It is well known that those of us in the business of trading or buying natural gas (and power for that matter) anxiously await the weekly natural gas storage reports issued by the Energy Information Administration. In fact, in my office there is friendly wagering amongst our price risk management and consulting staffs on exactly what the level of inventory build, or draw, will be.

Natural Gas Storage and Price, a Journey Back Through Time

Posted by Richard Zdunkewicz on Aug 9, 2016 9:43:13 AM

Topics: risk management, natural gas, EIA, NG, NYMEX

Power Prices: It's The Demand And Not Just The Usage

Posted by Richard Zdunkewicz on Jul 1, 2016 11:04:45 AM

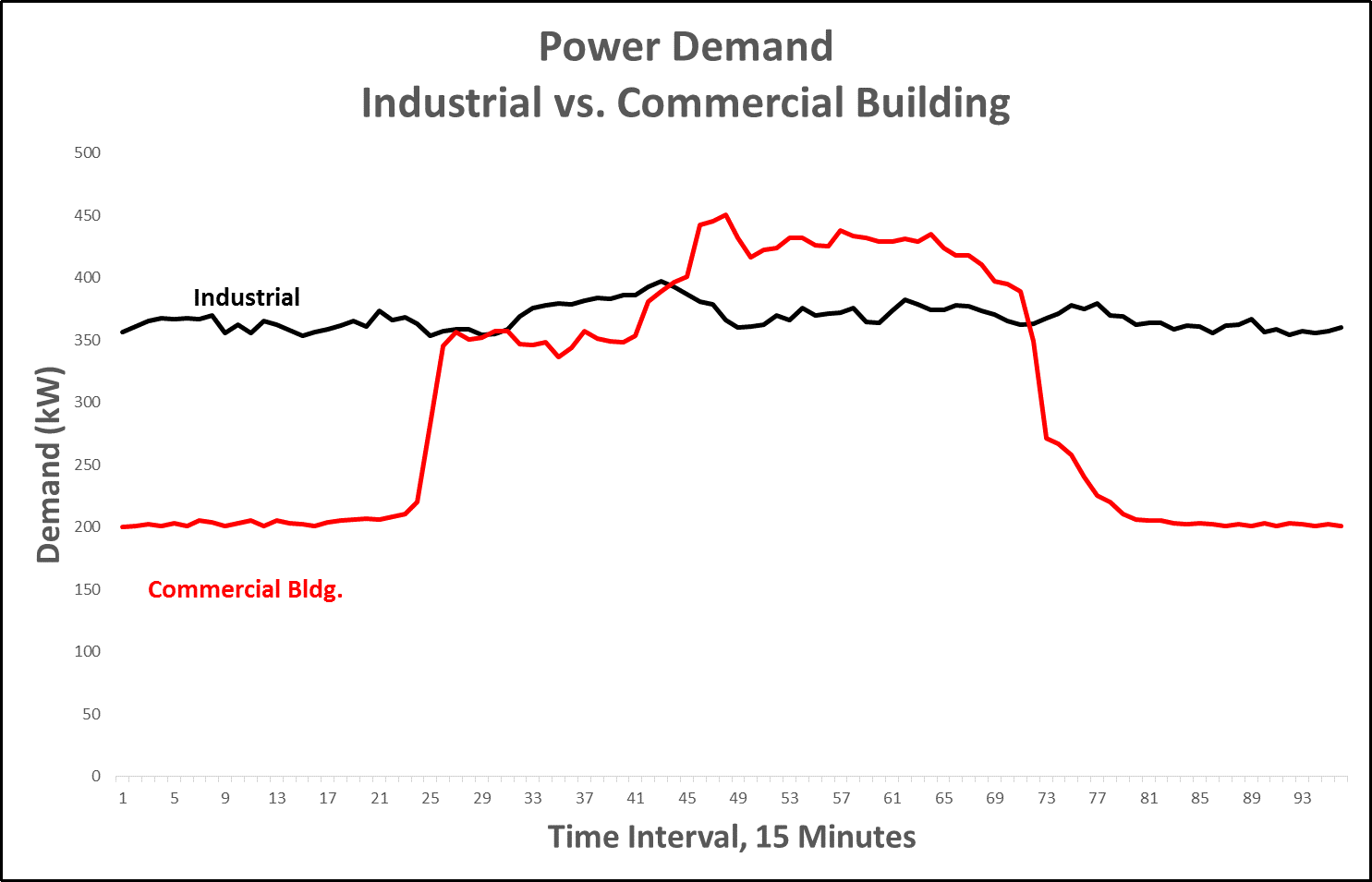

It’s always an interesting discussion with non-technical people involved in contracting for power supply. Energy contracting is oftentimes the responsibility of personnel who are not familiar with the price dynamics of the power markets. The conversation will typically start with “we use a lot of electricity…..we should see a great price”. While that may be true, it’s not necessarily the magnitude of usage that drives the price, but the consistency and level of demand. What’s the difference between demand and usage? Power demand is the amount being drawn from the grid at any point in time; usage is the aggregate of demand across time. A consistent or flat demand profile, meaning a higher load factor, will command a better price than that associated with a low load factor. So why is that?

