Platts recently reported that the 58 U.S. nuclear power plants totaling almost 60,000MW are expected to refuel in 2014, compared to 54 units totaling over 55,000MW in 2013. The analysis is based on historical refueling data from the US Nuclear Regulatory Commission.

In the first half of 2014, between 35-37 units, totaling 37,000MW are expected to shut down for refueling. This number is between 4-6 units above that of 2013, so outages during the spring of 2014 could be approximately 5,000MW above a year ago. During the second half of 2014, the number of units out for refueling is expected to be 23, which would match that of 2013. Therefore, capacity outages during the fall of 2014 are expected to total 23,000MW.

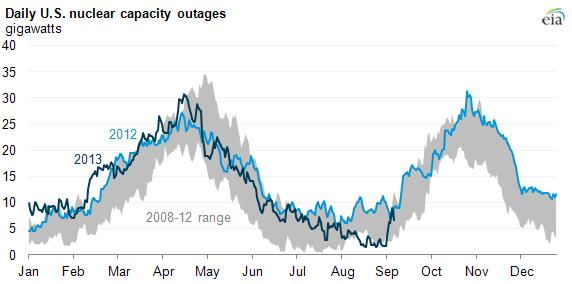

Refueling and maintenance outages for nuclear units typically take place in the spring (March –June) and fall (September – November) "shoulder" months when demand for electricity is normally lower. The chart below, which is the most recent outage chart that the Energy Information Administration published, shows the peak and troughs of the outage throughout the year. The chart also reflects nuclear capacity outages through September 2013, when outages were increasing with the start of the 2013 fall refueling season.

During a typical nuclear plant outage, approximately one-third of the fuel in the reactor is replaced. Outages usually include maintenance and routine inspections and usually this time is also used to replace equipment.

Why should energy end-users follow Nuclear Outages?

Natural gas market players follow nuclear outages closely because natural gas fired capacity typically fills the supply gap left by nuclear outages. Consequently, nuclear outages increase typically boost natural gas demand and lift natural gas prices which in turn raise electricity prices in markets where natural gas is the marginal fuel.

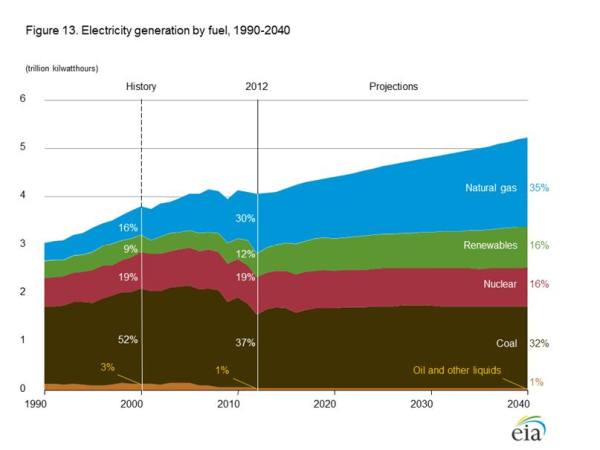

According to the Energy Information Administration’s Annual Energy Outlook 2014 (Early Release), natural gas electricity generation is projected to surpass coal generation as a percentage of total generation in the U.S. Generation from coal is expected to flatten as more coal-fired capacity is retired and fewer new coal plants are developed (see chart below). The relatively low cost of natural gas makes the dispatching of existing natural gas plants more competitive than coal plants and, in combination with relatively lower capital costs and lower emissions than coal generation, makes plants fueled by natural gas an alternative choice for new generation capacity. In the near-term though, coal will continue to be the largest component of electricity generation in the U.S.

What impact will a higher number of nuclear outages have on natural gas and electricity prices in 2014?

Temperatures recorded so far this winter have been the coldest in some regions for more than two decades. Consequently, heating related demand for natural gas has risen significantly. With two more winter months remaining and near-term expectations of below normal temperatures in the consuming regions, concerns that supplies will be very tight by the end of the natural gas winter season are rising. Some analysts are calling for inventories to decline well below 1,500Bcf by the end of the winter heating season. Such outcome would set a 6-year low.

An increase in the number of nuclear outages in 2014 compared to those in 2013 could further tighten the natural gas market. Since mid-November of 2013 natural gas price action has been driven by the shift in weather forecasts and higher than normal withdrawals from inventory. Therefore, an unusually low inventory by the end of the winter heating season followed by a high April nuclear outage peak could set the stage for a higher natural gas price environment in 2014 since natural gas demand could remain high during the spring. Customers with open 2014 natural gas or electricity exposures should start developing a risk management strategy to protect against potential adverse price movements.

Below we have included a list from Platts’ repot, which lists the projected outages per semester of 2014 across all markets:

MARKET REGIONS, FIRST-HALF 2014

Electric Reliability Council of Texas, or ERCOT, region, two units totaling 2,458 MW will refuel

-

Luminant's 1,207-MW Comanche Peak-2

-

STP Nuclear Operating Co.'s 1,251-MW South Texas Project-1. In the year-ago period, one 1,218-MW unit refueled.

In the Midwest/Upper Midwest region, seven units totaling 6,933 MW are expected to refuel in first-half 2014, compared to nine units totaling 9,194 MW in first-half 2013.

