Rising concerns about the impact of greenhouse gas (GHG) emissions on the environment have led to the creation of cap and trade programs in areas such as the European Union, Australia and even South Korea. While the U.S. has not, at this point, implemented a national cap and trade program, emissions trading programs are in place in the Northeast and Mid-Atlantic. The goals of these programs are to place a value on GHG emissions through an auction based system of allowance of emissions, essentially creating a value for releasing GHGs in to the atmosphere and imposing penalties if a source of emissions exceeds its allowances. Ultimately, the goal is to reduce overall emission by making it cost prohibitive to emit excess pollutants.

ENERGY MANAGEMENT: THE IMPACT OF CAP AND TRADE ON YOUR ORGANIZATION

Posted by Dennis Vegas on Apr 12, 2013 4:09:00 PM

ENERGY RISK MANAGEMENT: BEWARE OF THE 2013 PRICE DRIVERS

Posted by Dennis Vegas on Apr 1, 2013 3:51:00 PM

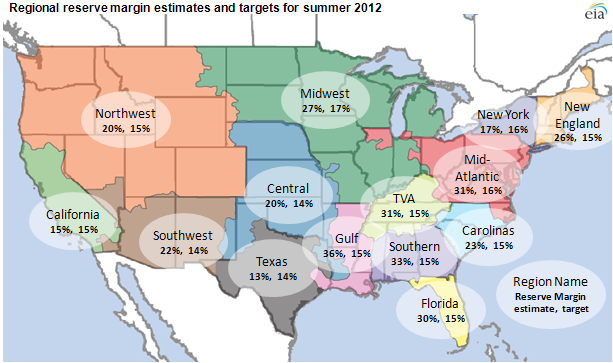

The first part of this 2 part series addressed 3 factors that will impact natural gas and electricity prices in 2013 and beyond. Part 2 explores the challenges faced by the power sector in terms of future grid reliability, summer weather outlook and the impact of continued drought conditions on power prices.

Topics: energy risk management, energy management consulting, energy procurement, energy reliability

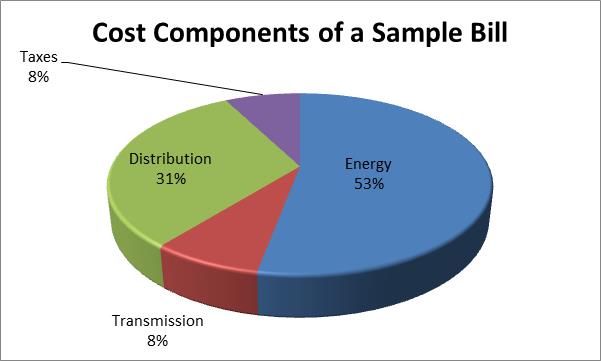

ENERGY RISK MANAGEMENT: THE COSTS OF TRANSMISSION & DISTRIBUTION

Posted by Dennis Vegas on Mar 27, 2013 4:04:00 AM

Energy risk management strategies vary in complexity and success, but those which deliver the highest value tend to look at the entire energy management picture. A holistic energy risk management strategy comprises:

Topics: Acclaim Energy Advisors, energy management consulting, energy procurement

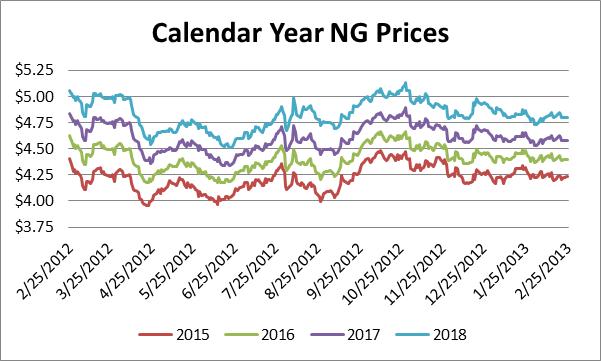

ENERGY RISK MANAGEMENT: 5 Natural Gas and Electricity Price Drivers

Posted by Dennis Vegas on Mar 26, 2013 11:40:00 AM

(Part I)

