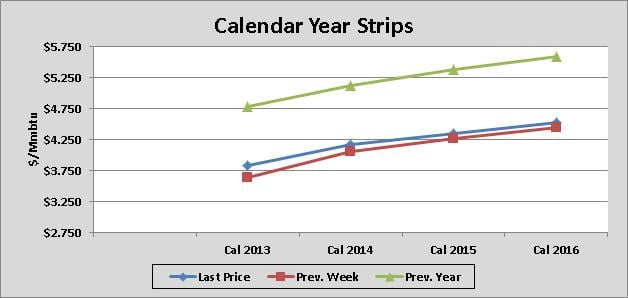

Natural Gas futures pulled back slightly this morning after a 10% increase this week, but rose at the close. Nevertheless, there are a couple of factors that could limit the upside:

- Utilities switching back to coal

- Mild Autumn weather

- Trading at resistance, and in overbought territory

- Prices rose too much and too fast on expectations of higher demand due to below normal temperatures, which might not materialize

- Sustained cold temperatures are needed to really boost demand

The factors that could support current levels are:

- Above nuclear outages (25% higher than the 5-year average)

- Even though prices are in overbought territory they could stay here for a while

- Getting close to weather driven market conditions

- Winter forecasts are completely unreliable!!! Too many variables

Anyway, probabilities seem to favor a price correction. Customers with open exposures on Q1-2013 should cover on a dip close to the low side of the trading range.

Regarding Heat Rates, we saw an increase since Tuesday September 25, 2012 and liquidity dried up in anticipation of today’s Texas PUCT meeting. The meeting did not live up to its hype since the Commission decided to defer action on raising the wholesale price caps. It will be interesting to see if we see any relief until the PUCT holds a workshop on the issue on October 25, 2012. Below you will find a link from energychoicematters.com

http://www.energychoicematters.com/stories/20120928g.html

Click to see the Daily NYMEX Report