Natural Gas futures paused today after the November 2012 contract rallied more than 20% during the last 5 trading sessions. This has been the biggest 5 day run in almost three years.

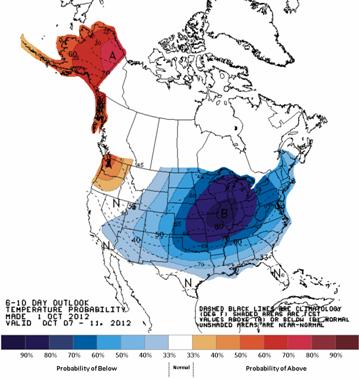

The 6-10 day weather forecasts (see picture below), are still calling for below normal temperatures across most of the continental U.S. MDA EarthSat is expecting that heating demand nationwide will be 78% above normal from 10/7-10/11. Therefore there will be an increase in natural gas fired power plant burn. There are a couple fundamental factors that could limit the upside, but we still see somewhat of a bullish bias in the market.

Technically we continue to be in overbought territory, yet we might consolidate around the $3.50/MMBtu level until we get fresh news from the storage data for the week ending on 9/28/12.

Click here to see the Daily NYMEX Report.