Moderating weather forecasts seem to be limiting the upside after EIA’s release of an injection number that was slightly above analysts’ estimates. Natural gas is currently consolidating around the sticky $3.40/MMbtu level. It is worth mentioning though that supplies are getting close to a record high. Under current fundamentals the front month is starting to feel a bit heavy.

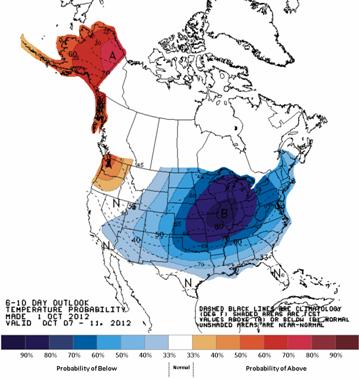

Natural Gas Futures lost some ground today. This is the first pull back in 6 trading sessions. Most of the recent support has been driven by expectations of higher heating demand due to below normal temperatures in the consuming regions. Nevertheless, current weather forecasts suggest that below normal temperatures will be a bit higher than previously expected. Likewise, long term forecasts are calling for a warmer than average first half of the winter. The National Weather Service models are showing above normal temperatures in the Midwest and Northeast. Long term forecasts are less reliable, but it is the best information available at this point. Price action will continue to be weather driven.

Expectations for Heating Demand Are Driving Prices Higher

Posted by Acclaim Energy on Oct 2, 2012 4:34:00 PM

Natural Gas futures paused today after the November 2012 contract rallied more than 20% during the last 5 trading sessions. This has been the biggest 5 day run in almost three years.

Natural Gas futures pulled back slightly this morning after a 10% increase this week, but rose at the close. Nevertheless, there are a couple of factors that could limit the upside:

The momentum from the last two trading sessions carried over today’s early trading ahead of the storage data release. EIA reported that 80Bcf were injected into storage during the week ending on 9/21/2012. Analysts were expecting an injection of 75Bcf, so the injection was slightly above expectations. Working gas in underground storage stands at 3,496Bcf, 9% above last year and 8.6% above the 5-yr average.

Natural Gas Rallies Ahead of Contract Expiration

Posted by Acclaim Energy on Sep 25, 2012 6:07:00 PM

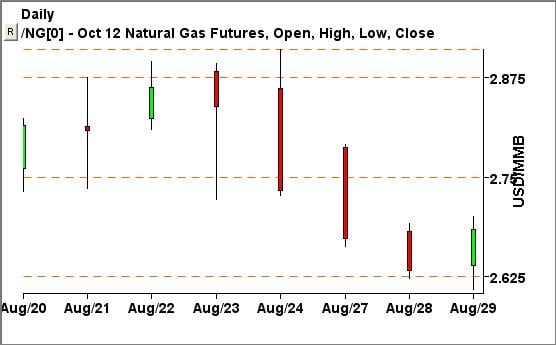

Natural Gas futures rebounded today, mainly due to the increase in US nuclear plant outages. Even though this information provides support the upside should be limited because most forecasts for the coming 15 days look fairly temperate. During the last couple of trading sessions natural gas had been consolidating between the $2.80/MMBtu-$2.90/MMBtu range. Upside above $3.00/MMBtu could be limited since some utilities will switch back to coal.

Analysts were expecting an injection between 60-70Bcf. Today EIA reported a build of 67Bcf, which met expectations for the week ending on 9/14/12. This data was below last year’s build of 89Bcf and the five-year average increase for last week of 73Bcf. With lower seasonal demand ahead of us, we could see negative pressure on prices. The only factor that could boost near-term demand for natural gas is the high level of nuclear plant outages, which currently stands at ~15,500MW.

After hitting the low of the day at $2.73/MMBtu, The October-2012 Natural Gas futures contract rebounded as the market was due for a price correction after a 4 day 10% decline.

Texas Commission Directs ERCOT to Perform Backcast Analysis of Resource Adequacy Options

Posted by Acclaim Energy on Sep 18, 2012 4:42:00 PM

There has been quite a bit of volatility in today’s NG futures trading session. The October 2012 contract is back to being flat, and the CAL2013 is approximately $.025/MMBtu up. Weather forecasts still favor a decline in natural gas demand; however, the high level of offline US nuclear capacity will provide some support to the downside.

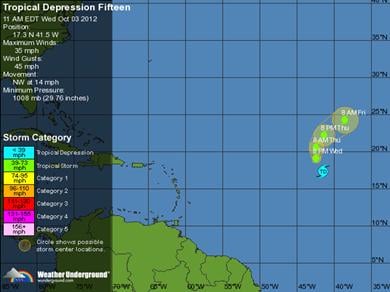

Natural Gas Futures have been muted by the following factors due to Hurricane Isaac:

- Isaac had a hard time organizing, and it was upgraded to a CAT1 hurricane shortly before it made landfall.

- The last storm that disrupted natural gas and oil operations in the Gulf was Gustav (in 2008), and producers have made improvements to their facilities to better withstand severe weather conditions since then.

- Government data shows that 72% of U.S. Gulf natural gas output, or 3.2 billion cubic feet per day, was shut in as of Wednesday Aug 29. 2012.

- Gulf producers have reported little to no damage.

- Cumulative production loss of natural gas is under 17 Bcf since Monday Aug 25, 2012.

- Facilities are expected to be brought back on line quickly after inspections in coming days, if no damage is discovered.

- Inventory surplus is 14.6% higher compared to last year and 12.0% higher compared to the 5-year average for the same week.

- As Isaac makes its way inland, cooler temperatures and power outages resulting from the storm will offset much of the impact of the temporary supply loss.

Topics: weather outlook, natural gas