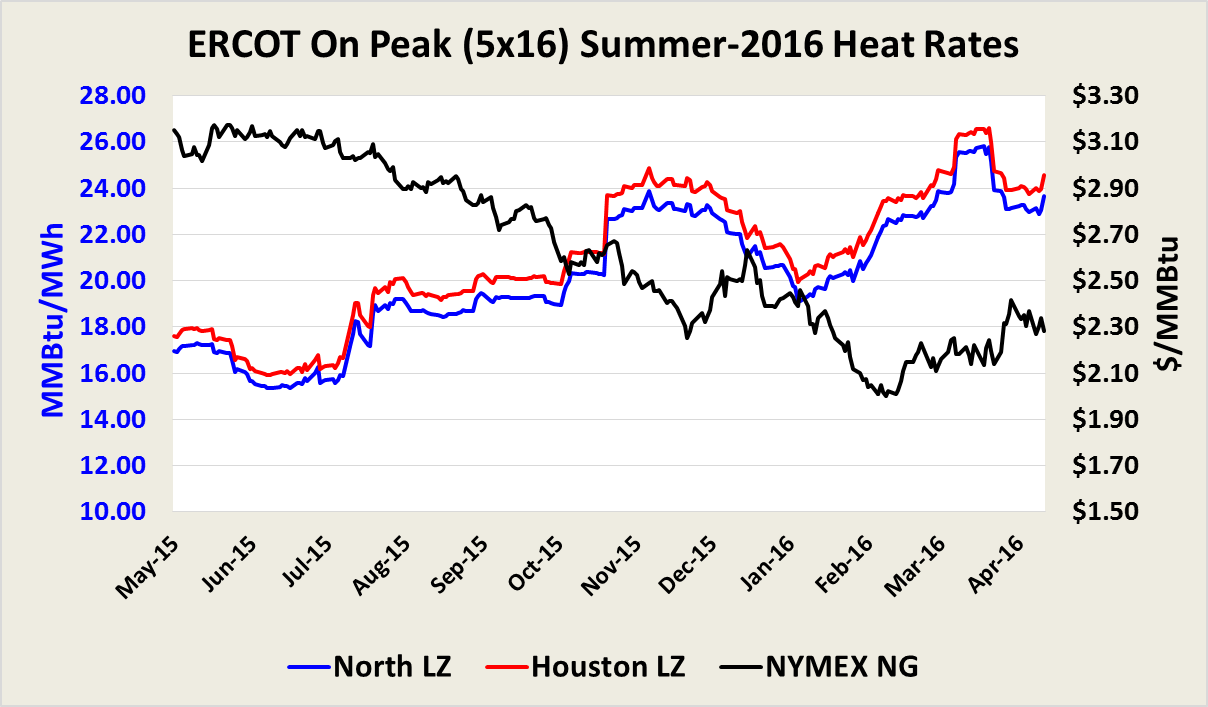

On December 1, 2015 ERCOT’s Capacity, Demand and Reserves report projected a summer 2016 Reserve margin of 16.5%, with Total Capacity at 79,280 MW and firm peak load at 68,063 MW. Nevertheless, the final summer SARA, which was released on May 3, 2016 estimates total generation resource capacity at 78,434 MW, and firm peak load at 70,588, so summer reserve margin is now projected to be 11.1%. Capacity is lower in the final SARA report because a couple of natural gas-fired Peaker facilities are now expected to be available later in the summer, 416 MW of additional mothballed capacity, and a decrease of 512 MW in planned capacity compared to the amounts reported in previous reports.