Topics: energy management, energy efficiency, Peak Demand, demand, power, power usage

Big Data Means Big Opportunity for Energy Cost Management

Posted by Richard Zdunkewicz on Jun 22, 2016 11:31:07 AM

Access to substantial amounts of data is only the beginning of the journey towards effective cost management. If the enterprise is not using its data to understand its business processes and the options that alternative or new approaches might present, the data remains merely a playground for analysts. This has never been truer than in the world of electric power. Smart meters and similar devices for measuring power demand at granular intervals are now widely distributed. This technology provides the enterprise, the utility and grid operators with an ocean of data. However, it seems that little is actually done with that data to improve the efficiency of operations.

Topics: Acclaim Energy Advisors, energy costs, Big Data, power

Why Don’t More Financial Execs Oversee Their Energy Supply Agreements

Posted by Richard Zdunkewicz on Jun 6, 2016 6:23:53 PM

It is concerning to observe a pattern of financial executives unaware of the terms of their own company’s energy supply agreements; particularly when to me it is so clear this is a necessity. These commitments represent substantial financial exposure that are arranged, in some cases, outside the company’s risk management policy and processes for financial commitments. Another very important reason for financial executives to have knowledge of their energy supply agreements is their treatment in the event of Chapter 11 bankruptcy. Obviously, no business plans for bankruptcy, but prudent financial executives should understand the potentially substantive risks that might arise in this unlikely event.

Topics: Acclaim Energy Advisors, energy, energy savings, energy blog, electricity markets

Oil & Gas Industry's Challenges And Potential Impact On Power Supply Agreements

Posted by Richard Zdunkewicz on Jun 1, 2016 5:06:15 PM

Even as crude oil and natural gas prices begin to rebound from their recent lows, we are seeing continued financial stress in the oil & gas sector. In recent months, Linn Energy, Chaparral Energy, Penn Virginia, Halcón Resources, and Breitburn Energy Partners have all filed Chapter 11. Financial concerns are not confined to the Upstream segment as Midstream players such as Plains All America Pipeline and Azure Midstream have seen their bonds downgraded by the rating agencies.

Topics: energy management, energy blog, NG

ERCOT Seasonal Assessment For Resource Adequacy (SARA) For Summer Anticipates Sufficient Reserves

Posted by Alberto Rios on May 10, 2016 9:30:11 AM

On December 1, 2015 ERCOT’s Capacity, Demand and Reserves report projected a summer 2016 Reserve margin of 16.5%, with Total Capacity at 79,280 MW and firm peak load at 68,063 MW. Nevertheless, the final summer SARA, which was released on May 3, 2016 estimates total generation resource capacity at 78,434 MW, and firm peak load at 70,588, so summer reserve margin is now projected to be 11.1%. Capacity is lower in the final SARA report because a couple of natural gas-fired Peaker facilities are now expected to be available later in the summer, 416 MW of additional mothballed capacity, and a decrease of 512 MW in planned capacity compared to the amounts reported in previous reports.

