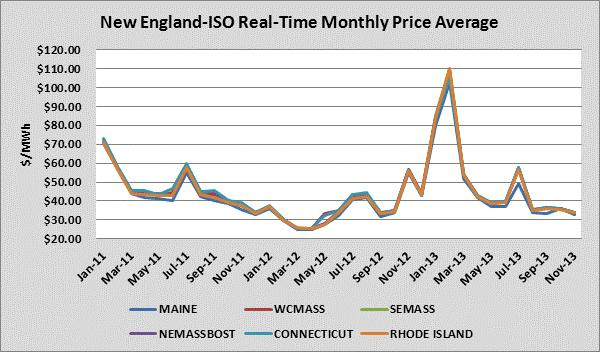

The U.S. 2011/2012 winter was the fourth warmest on record. NE energy end users who were exposed to the spot market were rewarded with very low prices. Nevertheless, the U.S. 2012/2013 winter was significantly colder despite being the twentieth warmest winter on record. Despite a mild winter start, last January had a large number of days below freezing and February was the fifth snowiest on record. Consequently, natural gas and electricity end users in NE who were exposed to index prices, found themselves facing significantly higher energy costs on the spot market. During these two months, unusually cold temperatures triggered price spikes due to forced plant outages, which caused reliability problems within the grid. To circumvent these issues, the entity responsible for maintaining electric reliability, the New England Independent System Operator (ISO-NE), was forced to dispatch higher cost power plants. The chart below shows historical monthly Real-Time prices across multiple Load Zones. Across these Load Zones, the average prices for the months of January 2013 and February 2013 were $83.54/MWh and $107.49/MWh. These prices were significantly higher than this period the previous year.

New England (NE) Market- Reasons Behind Winter Energy Price Spikes

Posted by Jennifer Chang on Nov 12, 2013 8:56:00 PM

Topics: Acclaim Energy Advisors, energy management consulting, energy, weather outlook, Weekly Energy Insights, energy management consultants, Winter Weather, new england

Energy Reliability: The Capacity Market Debate in Texas Heats Up!

Posted by Dennis Vegas on Aug 22, 2013 7:05:00 AM

During the hot summer months in Texas, participants in the energy markets, including the independent system operator known as the Electric Reliability Council of Texas (ERCOT), turn their attention to making sure that there is sufficient generation available to meet power demand. While ERCOT is unlikely to have significant reliability challenges during the balance of 2013’s summer, there are concerns about whether this will hold true in the future. In order to address these concerns, some market participants, such as NRG, have argued that Texas should consider implementation of a capacity market, and preferably one similar to the capacity market in the Mid-Atlantic region of the country.

Topics: ERCOT, energy sourcing, PJM, energy management consultants, capacity markets