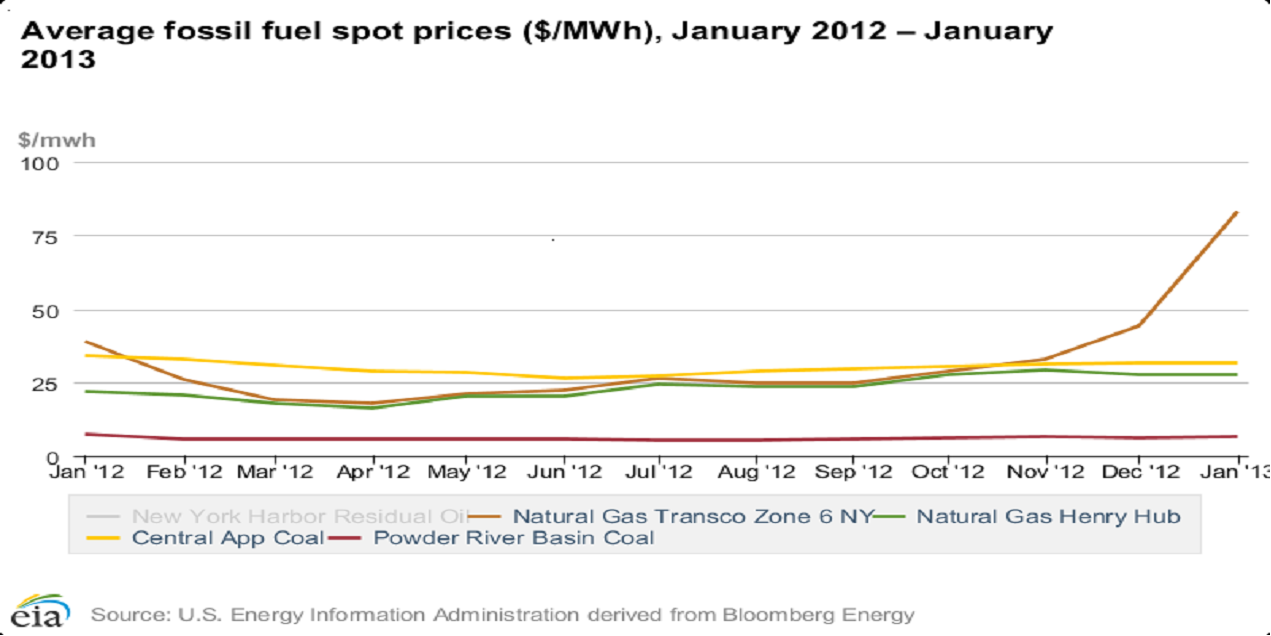

Retail electricity customers face a host of challenges heading in to the summer of 2013. Part 1 of this 2 part series addresses factors impacting natural gas prices and the impact these will have on electricity prices during this summer and beyond. Part 2 will focus on two more drivers: energy reliability opportunities in electricity markets and weather. Understanding the impact that these 5 drivers have on energy prices is critical for risk management purposes.

Topics: energy risk management, Acclaim Energy Advisors, energy management consulting

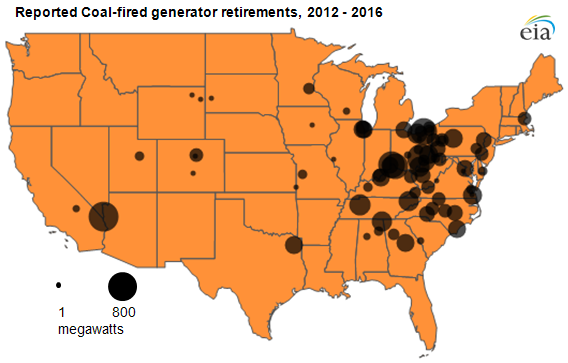

ENERGY MANAGEMENT CONSULTING: BEWARE OF THE WAR ON COAL

Posted by Dennis Vegas on Mar 19, 2013 9:31:00 AM

During the run-up and actual campaign for the Presidency in 2012, the Obama administration was cited for conducting a “war on coal” through various Environmental Protection Agency (EPA) actions, including but not limited to:

Topics: Acclaim Energy Advisors, risk management, Energy Solutions

ENERGY RELIABILITY: IF TXU's PARENT DECLARES BANKRUPTCY THEN WHAT?

Posted by Dennis Vegas on Mar 18, 2013 12:37:00 PM

Topics: ERCOT, energy risk management, energy management consulting, energy procurement, energy reliability

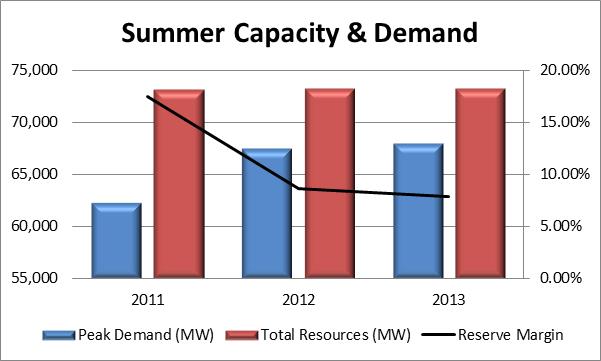

ENERGY RISK MANAGEMENT ALERT: ERCOT SUMMER ADEQUACY

Posted by Dennis Vegas on Mar 7, 2013 6:49:00 PM

ERCOT PRELIMINARY SUMMER RESOURCE ADEQUACY ASSESSMENT

On March 1, Electric Reliability Council of Texas (ERCOT) issued its preliminary assessment of Resource Adequacy for summer 2013. According to the published numbers reserve margins (excess capacity over projected peak demand) will be 8.4%, well below that of last summer. The report suggested that it is very likely that ERCOT will need to declare Emergency Energy Alerts (EEAs). Depending on which level of EEA is declared, ERCOT will take the following corresponding actions until supply and demand are brought back in to balance:

Topics: ERCOT, energy risk management, Acclaim Energy Advisors

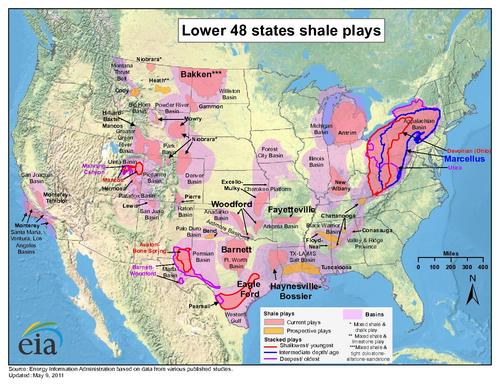

FRACKING: THE DRIVING FORCE BEHIND U.S. ENERGY INDEPENDENCE?

Posted by Dennis Vegas on Mar 1, 2013 5:41:00 PM

Over the last couple of years, significant attention has been paid to the practice of “fracking” in which a slurry of water, sand, and chemicals are injected at high pressure to crack open rock formations which hold natural gas and oil. The use of fracking has fueled the boom in natural gas production and could help the U.S. achieve energy independence by 2030 or sooner. The boom in natural gas production from fracking has kept natural gas, and therefore energy prices, lower than expected. In the mid-2000s, most analysts predicted natural gas prices would reach the $10-11/MMBTU range as compared with the current price of less than $3.50/MMBtu. In short, technology improvements have allowed producers to unlock previously uneconomic or unavailable natural gas and oil deposits in the U.S. Fracking provides substantial economic benefits across the entire U.S. economy; however, there are concerns about fracking’s environmental impact which are currently being addressed to determine if this technology is to fuel future energy independence for the U.S.

Topics: Acclaim Energy Advisors, energy management consulting, risk management, energy

WILL LIQUEFIED NATURAL GAS EXPORTS INCREASE NATURAL GAS PRICES?

Posted by Dennis Vegas on Feb 27, 2013 4:08:00 PM

In April 2012, Cheniere Energy received final regulatory approvals to build a major liquefied natural gas (LNG) export terminal at Sabine Pass in Louisiana. This event rippled through the energy world, with concern growing that export natural gas would lead to higher domestic prices. Currently, natural gas prices in Asia are 3-4 times higher than those in the U.S. while prices in Europe are 2-3 times higher. In light of these spreads, industrial gas producers are urging the Department of Energy to approve LNG exports. However, the export of LNG is unlikely to have significant impact on natural gas prices in the next 3-5 years. Rather, other factors, such as new environmental regulations, are likely to be more significant drivers of natural gas prices.

Topics: energy risk management, Acclaim Energy Advisors, energy management consulting, natural gas

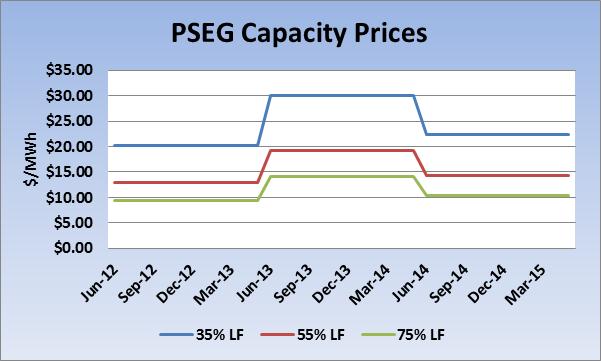

Volatile Energy Capacity Prices in PJM - Take a closer look at PSEG

Posted by Dennis Vegas on Feb 22, 2013 6:32:00 PM

A critical element of effective energy risk management is an understanding of all of the cost components behind a retail electric bill and what causes these components to move. Recently, capacity costs, which are determined by PJM’s Reliability Pricing Model, or RPM, have followed a bell shaped curve across multiple utilities in the Eastern Mid-Atlantic Region, including the Public Service Electric & Gas (PSEG) area in New Jersey.[1]

Topics: energy risk management, energy, PJM Energy