Topics: ERCOT Heat Rates, ERCOT, EIA, summer

3 Factors That Can Influence Natural Gas And Electricity Prices During The Spring of 2016

Posted by Alberto Rios on Apr 25, 2016 9:11:57 AM

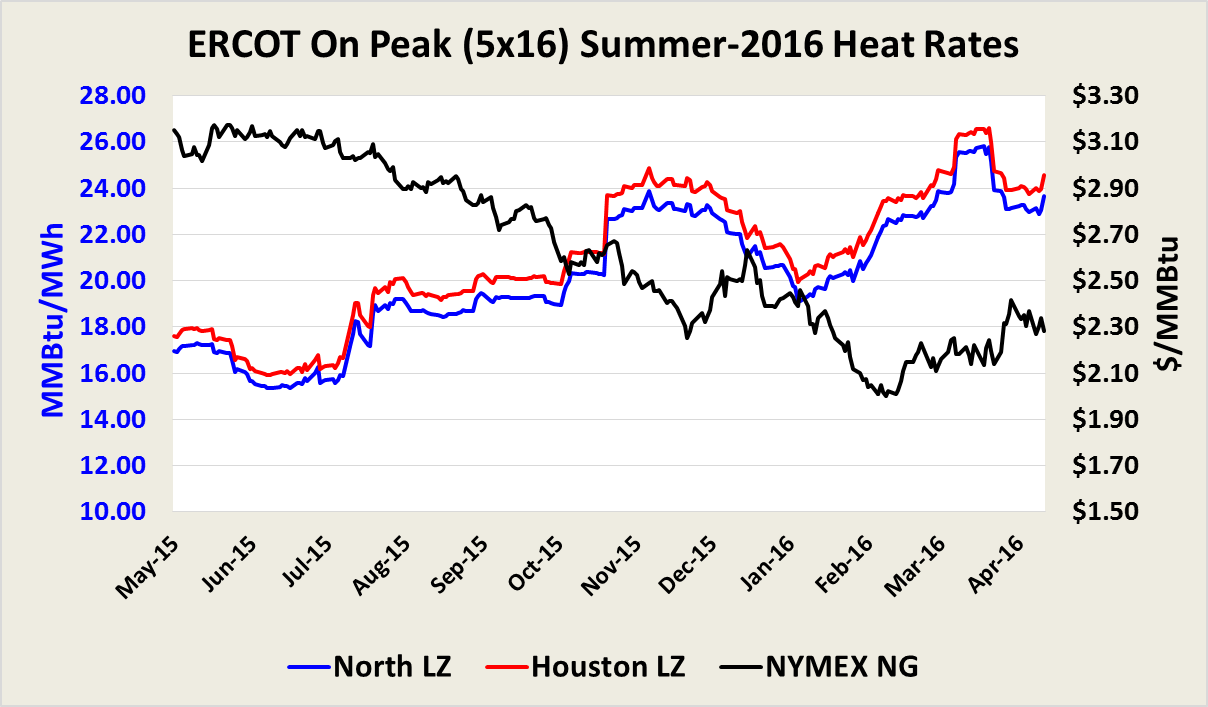

Typically, spring is a season of low electricity and natural gas demand as heating demands from the winter fades away and cooling demand tends to be low until it starts ramping up closer to the summer. This year though, there are several factors that could potentially buck the bearish trend that has been in play since 2014.

Topics: natural gas, NG, forecasting

Weak NG and Power Market Fundamentals - Low Price Environment Will Linger in 2016

Posted by Alberto Rios on Mar 7, 2016 2:39:58 PM

The lack of sustained cold temperatures across the consuming regions has curbed heating demand from residential and commercial consumers. El Niño has had a major influence this winter, so the bouts of below normal temperatures that have swept the eastern half of the country have been short lived. As we approach the spring, natural gas and power fundamentals continue to be bearish because of the following factors:

Topics: forward curve, risk management, energy, Natural Gas Supply, NG Demand, Texas, NG

Natural Gas Could Top 4,000 BCF, Setting A New Storage Record - Do You Have A Risk Management Strategy?

Posted by Alberto Rios on Nov 11, 2015 1:00:00 PM

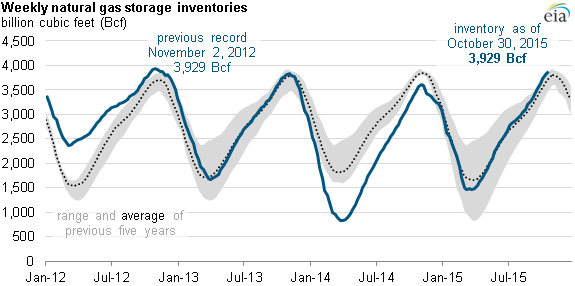

Typically, the end of October is considered by many in the industry the end of the natural gas injection season; history however, paints a different picture. During the last 13 years (including 2015), there have been net injections through at least the first week of November, and in 7 of the 13 years, there have been net injections in multiple weeks in November. In 2015, we expect to see injections at least through the week ended November 13, 2015.

Topics: risk management, energy storage, NG

NG Prices Nearing A Three and Half Year Low - 3 Factors That Are Driving The Selloff

Posted by Alberto Rios on Oct 27, 2015 10:33:27 AM

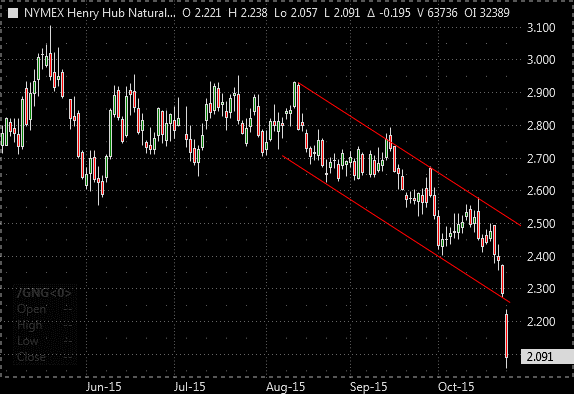

Weak fundamentals have contributed to the recent selloff in natural gas futures. The front month contract is currently trading 14.6% lower compared to last week. Expectations of lower heating demand during the fall, high production and healthy inventory levels are setting the stage for lower prices ahead of the winter as the market continues to discount the winter risk premium. The chart below shows that natural gas futures has been trading on a bearish channel since August 2015.