On December 1, 2015 ERCOT’s Capacity, Demand and Reserves report projected a summer 2016 Reserve margin of 16.5%, with Total Capacity at 79,280 MW and firm peak load at 68,063 MW. Nevertheless, the final summer SARA, which was released on May 3, 2016 estimates total generation resource capacity at 78,434 MW, and firm peak load at 70,588, so summer reserve margin is now projected to be 11.1%. Capacity is lower in the final SARA report because a couple of natural gas-fired Peaker facilities are now expected to be available later in the summer, 416 MW of additional mothballed capacity, and a decrease of 512 MW in planned capacity compared to the amounts reported in previous reports.

The ERCOT Board of Directors has a target planning reserve margin of 13.75%, but a study submitted by ERCOT to the Public Utility Commission of Texas in January 2015 concluded that 16.75% would be more appropriate to maintain reliability levels that would result in no more than one day of outages in 10 years (source: Platts).

Despite the lower reserve margin, ERCOT expects to have enough generation available to serve consumer needs this summer. It is worth mentioning that in the event of extreme load the reserve margin could drop to 2.7%, with capacity available for operating reserves at 1,921 MW (Less than 2,300 MW indicates risk of EEA1- Energy Emergency Alert).

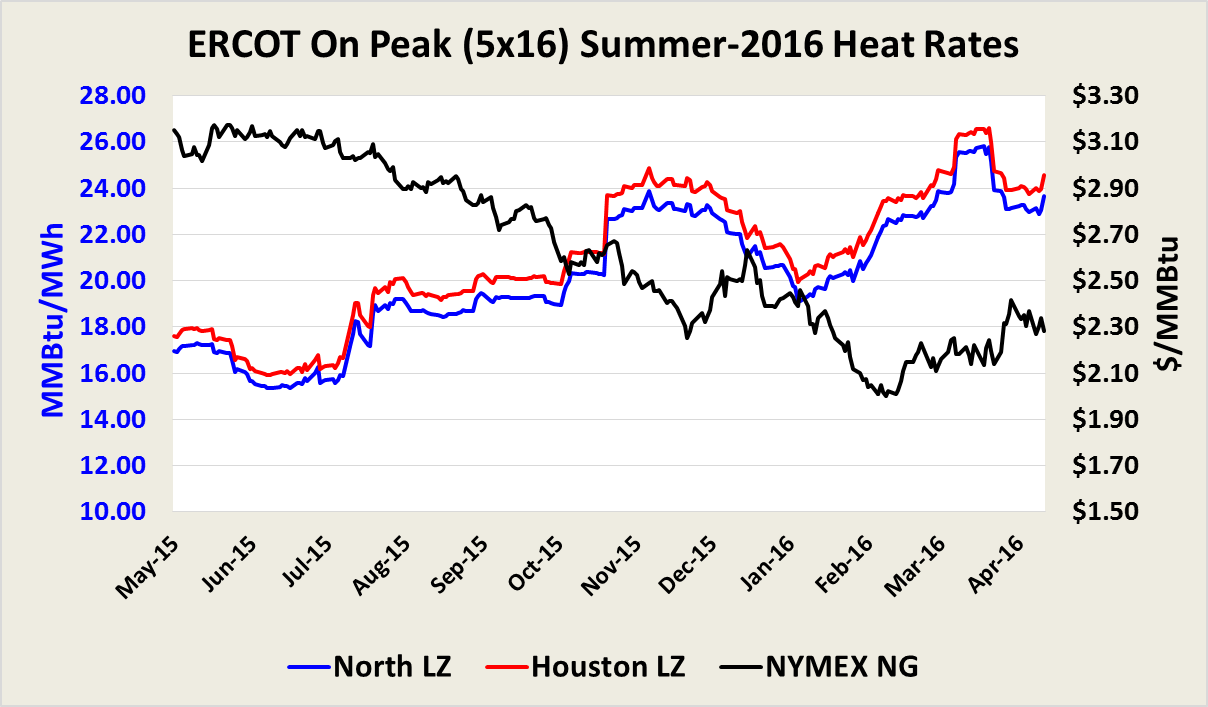

Summer Heat Rates

The Chart below shows the inverse relationship between NYMEX Henry Hub natural gas prices and ERCOT heat rates. Summer-2016 fixed prices have remained relatively steady during the last 12 months as a decline in natural gas prices has offset the increase in heat rates. Fixed electricity prices have rebounded from the lows reached in late February-2016 due to higher natural gas prices. As we approach the summer we expect to see higher heat rate volatility as a result of lower than previously expected reserve margins and shifts in summer weather forecasts. During the summer, electricity prices typically reach their highest level when total demand is high and when more expensive generation is added to meet the increased demand. Consequently, prices are very sensitive to changes in demand expectations during the summer.

Conclusion

Most U.S. deregulated market prices have rebounded as a result of the short squeeze on natural gas prices and this trend could continue. We strongly encourage consumers to hedge 2016 and even some 2017 open exposure ahead of the summer because of the potential of higher supply and demand conditions in the natural gas market driven by:

- The number of active rigs drilling for crude and natural gas has dropped to 415 (lowest level since 1949). Recent Bentek Energy data shows daily production from April 1 through April 23 declined 1.0% compared to average production in March, and a full 2.5% lower than the average production in February.

- Decrease in capital expenditures

- Delays on and cancellation of pipeline projectes designed to distribute Marcellus and Utica natural gas (source: EIA)

- Cheniere’s LA LNG export terminal has added 35.4 Bcf of demand since 10/2015. According to Bloomberg, such demand has helped support prices by $0.05-$0.10/MMBtu

- Increase in exports to Mexico

Therefore, it is likely that power prices will rise over the summer. Evaluating longer term transactions will likely pay off in several markets. Contact your Acclaim Energy representative to discuss your current situation and determine what strategic sourcing strategy best fits your risk profile.