It is well known that those of us in the business of trading or buying natural gas (and power for that matter) anxiously await the weekly natural gas storage reports issued by the Energy Information Administration. In fact, in my office there is friendly wagering amongst our price risk management and consulting staffs on exactly what the level of inventory build, or draw, will be.

Richard Zdunkewicz

Recent Posts

Natural Gas Storage and Price, a Journey Back Through Time

Posted by Richard Zdunkewicz on Aug 9, 2016 9:43:13 AM

Topics: risk management, natural gas, EIA, NG, NYMEX

Power Prices: It's The Demand And Not Just The Usage

Posted by Richard Zdunkewicz on Jul 1, 2016 11:04:45 AM

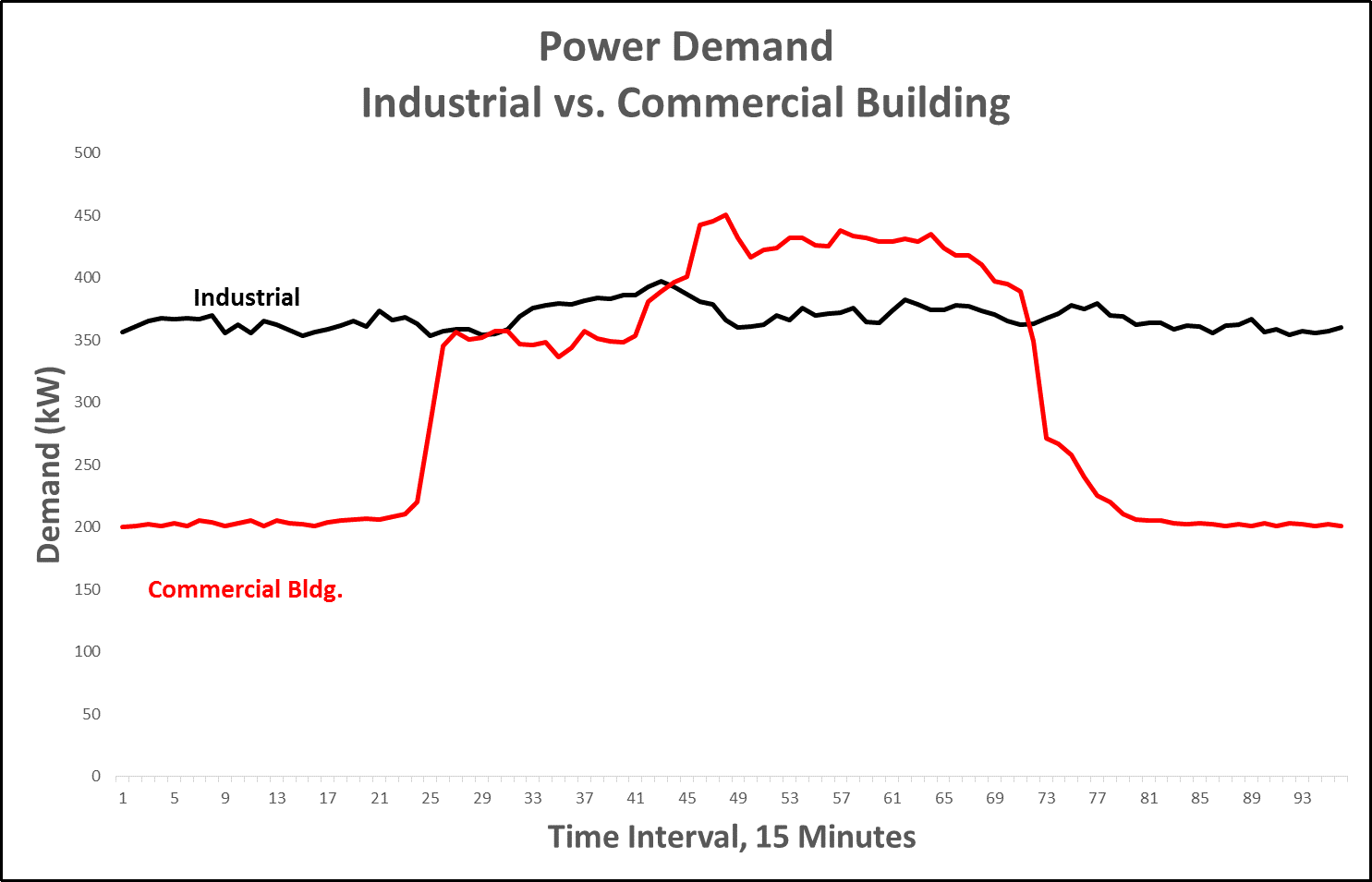

It’s always an interesting discussion with non-technical people involved in contracting for power supply. Energy contracting is oftentimes the responsibility of personnel who are not familiar with the price dynamics of the power markets. The conversation will typically start with “we use a lot of electricity…..we should see a great price”. While that may be true, it’s not necessarily the magnitude of usage that drives the price, but the consistency and level of demand. What’s the difference between demand and usage? Power demand is the amount being drawn from the grid at any point in time; usage is the aggregate of demand across time. A consistent or flat demand profile, meaning a higher load factor, will command a better price than that associated with a low load factor. So why is that?

Topics: energy management, energy efficiency, Peak Demand, demand, power, power usage

Big Data Means Big Opportunity for Energy Cost Management

Posted by Richard Zdunkewicz on Jun 22, 2016 11:31:07 AM

Access to substantial amounts of data is only the beginning of the journey towards effective cost management. If the enterprise is not using its data to understand its business processes and the options that alternative or new approaches might present, the data remains merely a playground for analysts. This has never been truer than in the world of electric power. Smart meters and similar devices for measuring power demand at granular intervals are now widely distributed. This technology provides the enterprise, the utility and grid operators with an ocean of data. However, it seems that little is actually done with that data to improve the efficiency of operations.

Topics: Acclaim Energy Advisors, energy costs, Big Data, power

Why Don’t More Financial Execs Oversee Their Energy Supply Agreements

Posted by Richard Zdunkewicz on Jun 6, 2016 6:23:53 PM

It is concerning to observe a pattern of financial executives unaware of the terms of their own company’s energy supply agreements; particularly when to me it is so clear this is a necessity. These commitments represent substantial financial exposure that are arranged, in some cases, outside the company’s risk management policy and processes for financial commitments. Another very important reason for financial executives to have knowledge of their energy supply agreements is their treatment in the event of Chapter 11 bankruptcy. Obviously, no business plans for bankruptcy, but prudent financial executives should understand the potentially substantive risks that might arise in this unlikely event.

Topics: Acclaim Energy Advisors, energy, energy savings, energy blog, electricity markets

Oil & Gas Industry's Challenges And Potential Impact On Power Supply Agreements

Posted by Richard Zdunkewicz on Jun 1, 2016 5:06:15 PM

Even as crude oil and natural gas prices begin to rebound from their recent lows, we are seeing continued financial stress in the oil & gas sector. In recent months, Linn Energy, Chaparral Energy, Penn Virginia, Halcón Resources, and Breitburn Energy Partners have all filed Chapter 11. Financial concerns are not confined to the Upstream segment as Midstream players such as Plains All America Pipeline and Azure Midstream have seen their bonds downgraded by the rating agencies.

Topics: energy management, energy blog, NG