ERCOT Seasonal Assessment For Resource Adequacy (SARA) For Summer Anticipates Sufficient Reserves

Posted by Alberto Rios on May 10, 2016 9:30:11 AM

Topics: ERCOT Heat Rates, ERCOT, EIA, summer

Opportunistic Low Energy Price Environment- Excellent Long Term Savings Potential

Posted by Alberto Rios on Apr 15, 2015 9:50:00 AM

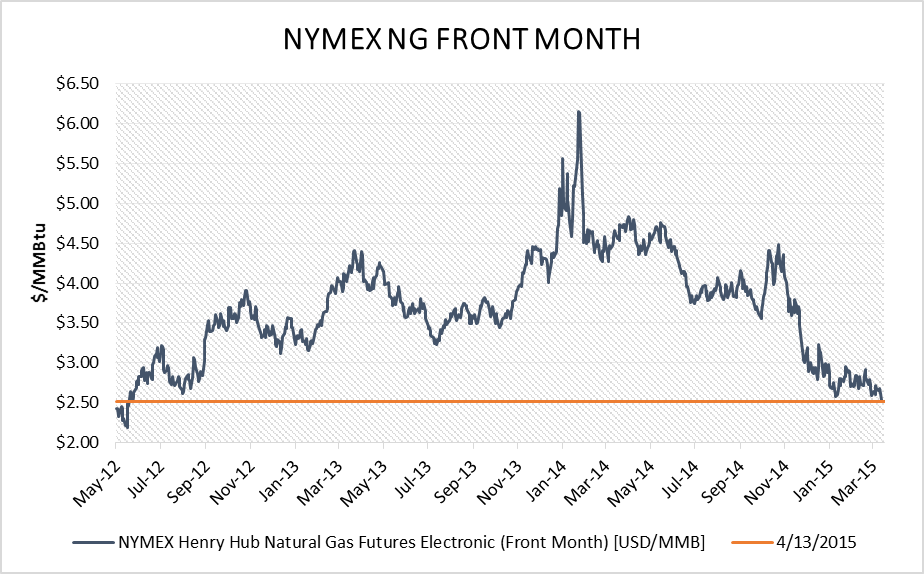

Depressed gas and electricity markets present one of the best buying environments in many years, even for terms as far out as 2020. This is particularly noteworthy considering the much higher price levels and prevailing market anxiety as we emerged from the Polar Vortex a year earlier.

In March 2014, natural gas (NG) inventories fell to 822 Bcf after a brutally cold winter that boosted heating demand well above normal levels. The sharp decline in inventories kept natural gas and electricity prices higher through most of 2014. However, record natural gas production, especially from shale plays including Marcellus have slowly replenished storage. Currently natural gas production is between 5 -7 Bcf higher compared to last year, so supply could outweigh demand throughout 2015.

Topics: Polar Vortex, ERCOT, Acclaim Energy Advisors, demand response, energy savings, energy costs, natural gas, energy blog, energy supply, distributed generation, current outlook, heating demand, electricity markets, Energy Prices, Energy Trends, Fixed Prices, Weak Spot Prices

ERCOT's Latest CDR Report Shows Higher Reserve Margins: How Will This Affect Regulatory Policy?

Posted by Jennifer Chang on Mar 5, 2014 10:15:00 AM

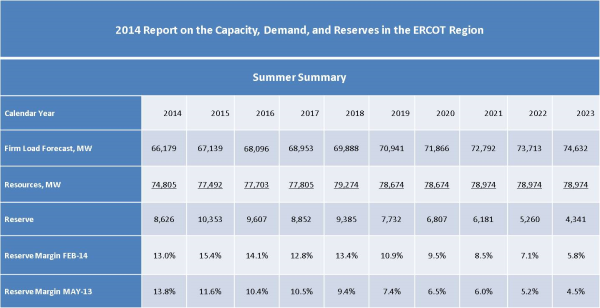

On Friday, February 28, ERCOT published its 2014 Capacity, Demand and Reserves (CDR) report. Resource adequacy has been at the forefront of ERCOT’s electricity policy debate. Forecasting future demand is critical for planning purposes to determine how much generation will be needed in future years to meet peak demand. Resource adequacy concerns have prompted the PUCT to approve mechanisms that increase the duration and frequency of scarcity pricing signals in ERCOT to support adequate generation development in the state. One measure, that has also encouraged some Commercial and Industrial customers to take advantage of higher prices through prices response (load shedding and Distributed Generation (DG) dispatch), is the October 2012 decision to increase the system-wide offer cap to the following levels, effective on the dates below:

