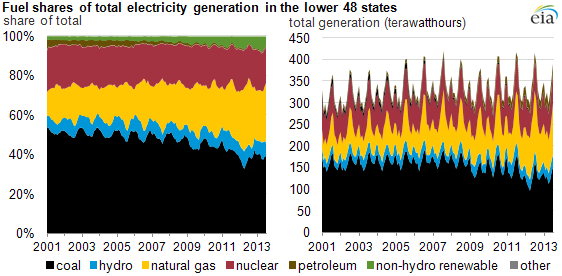

For years, coal has been the dominant fuel source for power generation in the U.S.. However, recent changes in the market place, including tighter emissions restrictions imposed by the Environmental Protection Agency (EPA) and low natural gas prices from abundant shale gas suppliers, threaten coal’s dominance as the leading fuel source for generation. An analysis conducted by the Department of Energy (DOE) was published in August and predicted that between 35 and 60 gigawatts of coal-fired electricity generation in the eastern half of the country will be retired within the next five years. Therefore, new generation, transmission investments and reliability must run (RMR) contracts will be needed to maintain grid reliability. Natural gas fired generation will most likely fill the bulk of the gap left by the coal retirements. The impact of retirements and the higher operation costs of the remaining coal plants will trigger an increase in prices. This effect will be magnified in regions that are more dependent on coal fired generation, like the Midwest.

Jennifer Chang

Recent Posts

Topics: coal, energy risk management, Acclaim Energy Advisors, energy, Energy Solutions, energy procurement, energy regulations, Weekly Energy Insights, energy management, U.S. energy

New England (NE) Market- Reasons Behind Winter Energy Price Spikes

Posted by Jennifer Chang on Nov 12, 2013 8:56:00 PM

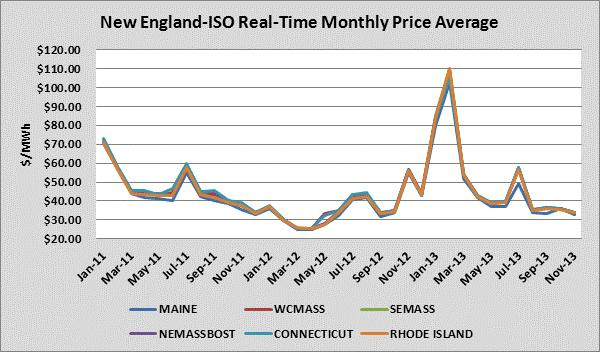

The U.S. 2011/2012 winter was the fourth warmest on record. NE energy end users who were exposed to the spot market were rewarded with very low prices. Nevertheless, the U.S. 2012/2013 winter was significantly colder despite being the twentieth warmest winter on record. Despite a mild winter start, last January had a large number of days below freezing and February was the fifth snowiest on record. Consequently, natural gas and electricity end users in NE who were exposed to index prices, found themselves facing significantly higher energy costs on the spot market. During these two months, unusually cold temperatures triggered price spikes due to forced plant outages, which caused reliability problems within the grid. To circumvent these issues, the entity responsible for maintaining electric reliability, the New England Independent System Operator (ISO-NE), was forced to dispatch higher cost power plants. The chart below shows historical monthly Real-Time prices across multiple Load Zones. Across these Load Zones, the average prices for the months of January 2013 and February 2013 were $83.54/MWh and $107.49/MWh. These prices were significantly higher than this period the previous year.

Topics: Acclaim Energy Advisors, energy management consulting, energy, weather outlook, Weekly Energy Insights, energy management consultants, Winter Weather, new england

2013/2014 Winter Weather Forecast- What to Expect?

Posted by Jennifer Chang on Nov 8, 2013 10:34:00 AM

Besides an uneventful 2013 hurricane season, which “technically” ends on November 30, the natural gas injection season is also coming to an end. According to the Energy Information Administration (EIA) storage injection report released on November 7, 2013, natural gas inventories are 1.5% above the five-year average. The latest near-term weather forecasts suggest that the gap will increase during the next two or three weeks. In other words, according to the EIA, there should be sufficient natural gas in storage to meet the projected natural gas heating demand for the upcoming winter.

Topics: Acclaim Energy Advisors, weather outlook, Weekly Energy Insights, natural gas, Hurricane Season, EIA, Texas

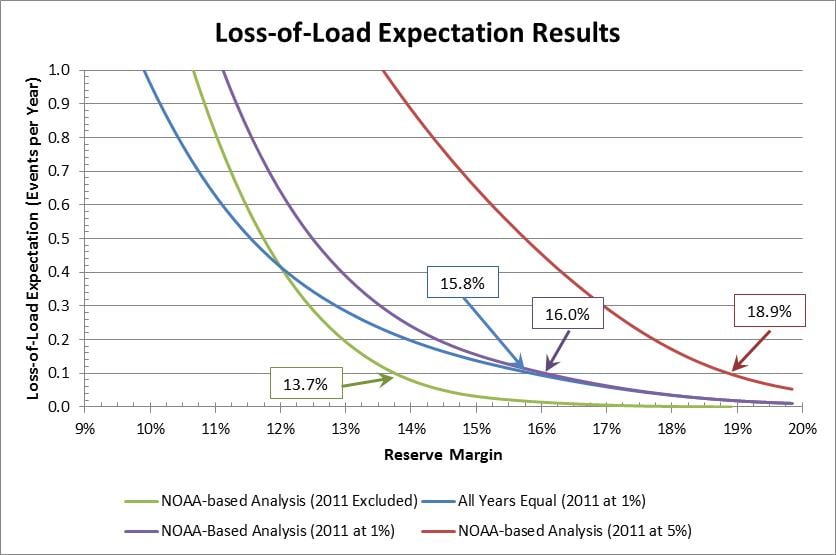

ERCOT Mandatory Reserve Margin- Reliability vs. Competition

Posted by Jennifer Chang on Oct 30, 2013 7:32:00 PM

At the Public Utility Commission of Texas (PUCT) open meeting on October 25, 2013, the PUCT voted 2-1 to establish a mandatory reserve margin. Chairman Donna Nelson and Commissioner Brandy Marty voted in favor of such directive, however, Commissioner Kenneth Anderson unwaveringly opposed to such measure. Nelson was, however, against an immediate decision as to which specific market model would best support the mandate. Therefore, the PUCT will wait for a report from the Brattle Group that will provide a study on the economically optimal reserve margin and mechanism to achieve it. The move toward a mandatory reserve requirement raises the following questions: