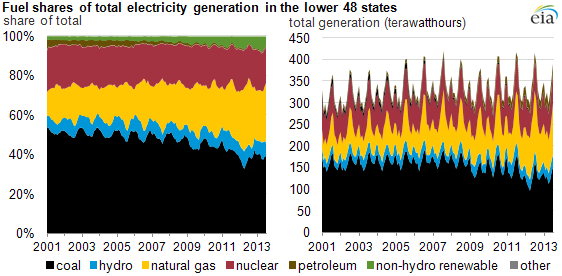

For years, coal has been the dominant fuel source for power generation in the U.S.. However, recent changes in the market place, including tighter emissions restrictions imposed by the Environmental Protection Agency (EPA) and low natural gas prices from abundant shale gas suppliers, threaten coal’s dominance as the leading fuel source for generation. An analysis conducted by the Department of Energy (DOE) was published in August and predicted that between 35 and 60 gigawatts of coal-fired electricity generation in the eastern half of the country will be retired within the next five years. Therefore, new generation, transmission investments and reliability must run (RMR) contracts will be needed to maintain grid reliability. Natural gas fired generation will most likely fill the bulk of the gap left by the coal retirements. The impact of retirements and the higher operation costs of the remaining coal plants will trigger an increase in prices. This effect will be magnified in regions that are more dependent on coal fired generation, like the Midwest.

Topics: coal, energy risk management, Acclaim Energy Advisors, energy, Energy Solutions, energy procurement, energy regulations, Weekly Energy Insights, energy management, U.S. energy

New England (NE) Market- Reasons Behind Winter Energy Price Spikes

Posted by Jennifer Chang on Nov 12, 2013 8:56:00 PM

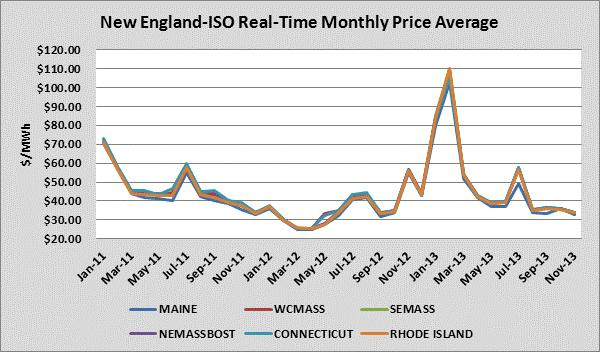

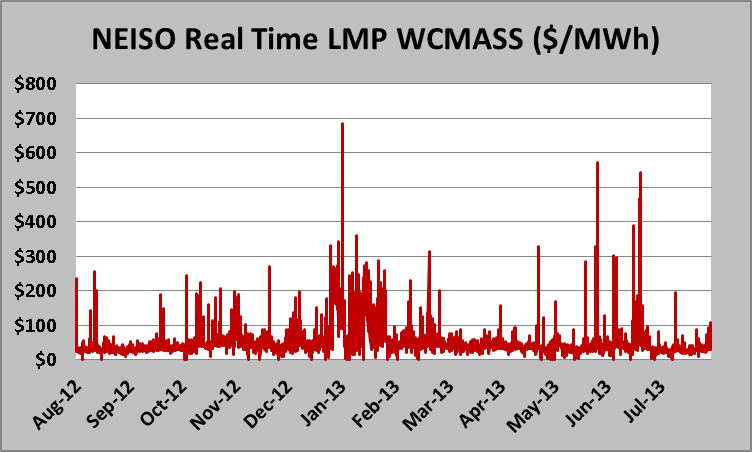

The U.S. 2011/2012 winter was the fourth warmest on record. NE energy end users who were exposed to the spot market were rewarded with very low prices. Nevertheless, the U.S. 2012/2013 winter was significantly colder despite being the twentieth warmest winter on record. Despite a mild winter start, last January had a large number of days below freezing and February was the fifth snowiest on record. Consequently, natural gas and electricity end users in NE who were exposed to index prices, found themselves facing significantly higher energy costs on the spot market. During these two months, unusually cold temperatures triggered price spikes due to forced plant outages, which caused reliability problems within the grid. To circumvent these issues, the entity responsible for maintaining electric reliability, the New England Independent System Operator (ISO-NE), was forced to dispatch higher cost power plants. The chart below shows historical monthly Real-Time prices across multiple Load Zones. Across these Load Zones, the average prices for the months of January 2013 and February 2013 were $83.54/MWh and $107.49/MWh. These prices were significantly higher than this period the previous year.

Topics: Acclaim Energy Advisors, energy management consulting, energy, weather outlook, Weekly Energy Insights, energy management consultants, Winter Weather, new england

2013/2014 Winter Weather Forecast- What to Expect?

Posted by Jennifer Chang on Nov 8, 2013 10:34:00 AM

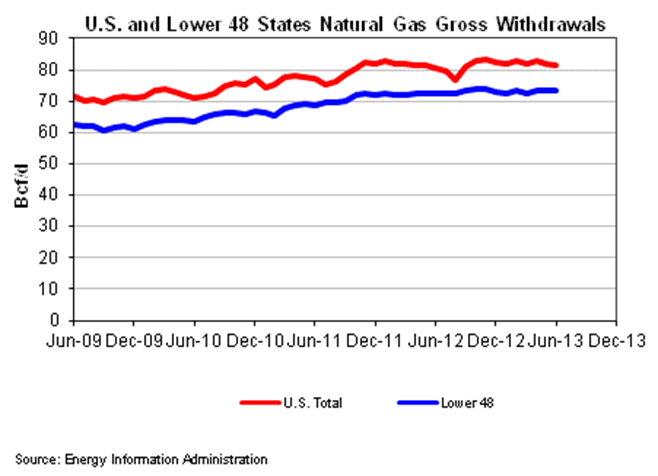

Besides an uneventful 2013 hurricane season, which “technically” ends on November 30, the natural gas injection season is also coming to an end. According to the Energy Information Administration (EIA) storage injection report released on November 7, 2013, natural gas inventories are 1.5% above the five-year average. The latest near-term weather forecasts suggest that the gap will increase during the next two or three weeks. In other words, according to the EIA, there should be sufficient natural gas in storage to meet the projected natural gas heating demand for the upcoming winter.

Topics: Acclaim Energy Advisors, weather outlook, Weekly Energy Insights, natural gas, Hurricane Season, EIA, Texas

ERCOT Mandatory Reserve Margin- Reliability vs. Competition

Posted by Jennifer Chang on Oct 30, 2013 7:32:00 PM

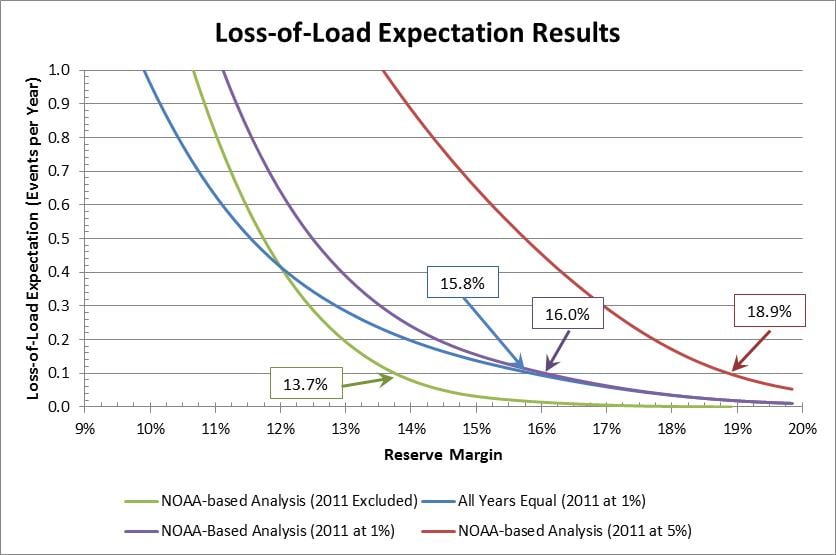

At the Public Utility Commission of Texas (PUCT) open meeting on October 25, 2013, the PUCT voted 2-1 to establish a mandatory reserve margin. Chairman Donna Nelson and Commissioner Brandy Marty voted in favor of such directive, however, Commissioner Kenneth Anderson unwaveringly opposed to such measure. Nelson was, however, against an immediate decision as to which specific market model would best support the mandate. Therefore, the PUCT will wait for a report from the Brattle Group that will provide a study on the economically optimal reserve margin and mechanism to achieve it. The move toward a mandatory reserve requirement raises the following questions:

ERCOT RT Prices Hit New High: Energy Risk Management Questions Raised

Posted by Dennis Vegas on Sep 12, 2013 11:59:00 AM

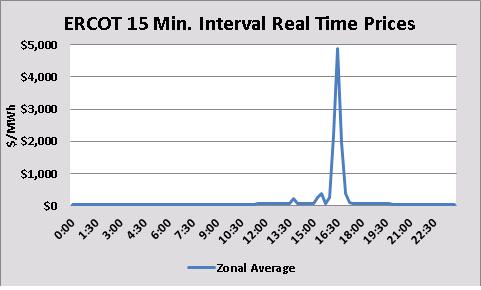

While the 2013 summer months were relatively mild by Texas standards, the first week of September produced one surprise. On 9/3/2013, the Electric Reliability Council of Texas (ERCOT), reported a 15 minute interval Real Time price spike, which neared the current $5,000/MWh price cap. The market clearing price at 4:30pm (or 1630) was $4,900/MWH or $4.90/kWh when temperatures and power usage were high. While the $4,900/MW price only lasted one 15 minute interval, the simple average price across all load zones for hour ending 5:00pm was $2,333/MWh, or $2.333/kWh.

