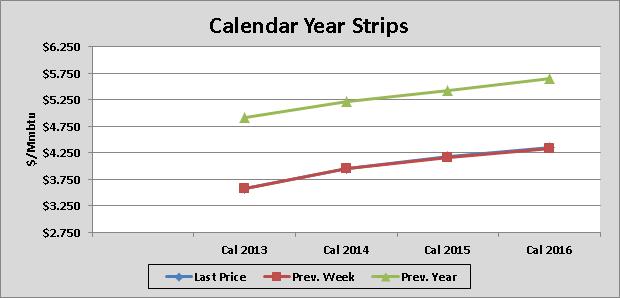

There has been quite a bit of volatility in today’s NG futures trading session. The October 2012 contract is back to being flat, and the CAL2013 is approximately $.025/MMBtu up. Weather forecasts still favor a decline in natural gas demand; however, the high level of offline US nuclear capacity will provide some support to the downside.

We are approaching the 9/28/12 PUC meeting, where a decision might be made on a multi-year higher system wide offer cap. Below you will find a couple of articles about the change in market structure and ERCOT’s West Congestion.

Texas Commission Directs ERCOT to Perform Backcast Analysis of Resource Adequacy Options

http://www.energychoicematters.com/stories/20120913c.html

In summary, the Texas PUC will not rush into a decision, so they have asked ERCOT to perform a backcast analysis for 2012 under current market design with higher price caps: $4,500/MW, $6,000/MW, $7,500/MW, and $9,000/MW. The PUC is carefully reviewing the options provided by the Brattle group, including the options that consider a capacity market. Even though, generators support the capacity market option, it seems that such change in market design will face strong headwinds.

The approval of an increase in price caps will bump up forward heat rates. The bump will be a directly proportional to the cap increase.

ERCOT Addresses West Zone Congestion Though Changes in Transmission Element Statuses

http://www.energychoicematters.com/stories/20120913e.html

ERCOT is working with ONCOR to reconfigure some facilities to improve congestion management. This operating changes were scheduled to start yesterday, 9/17/12.

The source of both articles is wwwenergychoicematters.com

Click here to see the Daily NYMEX Report