Alberto Rios

Recent Posts

Topics: Acclaim Energy Advisors, energy management consulting, Webinar, Energy Solutions

Will The NYMEX NG Front Month Contract Break $3.00/MMBtu?

Posted by Alberto Rios on Jul 23, 2012 8:56:00 AM

ENERGY INSIGHTS: JULY 18, 2012

Today above normal temperatures and nuclear outages drove prices close to $3.00/MMBtu. The imbalance between supply and demand continues to tighten, so be sure to contact your Acclaim representative to evaluate your current situation.

Topics: ERCOT Heat Rates, Acclaim Energy Advisors, energy management consulting, Weekly Energy Insights, natural gas

VIDEO OUTLOOK: JULY 16, 2012

During the past two weeks, Natural Gas has traded between a narrow range: $2.75/MMBtu & $2.90/MMBtu. Prices have limited upside potential since some utilities are switching back to burning coal. On the low end of the range, prices are supported by forecasts, which are calling for above normal temperatures in the coming weeks. Click here to watch the Video

Topics: Acclaim Energy Advisors, energy management consulting, Webinar, Energy Solutions

Energy Insights: July 3, 2012

NG futures modestly lower today as expectation of excessive heat have eased per the current 11-15 day forecast. Nevertheless, above normal temperatures are expected across most of the continental U.S., so weather will still offer some price support.

Topics: ERCOT Heat Rates, Acclaim Energy Advisors, energy management consulting, Weekly Energy Insights, natural gas

Video Outlook: July 2, 2012

Natural Gas price movements have been driven by above normal temperatures across the U.S. that have increased cooling demand. Likewise, Coal to gas switching has contributed to an increase in demand for the commodity. For risk management purposes, we recommend to follow price action around significant technical indicators to best manage your exposure.

Topics: Acclaim Energy Advisors, energy management consulting, Webinar

NG Bulls and Bears Grappling Within a $2.20 - $2.50/MMBtu Range

Posted by Alberto Rios on Jun 14, 2012 5:11:00 PM

Energy Insights: June 14, 2012

Today the NYMEX NG July-2012 contract settled 14% (or $.298/MMbtu) higher and CAL-2013 settled 4.2% (or $.14/MMbtu) higher compared to yesterday’s marks. Prices continued the upward trend in after hours electronic trading. This week we cover how to manage current volatility and avoid getting caught in a short squeeze.

Topics: ERCOT Heat Rates, Acclaim Energy Advisors, energy management consulting, Weekly Energy Insights, natural gas

Natural Gas Price Drop To Reflect Current Fundamentals

Posted by Alberto Rios on May 31, 2012 6:38:00 PM

Energy Insights: May 31, 2012

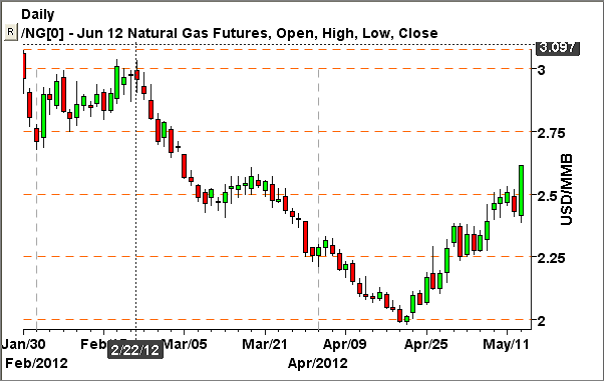

Natural Gas

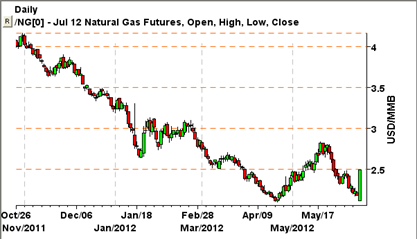

After reaching $2.75/MMBtu on 5/18/2012, price action for the June-2012 contract seesawed up until Thursday 5/24. Since then, NG futures have tumbled almost as fast as they rose. The decline showed that sustained prices above $2.50/MMBtu likely would inspire some switching back to coal.

Topics: ERCOT Heat Rates, Acclaim Energy Advisors, energy management consulting, Energy Solutions, Weekly Energy Insights, natural gas

Energy Insights May 23, 2012

High volatility in NG futures ahead of storage data release. Fresh news will give the market more direction; however, this is becoming a weather driven market again, so prices will swing as conditions change. Regarding the electricity market, on 5/22/2012, ERCOT released a new long-term study which confirmed the potential of electricity shortages within the coming decade as electric use in Texas continues to hit new records.

Topics: ERCOT Heat Rates, Acclaim Energy Advisors, energy management consulting, Energy Solutions, Weekly Energy Insights, natural gas

Energy Insights: May 17, 2012

Natural gas futures have risen sharply from the 10-year lows set last month. This rally has been driven by a combination of an increase in demand (mainly from coal to natural gas switching) and an increase in production cuts.

Topics: ERCOT Heat Rates, Acclaim Energy Advisors, energy management consulting, Energy Solutions, Weekly Energy Insights, natural gas

Energy Insights: May 9, 2012

Natural Gas closed today at a two month high on expectations of slower production and the prospect of more demand for the fuel by natural gas fired generation. Tomorrow, 5/10/2012, all eyes will be on the EIA’s storage report release at 9:30am CST. Expectations on the injection number for the week ending on 5/4/2012 range from 25Bcf to 55Bcf. This range is well below the average. Last year for this week, gas storage rose by 71 billion cubic feet, while the five-year average rise in the week is 84 billion cubic feet.

Topics: ERCOT Heat Rates, Acclaim Energy Advisors, energy management consulting, Energy Solutions, Weekly Energy Insights, natural gas