It is well known that those of us in the business of trading or buying natural gas (and power for that matter) anxiously await the weekly natural gas storage reports issued by the Energy Information Administration. In fact, in my office there is friendly wagering amongst our price risk management and consulting staffs on exactly what the level of inventory build, or draw, will be.

Natural Gas Storage and Price, a Journey Back Through Time

Posted by Richard Zdunkewicz on Aug 9, 2016 9:43:13 AM

Topics: risk management, natural gas, EIA, NG, NYMEX

Energy Future Holdings-Is a Bankruptcy Filing Looming?

Posted by Jennifer Chang on Feb 28, 2014 12:48:00 PM

On October 10, 2007, the largest leveraged buy-out in American history was completed by Kohlberg Kravis Roberts, Texas Pacific Group and Goldman Sachs Capital Partners. Energy Future Holdings (EFH), executed a merger agreement to acquire all the shares of the publicly traded TXU Corp for $45 billion (32 billion plus $13billion in assumed debt). All parties agreed to the deal in February 2007, and in September 2007, TXU shareholders had approved the takeover. EFH ended up with a portfolio of competitive and regulated energy companies:

Topics: TXU, bankruptcy, Energy Future Holdings, TXU Energy, ERCOT, energy sourcing, Acclaim Energy Advisors, energy management consulting, energy, Energy Solutions, energy procurement, demand response, energy reliability, energy costs, Weekly Energy Insights, energy management, energy blog, DLO 365, U.S. energy, curtailment, NYMEX

Highest NYMEX Natural Gas Expiration in Four Years: Tough Risk Management Lesson for Some

Posted by Jennifer Chang on Jan 31, 2014 5:16:00 PM

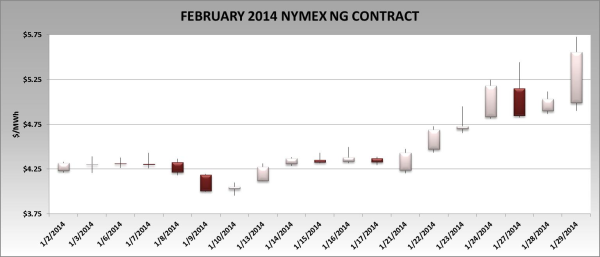

On January 2, 2014, the NYMEX Henry Hub NG February-2014 (front month) contract settled at $4.321/MMBtu, and on January 29, 2014, the contract expired at $5.557/MMBtu (see chart below). This was the highest expiration settlement price for the front month in four years. During the month of January, the front month contract rose $1.24/MMBtu, or 28.6%. The chart below shows that on expiration day (1/29/14) the front month price posted a $0.52/MMBtu or 10% gain for the day. The March 2014 contract followed suit and rallied almost 11%, settling at $5.465/MMBtu. During the expiration day, weather forecasts turned colder than previously expected, so market players that underestimated demand rushed to the market and were clobbered in a short squeeze.

Topics: energy risk management, energy sourcing, Acclaim Energy Advisors, energy, Energy Solutions, energy procurement, reliable energy, demand response, energy regulations, energy reliability, energy savings, energy costs, power generation, Weekly Energy Insights, natural gas, energy management, energy management consultants, energy price spikes, Price Spike, energy blog, Natural Gas Supply, price volatility, energy supply, U.S. energy, NG, curtailment, Emergency, gas gross production report, price direction, NG contract, NYMEX