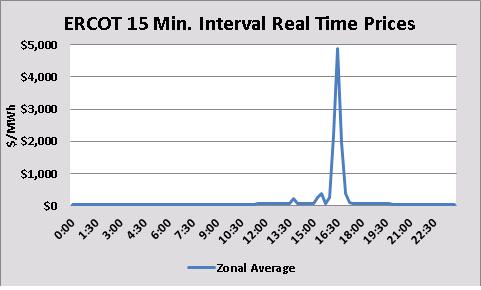

Several decades ago the term “negawatt” gained notoriety; however, as deregulated markets have developed and with the rise of Demand Response (DR) programs, the concept of reducing energy spend through the deployment of more energy efficient technologies has evolved into something larger. The negawatt concept has expanded from its foundation with the growth in utility and Independent System Operator (ISO) DR programs. Another important, and more recent, development has been the growth of economic price response, which is the ability to add capacity to the grid or shed load when real-time market conditions create financial incentives. The combination of flexible distributed generation, access to real-time price data, and ”structural incentives” in deregulated markets have enabled end-users to profit from these programs andactivities. In ERCOT for example, these incentives include price scarcity mechanisms (Operating Reserve Demand Curve) and system-wide offer caps that will increase to $9,000/MWh on June 1, 2015. Aside from generating revenues for end-users, these measures will contribute to improve balance between supply and demand, and support overall grid reliability.

The Negawatts Evolution: The Maturation of Demand Response

Posted by Jennifer Chang on Dec 9, 2013 12:06:00 PM

Topics: Negawatt, ERCOT, energy risk management, Acclaim Energy Advisors, energy management consulting, energy, Energy Solutions, energy procurement, demand response, energy regulations, energy savings, energy costs, Weekly Energy Insights, energy management, dynamic load optimization 365, DLO 365, curtailment

ERCOT Revamping Power Forecasting Methodologies: Reserve Margin Challenges

Posted by Jennifer Chang on Dec 5, 2013 6:45:00 PM

There has been significant debate, quite heated at times, surrounding the future structure of the Texas electricity market that the Electric Reliability Council of Texas (ERCOT) manages. The discussion has been centered on several topics, including how to ensure that there is sufficient generation capacity in the state to meet future electricity needs. On October 25, 2013, without a final vote, two out of the three Public Utility Commission of Texas (PUCT) commissioners expressed support for a mandatory reserve margin to address resource adequacy concerns. At this time, ERCOT’s board does not plan to take action on proposed changes to the target reserve margin until the PUCT provides further direction. In the meantime, ERCOT has been working on revamping its load forecasting assumptions and its methodologies are being re-examined and may be more important than ever. ERCOT’s staff has also been working to refine its load forecast models and process, and will update the board on these proposed changes on December, 10,2013. Therefore, the release of the next Capacity, Demand and Reserve report will be postponed.

Topics: ERCOT, energy risk management, Acclaim Energy Advisors, energy management consulting, energy, energy procurement, energy regulations, energy savings, reserve margin, PUCT, forecasting

Liquified Natural Gas Exports: What This Means for U.S. Consumers

Posted by Jennifer Chang on Nov 22, 2013 11:36:00 AM

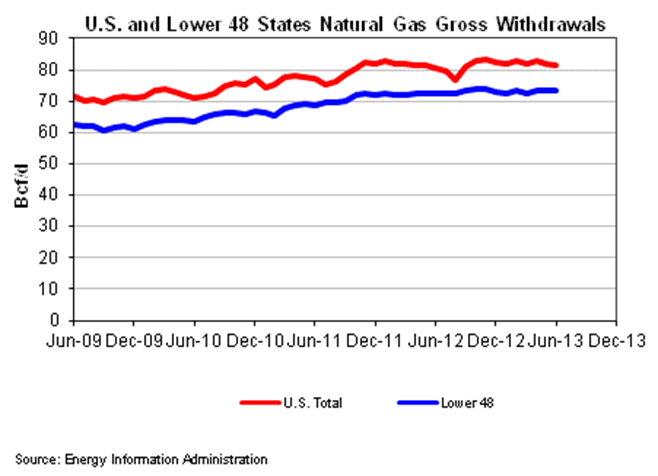

The rise of fracking has shifted the U.S. natural gas market at fundamental levels that are not yet fully understood or appreciated. In fact, there is a strong argument to be made that as fracking and other recovery technologies continue to improve, the U.S. will become a major energy provider. By exporting copious amounts of liquefied natural gas (LNG), the U.S. will achieve greater energy independence by cutting back on imports of foreign crude oil products. A massive shift in the global energy markets is neither that far-fetched nor far off and will likely take place over the next decade. As discussed in greater detail below, natural gas has the potential to become a globally traded commodity like crude oil.

Topics: energy risk management, Acclaim Energy Advisors, energy, Energy Solutions, energy procurement, energy regulations, energy reliability, energy savings, Weekly Energy Insights, energy management, exports

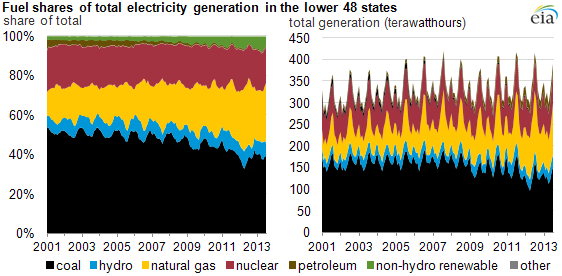

For years, coal has been the dominant fuel source for power generation in the U.S.. However, recent changes in the market place, including tighter emissions restrictions imposed by the Environmental Protection Agency (EPA) and low natural gas prices from abundant shale gas suppliers, threaten coal’s dominance as the leading fuel source for generation. An analysis conducted by the Department of Energy (DOE) was published in August and predicted that between 35 and 60 gigawatts of coal-fired electricity generation in the eastern half of the country will be retired within the next five years. Therefore, new generation, transmission investments and reliability must run (RMR) contracts will be needed to maintain grid reliability. Natural gas fired generation will most likely fill the bulk of the gap left by the coal retirements. The impact of retirements and the higher operation costs of the remaining coal plants will trigger an increase in prices. This effect will be magnified in regions that are more dependent on coal fired generation, like the Midwest.

Topics: coal, energy risk management, Acclaim Energy Advisors, energy, Energy Solutions, energy procurement, energy regulations, Weekly Energy Insights, energy management, U.S. energy

ERCOT RT Prices Hit New High: Energy Risk Management Questions Raised

Posted by Dennis Vegas on Sep 12, 2013 11:59:00 AM

While the 2013 summer months were relatively mild by Texas standards, the first week of September produced one surprise. On 9/3/2013, the Electric Reliability Council of Texas (ERCOT), reported a 15 minute interval Real Time price spike, which neared the current $5,000/MWh price cap. The market clearing price at 4:30pm (or 1630) was $4,900/MWH or $4.90/kWh when temperatures and power usage were high. While the $4,900/MW price only lasted one 15 minute interval, the simple average price across all load zones for hour ending 5:00pm was $2,333/MWh, or $2.333/kWh.

Topics: ERCOT Heat Rates, ERCOT, energy risk management, energy sourcing

Demand Response Is Booming: Are You Leaving Money On The Table?

Posted by Dennis Vegas on Sep 11, 2013 7:05:00 AM

Too often, energy risk management professionals focus on one side of the energy equation, specifically the supply contract. While this is certainly a critical piece of any procurement or strategic energy sourcing approach, it can lead to real value being left on the table for the end user through too much focus on the supply side. A thorough energy risk management strategy will account for the possibility of generating additional revenues through participation in various demand response programs. Of course, the value of those demand response programs will vary based on the type of consumer, their ability to curtail usage, availability of back-up generation and which of the various demand response programs they choose or are able to participate in . With these factors in mind, it is important to evaluate the options for demand response based on each customer’s unique profile.

Basics of Demand Response

Topics: ERCOT, energy risk management, demand response, energy reliability, PJM

Strategic Energy Sourcing and 2013 Energy Developments Part 2

Posted by Dennis Vegas on Sep 5, 2013 1:19:00 PM

Part 2 of the 4 Major Energy Developments in 2013 deals with two more trends that have impacted wholesale market prices this year:

Topics: energy risk management, energy management consulting, PJM, strategic energy sourcing, EPA

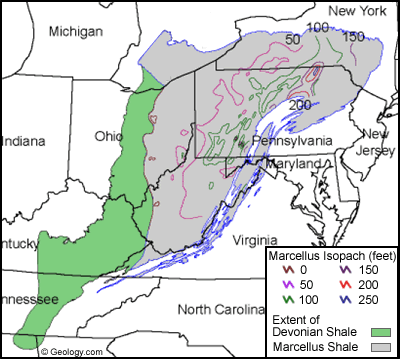

The Impact of the Marcellus Shale Boom on Energy Risk Management

Posted by Dennis Vegas on Aug 19, 2013 1:05:00 PM

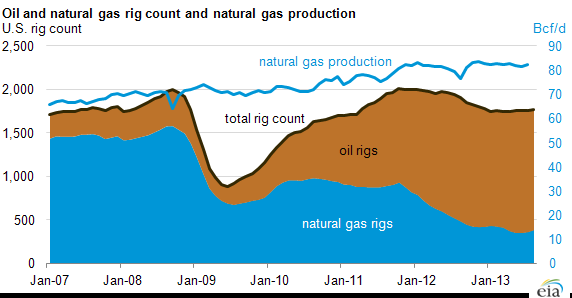

The United States faces a new future with a real possibility of energy independence rather than some pie in the sky notion predicated on unproven technologies. One of the key drivers behind this new opportunity for energy independence is the emergence of shale gas, particularly in the Marcellus Shale in Pennsylvania. While there are other areas of the country with larger shale deposits, the Marcellus holds particular benefits because of its proximity to the major population centers along the East Coast. The boom in natural gas and other petroleum rich products along the East Coast has created opportunities for energy management consultants to manage their clients overall energy expenditures in new ways.

Topics: energy risk management, energy management consulting, energy procurement, energy management

Is King Coal’s Demise Exaggerated? Energy Risk Management Suggests...

Posted by Dennis Vegas on Aug 9, 2013 9:04:00 AM

With President Obama directing the Environmental Protection Agency (EPA) to implement policies to curb emissions from coal fired power plants, the Mercury and Air Toxin Standards (MATS) rule taking effect and continued low prices, it has become uneconomic for older and smaller coal plants to install environmental controls. Between 2013 and 2016 approximately 40,000MW of coal generation will be retired.

Topics: energy risk management, energy procurement, PJM Energy, energy regulations

Will Market Consolidation Hurt Retail Energy Procurement

Posted by Dennis Vegas on Aug 6, 2013 5:43:00 PM

On July 30, 2013, Direct Energy Business Services (Direct) announced that it was acquiring Hess Energy Marketing, a long-time powerhouse of electricity and natural gas supply in the Northeast. According to published reports, Direct paid over $730 million dollars for Hess, not including an additional $300 million in working capital. This acquisition did not shock the industry as Hess had been trying to sell its energy marketing business to focus on its exploration and production activities. This highlights an emerging trend in the energy markets that could have meaningful implications for end users in the energy industry—namely a move towards consolidation.

Topics: energy risk management, energy procurement, energy management