weather outlook, demand response, energy regulations, energy reliability, energy savings, Weekly Energy Insights, natural gas, energy management, reserve margin, energy price spikes, Price Spike, energy blog, Natural Gas Supply, price volatility, NG Demand, Winter Weather, new england, NG

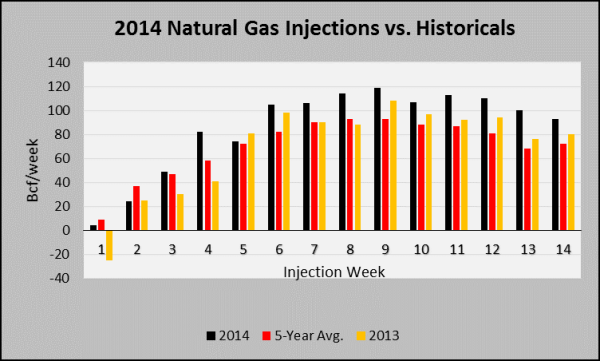

A brutal cold start of the year has been followed by moderate temperatures across the country. Natural gas prices have risen significantly since early January 2014, as inventories were being depleted at a faster than normal rate due to higher than normal heating demand. Nevertheless, record production and tepid demand after the spring months triggered a massive selloff in mid-June 2014, with the front month losing more than 20 percent to date. Early concerns of tight supply conditions ahead of the next heating season have eased due to weekly record or near-record injections. Electricity prices have also plunged not only because of the recent drop in natural gas prices, but also because of a drop in heat rates. In Texas, peak load had not been this low in June and July since 2010. Low electricity demand has depressed spot and forward heat rates.

Topics: energy risk management, energy sourcing, Acclaim Energy Advisors, risk management, energy procurement, weather outlook, reliable energy, demand response, energy reliability, power generation, Weekly Energy Insights, natural gas, Event, economic demand response, energy management, energy management consultants, strategic energy sourcing, Hurricane Season, reserve margin, energy price spikes, renewable energy, Price Spike, energy blog, power outages, Natural Gas Supply, price volatility, reserve, report, energy efficiency, mild weather, energy storage, NG Demand, seasonal drought

Natural gas inventories have recovered significantly after reaching an 11-year record low of 822Bcf in late March-2014. During the last nine weeks, natural gas injections into storage have outperformed historical levels, and eight of them exceeded 100Bcf/week. Moreover, the last nine injections have exceeded the five-year average gains by 24Bcf on average. The drivers behind these above normal injections are the following:

Topics: Texas Energy, tropical storm, hurricane, energy sourcing, Acclaim Energy Advisors, energy management consulting, risk management, energy, Energy Solutions, energy procurement, weather outlook, reliable energy, demand response, energy regulations, energy reliability, energy savings, Weekly Energy Insights, natural gas, energy management, Price Spike, energy blog, power outages, Natural Gas Supply, price volatility, mild weather, energy supply, Texas, load generators, Peak Demand, forecasting

ERCOT's Latest CDR Report Shows Higher Reserve Margins: How Will This Affect Regulatory Policy?

Posted by Jennifer Chang on Mar 5, 2014 10:15:00 AM

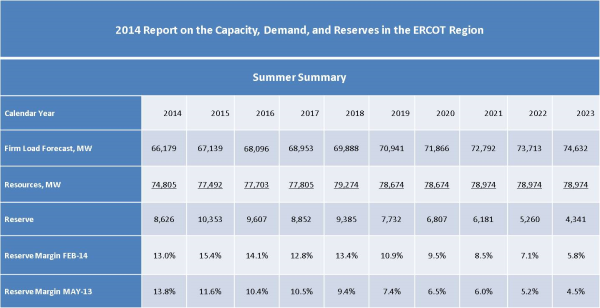

On Friday, February 28, ERCOT published its 2014 Capacity, Demand and Reserves (CDR) report. Resource adequacy has been at the forefront of ERCOT’s electricity policy debate. Forecasting future demand is critical for planning purposes to determine how much generation will be needed in future years to meet peak demand. Resource adequacy concerns have prompted the PUCT to approve mechanisms that increase the duration and frequency of scarcity pricing signals in ERCOT to support adequate generation development in the state. One measure, that has also encouraged some Commercial and Industrial customers to take advantage of higher prices through prices response (load shedding and Distributed Generation (DG) dispatch), is the October 2012 decision to increase the system-wide offer cap to the following levels, effective on the dates below:

Topics: ERCOT, risk management, Energy Solutions, energy procurement, demand response, energy reliability, power generation, Weekly Energy Insights, reserve margin, energy price spikes, energy blog, reserve, report, energy efficiency, U.S. energy, PUCT, forecasting, CDR, capacity, demand, load shedding, distributed generation, scarcity pricing, current outlook

Energy Future Holdings-Is a Bankruptcy Filing Looming?

Posted by Jennifer Chang on Feb 28, 2014 12:48:00 PM

On October 10, 2007, the largest leveraged buy-out in American history was completed by Kohlberg Kravis Roberts, Texas Pacific Group and Goldman Sachs Capital Partners. Energy Future Holdings (EFH), executed a merger agreement to acquire all the shares of the publicly traded TXU Corp for $45 billion (32 billion plus $13billion in assumed debt). All parties agreed to the deal in February 2007, and in September 2007, TXU shareholders had approved the takeover. EFH ended up with a portfolio of competitive and regulated energy companies:

Topics: TXU, bankruptcy, Energy Future Holdings, TXU Energy, ERCOT, energy sourcing, Acclaim Energy Advisors, energy management consulting, energy, Energy Solutions, energy procurement, demand response, energy reliability, energy costs, Weekly Energy Insights, energy management, energy blog, DLO 365, U.S. energy, curtailment, NYMEX