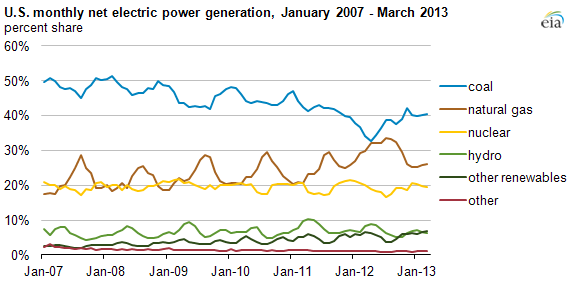

According to the Energy Information Administration (EIA), the electricity generation sector is responsible for over 90% of the total coal consumption in the U.S., and coal fired generation has historically been the most prominent source of electricity production. As seen in the graph below, however, natural gas has been increasing its market share as generation feedstock over the past couple of years. In February 2012, Coal and Natural Gas had the same percent share of power generation in the U.S.

Source: Energy Information Administration, Compilation of Numbers from Electric Power Monthly

In its 2013 Annual Energy Outlook, the EIA noted that since 1990, over 75% of all new electric generation capacity has been natural gas fired. This growth slowed because of high natural gas price and a slow- down in economic activity in the mid-to-late 2000s. You may wonder why natural gas has made such significant strides in the generation sector and what does this fuel shift signify for energy procurement?

The increased bias towards natural gas and away from coal results from three critical drivers—strong production from shale plays, lower natural gas fired capital costs, and environmental policy. These three drivers have contributed to boost the development of natural gas fired power plants across the U.S. For end users, this means that changes in natural gas prices on a forward basis will have an increasingly important role to play when deciding on hedging strategies and energy procurement risk management. The above mentioned drivers are further described below:

Increased Supply of Natural Gas Has Lowered its Cost

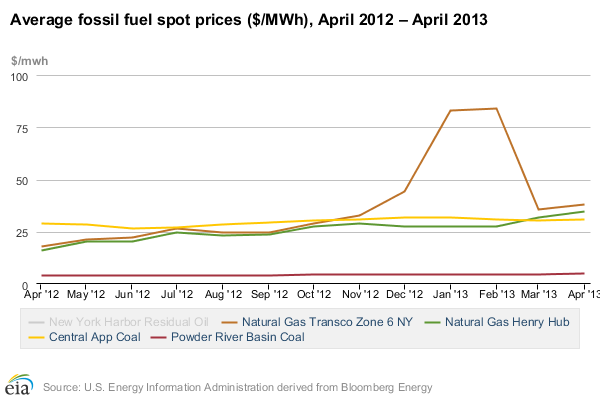

Since 2009, natural gas prices have been falling, due largely to massive increases in natural gas supply as a result of the increased use of fracking to access previously trapped natural gas deposits. As the supply of natural gas has increased, the prices have dropped sharply since 2008. In the electricity generation sector, natural gas fired power plants have actually become increasingly cost competitive with coal fired generation. As seen in the chart below, natural gas fired plants burning gas at Henry Hub spot prices were cheaper than coal plants except those burning Power River Basin Coal for most of the past year.

In 2013, Coal to natural gas switching has been much lower compared to that of 2012, since spot price have been much higher compared to last year.

Lower Capital Costs

According to an April 2013 study published by the EIA, an advanced pulverized coal plant (the cheapest model coal plant) has capital costs of roughly $3,000/kW, compared to a cost of less than $1,000/kW for a natural gas combined cycle plant. These lower initial capital costs mean that natural gas plants can be built for less and also tend to take less time. In addition, the capital costs for coal are increasing while the same costs are decreasing for natural gas fired plants. The study found that capital costs for coal plants have increased by roughly 20% since 2010 while costs for natural gas plants have fallen by 10%.[1]

Environmental Policy

While the Environmental Protection Agency’s (EPA) Cross-State Air Pollution Rule (CSAPR) remains in legal limbo with an appeal pending before the Supreme Court, there is no question that the environmental impacts of coal plants have resulted in them falling increasingly out of favor. In his recently announced environmental policy, President Obama stressed the importance of natural gas as a fuel source for the U.S. and directed the EPA to develop rules for pollutants emitted from power plants. This policy directive will put increasing pressure on coal fired power plants as emissions controls are tightened, requiring either expensive retrofits or the closure of older coal plants that will not be able to comply with any proposed environmental regulations. This need to reduce emissions from power plants will push new generation development towards cleaner burning natural gas and put pressure on existing coal plants, further eroding the predominance of coal as a fuel for electric generation.

What Does This Mean for The Consumer?

For the reasons discussed briefly above, natural gas fired generation will become an increasingly vital part of the overall energy production fleet. Of course, one of the challenges facing end users will be the volatility of natural gas prices and the translation of that volatility into energy prices as natural gas takes on an increasingly important role as a generation fuel source. Therefore, an effective energy procurement risk strategy will look closely at the relationship between natural gas and electricity prices in any given area. This means that end users will need to become increasingly savvy concerning the natural gas futures market in order to make informed decisions. Eventually heat rate product structures will be much more widespread in MISO and PJM.

Conclusion

While coal remains, and is likely to remain, the key source for fueling electricity generation for the near future, natural gas will gradually increase its market share. The move to natural gas fired generation is driven by three factors:

- Falling natural gas prices as fracking unlocks additional supplies of natural gas, resulting in increased supply;

- Lower capital costs for natural gas fired plants versus coal plants combined with a trend of increasing capital costs for coal generation while the cost for natural gas generators are falling; and

- Concerns about the environmental impact of coal fired generation versus natural gas fueled plants.

From the perspective of end users attempting to implement sound energy procurement risk management principles, natural gas will take on an increasingly important role in the overall costs of electricity. This will require consumers to become increasingly aware of the impacts of natural gas on power prices and be able to respond quickly to changing market conditions. While the supremacy of coal as a fuel for generation will likely continue for the next 5-10 years, its hegemony will be increasingly challenged by natural gas.

[1] See generally “Updated Capital Cost Estimates for Utility Scale Electricity Generation Plants”, April 2013, available at: http://www.eia.gov/forecasts/capitalcost/pdf/updated_capcost.pdf