-

FirstEnergy Nuclear Operating Co.'s 933-MW Beaver Valley-2 in Pennsylvania

-

Exelon's 1,155-MW, Braidwood-2 (to begin March 1), 1,187-MW, Byron-1, 1,178-MW LaSalle-1 and 957-MW Quad Cities-2 (to begin in April) in Illinois

-

Fenoc's 908-MW Davis-Besse in Ohio

-

NextEra Energy Resources' 615-MW Point Beach-2 in Wisconsin.

In the Northeast/Mid-Atlantic region, nine units totaling 9,570 MW are expected to refuel in first-half 2014, compared with nine units totaling 8,703 MW in first-half 2013. Units expected to refuel in the first half are:

-

Constellation's 845-MW Calvert Cliffs-1 in MarylandDominion's 884-MW Millstone-2 in Connecticut; PSEG's 1,181-MW Salem-2 in New Jersey; NextEra Energy Resources' 1,248-MW Seabrook in New Hampshire; and PPL's 1,287-MW Susquehanna-1 in Pennsylvania.

-

Constellation's 585-MW Ginna (to begin in May) and 1,300-MW Nine Mile Point-2 (to begin in April) , Entergy's 1,035-MW Indian Point-2 in New York

-

Exelon's 1,205-MW Limerick-1 in Pennsylvania; Dominion's 884-MW Millstone-2 in Connecticut; PSEG's 1,181-MW Salem-2 in New Jersey; NextEra Energy Resources' 1,248-MW Seabrook in New Hampshire; and PPL's 1,287-MW Susquehanna-1 in Pennsylvania.

-

Dominion's 884-MW Millstone-2 in Connecticut

-

PSEG's 1,181-MW Salem-2 in New Jersey

-

NextEra Energy Resources' 1,248-MW Seabrook in New Hampshire

-

PPL's 1,287-MW Susquehanna-1 in Pennsylvania.

In the Southeast, 15 units totaling 15,647 MW are expected to refuel in first-half 2013, compared to nine units totaling 9,058 MW in first-half 2013. Units expected to refuel in the first half are:

-

Entergy's 1,032-MW Arkansas Nuclear One-2 in Arkansas

-

Tennessee Valley Authority's 1,120-MW Browns Ferry-3 in Alabama

-

Duke Energy's 983-MW Brunswick-1 and 1,180-MW McGuire-2 in North Carolina Duke's 1,145-MW Catawba-1 and 886-MW Oconee-3

-

Duke's 1,145-MW Catawba-1 and 886-MW Oconee-3, South Carolina Electric & Gas' 973-MW Summer in South Carolina

-

TVA's 1,151-MW Sequoyah-2 and 1,155-MW Watts Bar-1 in Tennessee

-

NextEra's 1,074-MW St. Lucie-2 (to begin in March) and 845-MW Turkey Point-3 (to begin in March) in Florida

-

Dominion's 839-NW Surry-2 in Virginia

-

Entergy's 1,173-MW Waterford-3 in Louisiana.

In the West, two units totaling 2,474 MW will refuel in first half-2014

-

Pacific Gas & Electric's 1,138-MW Diablo Canyon-1 in California

-

Arizona Public Service's 1,336-MW Palo Verde-2 in Arizona. In first-half 2013, three units totaling 3,637 MW refueled.

MARKET REGIONS, SECOND-HALF 2014

One unit in the ERCOT region

-

1,218-MW Luminant's Comanche Peak-1

In the Midwest/Upper Midwest region, eight units totaling 6,955 MW are expected to refuel in the second half of 2014

-

Exelon's 1,155-MW Byron-2 and 879-MW Dresden-3 (to begin in October) in Illinois

-

Ameren's 1,228-MW Callaway in Missouri; American Electric Power's 1,084-MW Cook-1 in Michigan

-

Nebraska Public Power District's 815-MW Cooper (to begin in September) in Nebraska

-

NextEra Energy Resources' 622-MW Duane Arnold in Iowa and 615-MW Point Beach-1 (to begin in October) in Wisconsin

-

Xcel Energy's 557-MW Prairie Island-1 in Minnesota.

In the Northeast/Mid-Atlantic region, five units totaling 5,002 MW are expected to refuel in the second half --

-

Entergy's 816-MW FitzPatrick in New York; Dominion's 1,229-MW Millstone-3 in Connecticut,

-

Exelon's 650-MW Oyster Creek and PSEG's 1,169-MW Salem-1 in New Jersey

-

Exelon's 1,138-MW Peach Bottom-2 in Pennsylvania. In the second half of last year, three units totaling 3,185 MW refueled.

In the Southeast, seven units totaling 7,084 MW are to refuel in the second half, compared to 10 units totaling 10,097 in second-half 2013.

-

TVA's 1,120-MW Browns Ferry-1 and Southern Nuclear's 878-MW Farley-2 in Alabama

-

Duke's 1,200-MW McGuire-1 in North Carolina

-

Dominion's 973-MW North Anna-2 in Virginia

-

Southern's 886-MW Oconee-1 in South Carolina

- NextEra's 845-MW Turkey Point-4 in Florida

In the West, two units totaling 2,490 MW --

-

PG&E's 1,157-MW Diablo Canyon-2 (to begin in October) in California

-

APS' 1,333-MW Palo Verde-1 (to begin in October) in Arizona -- are expected to refuel in second-half 2014, compared to APS' 1,334-MW Palo Verde-3 a year ago.