Topics: ERCOT Heat Rates, ERCOT, energy risk management, energy sourcing

Demand Response Is Booming: Are You Leaving Money On The Table?

Posted by Dennis Vegas on Sep 11, 2013 7:05:00 AM

Too often, energy risk management professionals focus on one side of the energy equation, specifically the supply contract. While this is certainly a critical piece of any procurement or strategic energy sourcing approach, it can lead to real value being left on the table for the end user through too much focus on the supply side. A thorough energy risk management strategy will account for the possibility of generating additional revenues through participation in various demand response programs. Of course, the value of those demand response programs will vary based on the type of consumer, their ability to curtail usage, availability of back-up generation and which of the various demand response programs they choose or are able to participate in . With these factors in mind, it is important to evaluate the options for demand response based on each customer’s unique profile.

Basics of Demand Response

Topics: ERCOT, energy risk management, demand response, energy reliability, PJM

Texas PUCT: Will Power Market Structure Shift With New Appointee?

Posted by Dennis Vegas on Sep 9, 2013 7:05:00 AM

On August 21, Governor Rick Perry appointed Brandy Marty to the third seat on the Texas Public Utility Commission that was vacated for six months ago. Ms. Marty, who is an

attorney, has held several positions on Governor Perry’s staff, including chief of staff, deputy chief of staff, and director of Budget, Planning and Policy, among others.

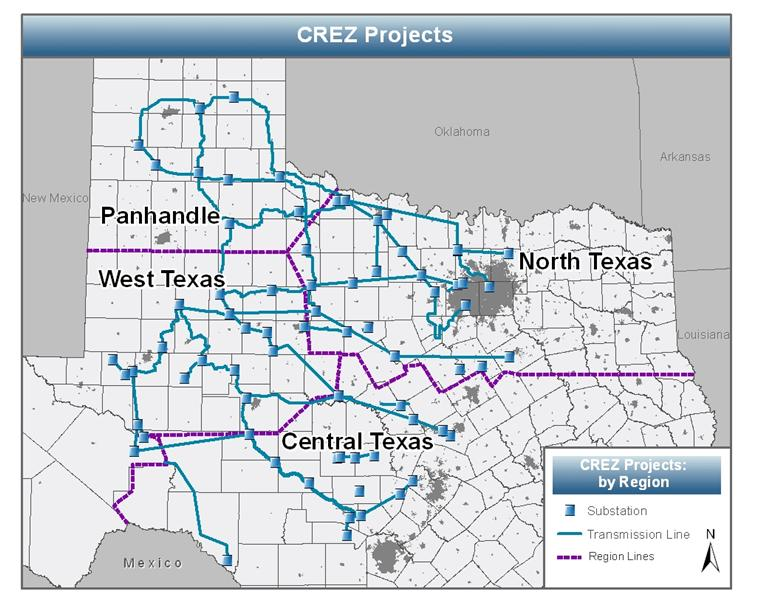

Topics: ERCOT, energy sourcing, demand response, energy reliability, CREZ

Strategic Energy Sourcing and 2013 Energy Developments Part 2

Posted by Dennis Vegas on Sep 5, 2013 1:19:00 PM

Part 2 of the 4 Major Energy Developments in 2013 deals with two more trends that have impacted wholesale market prices this year:

Topics: energy risk management, energy management consulting, PJM, strategic energy sourcing, EPA

2013 Energy Developments Impacting Strategic Energy Sourcing (Part 1)

Posted by Dennis Vegas on Aug 29, 2013 1:03:00 PM

As we near the end of the summer, it is worthwhile to examine trends that have had an effect on energy procurement in 2013. The focus will be specifically on the deregulated electric and natural gas markets, through the first two-thirds of 2013. The first two developments that will be covered in this blog are:

Topics: energy management consulting, PJM, strategic energy sourcing

Energy Reliability: The Capacity Market Debate in Texas Heats Up!

Posted by Dennis Vegas on Aug 22, 2013 7:05:00 AM

During the hot summer months in Texas, participants in the energy markets, including the independent system operator known as the Electric Reliability Council of Texas (ERCOT), turn their attention to making sure that there is sufficient generation available to meet power demand. While ERCOT is unlikely to have significant reliability challenges during the balance of 2013’s summer, there are concerns about whether this will hold true in the future. In order to address these concerns, some market participants, such as NRG, have argued that Texas should consider implementation of a capacity market, and preferably one similar to the capacity market in the Mid-Atlantic region of the country.

Topics: ERCOT, energy sourcing, PJM, energy management consultants, capacity markets