A recent proposed change to the PJM demand response program could reduce the value of “limited demand response” to end users.

Limited Demand Response: Will PJM experience further restrictions?

Posted by Dennis Vegas on Feb 19, 2013 11:50:00 AM

Topics: energy, demand response, PJM Energy

Critical News...Electricity Product Structuring Matters!

Posted by Dennis Vegas on Feb 15, 2013 5:25:00 PM

Competitive retail energy markets offer tremendous opportunities to manage energy spend effectively. however, energy commodities are volatile, and can affect energy costs, if not managed correctly. Click For Whitepaper

Topics: energy risk management, energy management consulting

Weather Shifts Continue To Drive Natural Gas Pricing

Posted by Dennis Vegas on Feb 8, 2013 4:58:00 PM

If you need timely information on what is happening in the natural gas market you need to read the Acclaim Energy Insider every week. This week his 2 page overview (see link below) focuses on the natural gas maket and ERCOT heat rates. Don't get caught without understanding what may be in store for the days ahead.....

Topics: ERCOT Heat Rates, Acclaim Energy Advisors, energy procurement

According to a recent report issued by ERCOT, transmission constraints, which have caused significant congestion cost increases for end users in the West Zone(e.g. Midland, Odessa) since March of 2012, are likely to spread to the Houston and South Zones (e.g. Brownsville, McAllen) of ERCOT in 2013.

Topics: ERCOT, energy management consulting

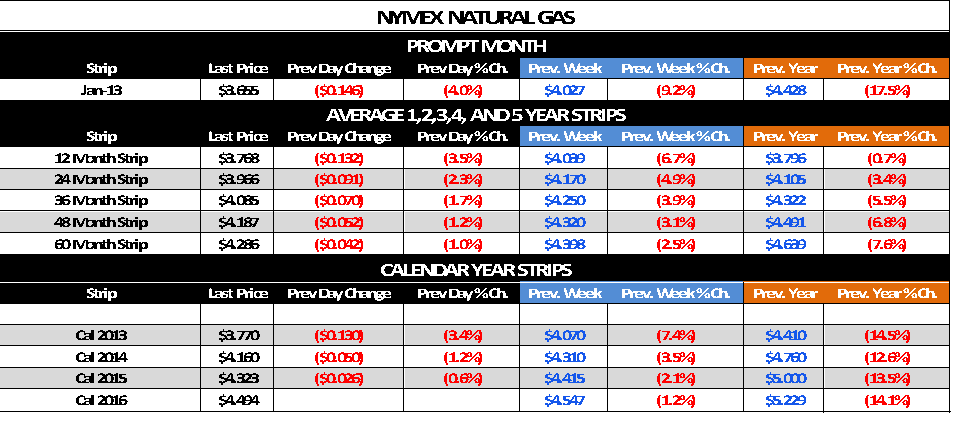

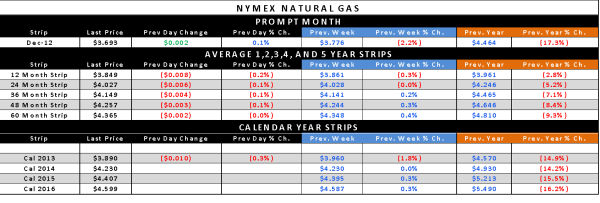

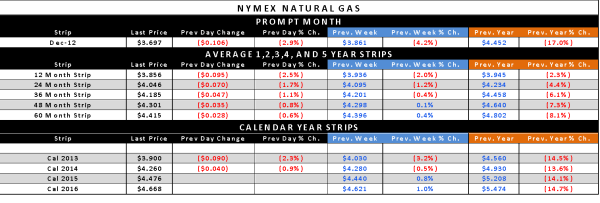

Natural Gas futures tumbled after EIA reported an injection of 4Bcf, compared to analysts’ estimates of a 10Bcf draw. The JAN13 contract broke $3.70/MMBtu support and rebounded at the next level $3.637/MMBtu, which was set earlier this month. This report was bearish on all counts, since the injection was also above last year’s 2Bcf injection.

Slight rebound today after a sharp Friday selloff. The 1-5 day forecast is calling for below normal temperatures in the eastern half of the U.S., however, above normal temperatures are expected over the next 7-10 days. Longer term winter forecasts are less reliable as unprecedented conditions are making it impossible to use historical trends. With that said, NOAA is projecting above normal temperatures in the western half of the U.S., and equal chances on the eastern half.

Natural Gas futures slipped this morning as traders weighed yesterday’s injection, which boosted inventories to 3.908TCF, which is an all time record. For two consecutive weeks EIA has reported injections that have been higher than the 5-year average, bucking the underperforming trend from the summer. Moreover, it is likely that there will be additional injections this year in light of moderating temperatures in the 6-14 day horizon. Nevertheless, we have seen some mixed weather forecasts from different outfits, so front month prices will be quite volatile during the next couple of weeks.

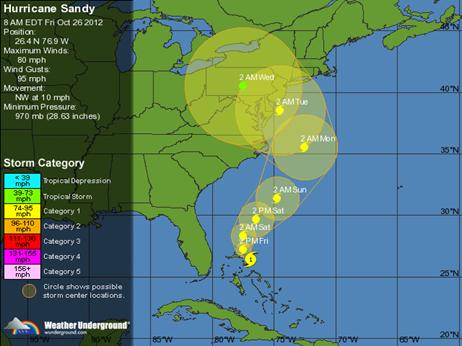

Market Weighing Supply vs. Demand in Wake of Sandy

Posted by Dennis Vegas on Oct 31, 2012 4:34:00 PM

Natural Gas futures edged higher in the morning as power has been restored for several million households in the northeast; however, the number of households without power is still high (6.6million). Another fact that is currently limiting the downside is the elevated number of nuclear plant outages. Additional nuclear capacity was lost due to Sandy. Currently, the number of outages is ~36% higher than the five year average for this time of the year.

After very choppy trading yesterday, Natural Gas futures continued the downward trend from the previous 4 trading sessions. Yesterday’s build bucked the trend of underperforming injections, as the 67Bcf was slightly higher than the 5-year average 65Bcf. Next week’s report has the potential of showing an even higher injection due to the mild temperatures during this week.