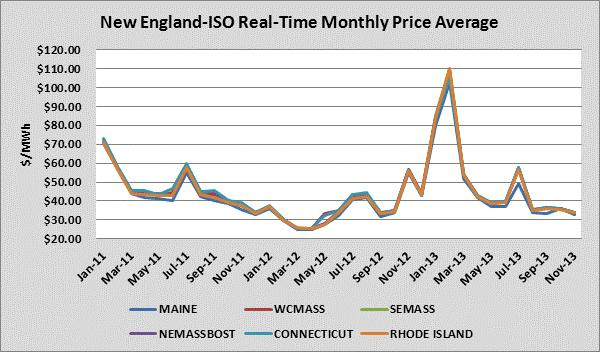

The U.S. 2011/2012 winter was the fourth warmest on record. NE energy end users who were exposed to the spot market were rewarded with very low prices. Nevertheless, the U.S. 2012/2013 winter was significantly colder despite being the twentieth warmest winter on record. Despite a mild winter start, last January had a large number of days below freezing and February was the fifth snowiest on record. Consequently, natural gas and electricity end users in NE who were exposed to index prices, found themselves facing significantly higher energy costs on the spot market. During these two months, unusually cold temperatures triggered price spikes due to forced plant outages, which caused reliability problems within the grid. To circumvent these issues, the entity responsible for maintaining electric reliability, the New England Independent System Operator (ISO-NE), was forced to dispatch higher cost power plants. The chart below shows historical monthly Real-Time prices across multiple Load Zones. Across these Load Zones, the average prices for the months of January 2013 and February 2013 were $83.54/MWh and $107.49/MWh. These prices were significantly higher than this period the previous year.

During the winter, natural gas price volatility is very high in NE. The Algonquin Gas Transmission city gates basis, which is a major Boston price index and the Tennessee Gas Pipeline Zone 6-200 leg, another NE basis point, has historically spiked during the winter due to capacity constraints. Even though Algonquin is close to the Marcellus Shale, less than 2Bcf/day can make it to market. While there are significant pipeline expansions in place for natural gas transportation from the Marcellus Shale into New Jersey and New York, these expansions are unlikely to provide any relief for customers in the New England area. The combination of capacity pipeline constraints and a number of old power plants in this region should raise concerns on the possible adverse price movements in NE. If you are currently exposed to natural gas or electricity index prices in this region, contact your energy advisor to develop an energy management plan ahead of the peak of the winter season.

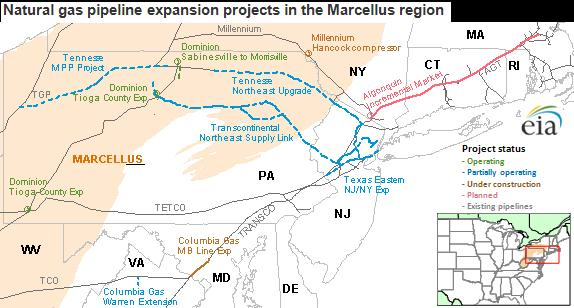

The planned natural gas pipeline expansion

The Marcellus Shale is one of the four major shale formations where fracking has unlocked and added significant amounts of natural gas available to the market. One factor limiting this process has be.,en the lack of transmission infrastructure to transport the gas to major areas of demand. The map below shows the natural gas pipeline expansions that are currently planned.

Source: U.S. Energy Information Administration

As shown above, transmission projects designed to carry gas from the Marcellus Shale to New York and New Jersey are either operating to some degree or are under construction. The red line on the map is the Algonquin Incremental Market (AIM) expansion. It is the only project which is still in the planning phase and the only one that will increase natural gas pipeline capacity into New England. The construction of this pipeline means that New England, at least for the next several years, will continue to face challenges as the natural gas infrastructure will be strained to provide sufficient natural gas for the region’s generators.

The conundrum in New England

Since 1998, the NE-ISO area has added over 12,000 MW of natural gas fired electricity to the generation mix, making natural gas the primary fuel source for power generation in the region. According to ISO-NE, almost 40% of the total power consumed came from natural gas fired power plants in 2012.

However, when the weather turns cold problems arise. Most natural gas fired power plants receive natural gas only on a non-firm basis, meaning that there is no guarantee of delivery if natural gas is needed for other reasons, such as home heating. This means that when the weather turns cold and people turn on their natural gas fired furnaces, the pipeline capacity for the transport of natural gas is used to meet home heating requirements, reducing the available transport capacity to natural gas fired power plants at times when demand tends to be at its highest. A mere 10% reduction in available natural gas pipeline capacity will reduce available generation by 4% (10% reduction multiplied by the 40% share of natural gas fired generation in NE-ISO). At times of peak demand, a reduction of available capacity by 4% can lead to significant price spikes as ISO-NE has to dispatch higher cost power plants to match generation with demand.

Stop-Gap Measures—ISO-NE additional capacity purchases

In order to make sure that there is sufficient generation capacity for the upcoming winter, ISO-NE received approval from the Federal Energy Regulatory Commission (FERC) to implement a winter reliability program. Under this program, NE-ISO purchased an additional 2.4 million MWH of generation from power plants that can switch from natural gas to oil for fuel in order to ensure that there is sufficient generation capacity available to provide reliable electricity service. The program was met with initial problems. One of these issues was the fact that ISO-NE has not been able to purchase all of the energy that it believes may be necessary to meet the shortfall the market may experience this winter. In addition, this program is projected to cost approximately $75 million, which will be charged to end users in the form of a pass-through; clients who believe they have a fixed price product will actually see higher costs.

The challenges for energy risk managers

With limited natural gas pipeline capacity in New England for the foreseeable future and the region’s increasing reliance on natural gas fired generation, price spikes are likely to continue, especially in the winter months. From an energy risk management perspective, this means that end users should proactively monitor and opportunistically lock forward fixed price contracts, especially for the winter months. Risk managers should also be prepared for potential pass-through charges as a result of regulatory changes brought about by the lack of sufficient natural gas pipeline infrastructure in an area which is increasingly becoming more reliant on natural gas fired generation.