The rise of fracking has shifted the U.S. natural gas market at fundamental levels that are not yet fully understood or appreciated. In fact, there is a strong argument to be made that as fracking and other recovery technologies continue to improve, the U.S. will become a major energy provider. By exporting copious amounts of liquefied natural gas (LNG), the U.S. will achieve greater energy independence by cutting back on imports of foreign crude oil products. A massive shift in the global energy markets is neither that far-fetched nor far off and will likely take place over the next decade. As discussed in greater detail below, natural gas has the potential to become a globally traded commodity like crude oil.

Natural gas production

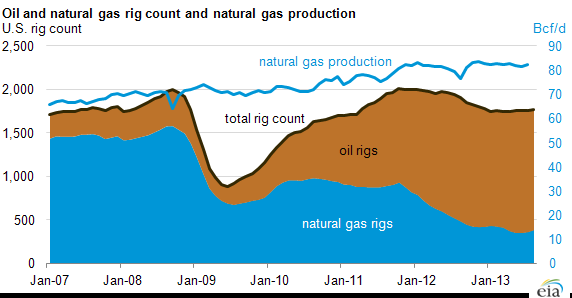

Increased use and improvements in fracking techniques have created a supply surplus for natural gas, even as the number of rigs that are drilling for natural gas has fallen sharply, as seen in the below graphic (Source: EIA).

As production growth continues in the U.S. natural gas shale plays, the question has arisen as to what this means for the future of the U.S. natural gas industry and gas prices. While domestic production should be able to keep pace with increasing demand, the question remains as to how LNG exports will impact prices. Consumer groups argue that LNG exports should be restricted to maintain a low natural gas price environment locally. Conversely, producers argue that not only will there be enough supply to meet domestic demand and LNG exports with only moderate increases in natural gas prices, but that drilling activity will add jobs and increase economic activity in the U.S.

The outlook for LNG Exports

Initially, LNG exports were expected to be relatively modest at 4-6.5BCF/day. However, changes in the global landscape have called this estimate into question. It is increasingly unlikely that Japan will re-start its fleet of nuclear generation after the Fukajima incident in 2011. To compensate for this loss, Japan will need to dramatically increase its imports of natural gas in order to meet its energy demand. Similarly, countries such as Indonesia and Malaysia have seen domestic production crater, leading to the need for increased natural gas imports. On the other hand, there is China. While there is no doubt that China has significant supplies of natural gas that have yet to be tapped, the country is relatively closed off, making is unlikely that these resources will come to market any time soon. As China continues to consume ever increasing amounts of energy, the country will likely look to import LNG in the near- to medium-term until domestic production can start satisfying domestic demand.

The role of the federal government

The Federal Energy Regulatory Commission (FERC) has jurisdiction over liquefied natural gas terminals and shares permitting responsibilities with the Department of Energy (DOE). As of October 15, 2013, there were 30 applications received by the DOE to export domestically produced LNG from the lower-48 states (in addition to the four that have already been permitted). Non-Free Trade Agreement (Non-FTA) applications require the DOE to post a notice of application in the Federal Register for comments, protests and motions to intervene and evaluate the application to make a public interest consistency determination (energy.gov).

The anticipated export capability of all applications under review by the DOE is approximately 36BCF/day. This quantity is well in excess of the originally anticipated Bcf/day quantity. Previous studies suggested that LNG exports would not have a significant impact on natural gas prices in the U.S. Now, producers will need to make a strong case in disassociating the concept of an increase in domestic natural gas prices as a function of an increase in LNG exports. Even if only half of these projects are finally permitted and come to fruition, the U.S. could be exporting more than twice the original estimates.

Application Status as of October 15, 2013

|

Approved |

Non-FTA Application Quantity |

Status |

|

Sabine Pass Liquefaction, LLC |

2.2Bcf/d |

**Approved |

|

Freeport LNG Expansion L.P, and FLNG Liquefaction LLC. |

*1.8Bcf/d |

**Approved |

|

Lake Charles Exports, LLC |

2.0Bcf/d |

**Approved |

|

Dominion Cove Point |

.77Bcf/d |

**Approved |

|

30 applications |

Up to 36Bcf/d |

Under DOE Review |

*On November 15, 2013 the DOE approved an increase in Freeport’s export quantity.

**The federal government has authorized about 6.8 billion cubic feet of U.S. natural gas to be exported to non-free trade nations.

Source: energy.gov

The price outlook for 2016 and beyond

From an economic perspective, LNG exports are unlikely to have significant near-term impacts on natural gas prices due to the long lead time required to permit, design, finance and construct LNG terminals. Natural gas demand will rise due to increasing pressure beyond 2016 from the following drivers:

- Increasing use of natural gas as a fuel for power plants

- Exports of LNG

- Compressed Natural Gas Vehicles

- Petrochemical industry growth in the U.S. (Texas and the Northeast)

In light of these factors, the long-term impact on natural gas prices will be driven by the market’s ability to absorb demand coupled with LNG exports. When managing the forward curve market, knee-jerk reactions must be taken into consideration. For example, on May 17, 2013 the DOE authorized the Freeport LNG expansion, L.P. project to export domestically produced LNG, and between May 15 and May 22, the NYMEX NG calendar strip 2017 and calendar strip 2018 jumped $.30/MMBtu and $.37/MMBtu respectively. Since then, calendar strip 2018 has dropped $.71/MMBtu and is currently trading around $4.25/MMBtu.

There is fierce international competition amongst projects. As the number of LNG projects that can meet global demand increases, potential revenues will be under pressure, allowing a short list of applications to actually make it to market. By 2025, the window of opportunity to profitably supply natural gas to Asia will most likely be closed.