Topics: ERCOT, risk management, Energy Solutions, energy procurement, demand response, energy reliability, power generation, Weekly Energy Insights, reserve margin, energy price spikes, energy blog, reserve, report, energy efficiency, U.S. energy, PUCT, forecasting, CDR, capacity, demand, load shedding, distributed generation, scarcity pricing, current outlook

Energy Future Holdings-Is a Bankruptcy Filing Looming?

Posted by Jennifer Chang on Feb 28, 2014 12:48:00 PM

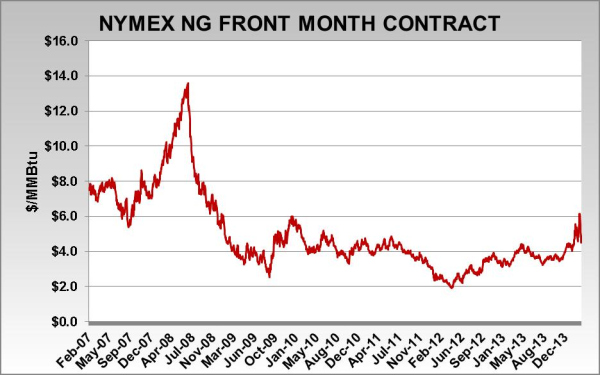

On October 10, 2007, the largest leveraged buy-out in American history was completed by Kohlberg Kravis Roberts, Texas Pacific Group and Goldman Sachs Capital Partners. Energy Future Holdings (EFH), executed a merger agreement to acquire all the shares of the publicly traded TXU Corp for $45 billion (32 billion plus $13billion in assumed debt). All parties agreed to the deal in February 2007, and in September 2007, TXU shareholders had approved the takeover. EFH ended up with a portfolio of competitive and regulated energy companies:

Topics: TXU, bankruptcy, Energy Future Holdings, TXU Energy, ERCOT, energy sourcing, Acclaim Energy Advisors, energy management consulting, energy, Energy Solutions, energy procurement, demand response, energy reliability, energy costs, Weekly Energy Insights, energy management, energy blog, DLO 365, U.S. energy, curtailment, NYMEX

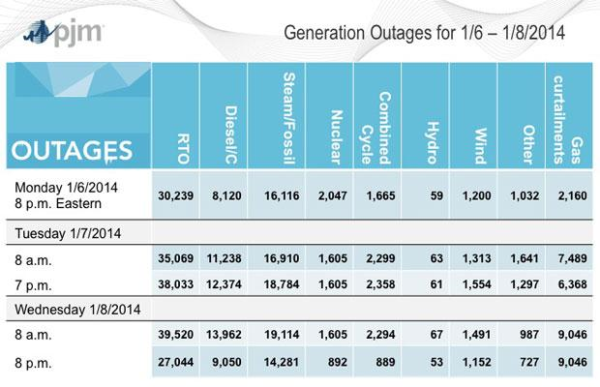

Arctic Blast Shuts Down 20% of PJM's Installed Capacity-Conservation, Demand Response and Power Imports Save the Day

Posted by Jennifer Chang on Jan 12, 2014 10:49:00 AM

PJM is the largest regional transmission organization (RTO) in the U.S. and coordinates wholesale operations in all or parts of Delaware, Illinois, Indiana, Kentucky, Maryland, Michigan, New Jersey, North Carolina, Ohio, Pennsylvania, Tennessee, Virginia, West Virginia and the District of Columbia.

Topics: ERCOT, energy risk management, Acclaim Energy Advisors, energy management consulting, risk management, energy, Energy Solutions, energy procurement, weather outlook, reliable energy, energy regulations, energy reliability, PJM, energy savings, energy costs, Weekly Energy Insights, energy management, energy price spikes, energy blog, power outages, Winter Weather, U.S. energy, load generators, RTO

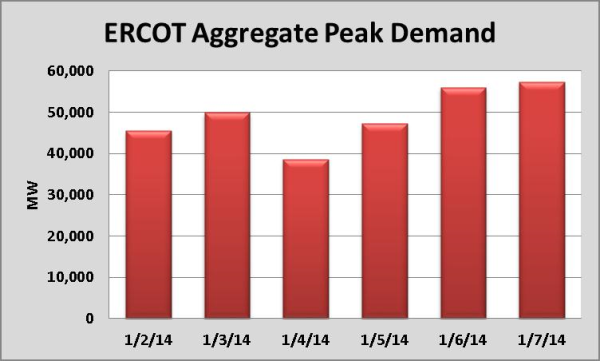

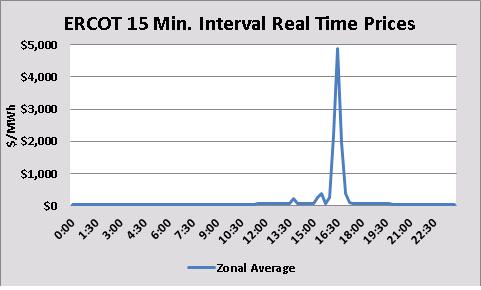

ERCOT Sets New Winter Peak Demand- Real Time Prices Hit $5,000/MWh Cap on January 6, 2014

Posted by Jennifer Chang on Jan 8, 2014 12:59:00 PM

Topics: Heat Rate, REP, ERCOT, Acclaim Energy Advisors, energy management consulting, risk management, energy, Energy Solutions, energy procurement, weather outlook, energy regulations, energy reliability, energy savings, energy costs, Weekly Energy Insights, Event, energy management, energy management consultants, energy price spikes, Price Spike, Winter Weather, U.S. energy, Peak Demand, Emergency

The Negawatts Evolution: The Maturation of Demand Response

Posted by Jennifer Chang on Dec 9, 2013 12:06:00 PM

Several decades ago the term “negawatt” gained notoriety; however, as deregulated markets have developed and with the rise of Demand Response (DR) programs, the concept of reducing energy spend through the deployment of more energy efficient technologies has evolved into something larger. The negawatt concept has expanded from its foundation with the growth in utility and Independent System Operator (ISO) DR programs. Another important, and more recent, development has been the growth of economic price response, which is the ability to add capacity to the grid or shed load when real-time market conditions create financial incentives. The combination of flexible distributed generation, access to real-time price data, and ”structural incentives” in deregulated markets have enabled end-users to profit from these programs andactivities. In ERCOT for example, these incentives include price scarcity mechanisms (Operating Reserve Demand Curve) and system-wide offer caps that will increase to $9,000/MWh on June 1, 2015. Aside from generating revenues for end-users, these measures will contribute to improve balance between supply and demand, and support overall grid reliability.

Topics: Negawatt, ERCOT, energy risk management, Acclaim Energy Advisors, energy management consulting, energy, Energy Solutions, energy procurement, demand response, energy regulations, energy savings, energy costs, Weekly Energy Insights, energy management, dynamic load optimization 365, DLO 365, curtailment

ERCOT Revamping Power Forecasting Methodologies: Reserve Margin Challenges

Posted by Jennifer Chang on Dec 5, 2013 6:45:00 PM

There has been significant debate, quite heated at times, surrounding the future structure of the Texas electricity market that the Electric Reliability Council of Texas (ERCOT) manages. The discussion has been centered on several topics, including how to ensure that there is sufficient generation capacity in the state to meet future electricity needs. On October 25, 2013, without a final vote, two out of the three Public Utility Commission of Texas (PUCT) commissioners expressed support for a mandatory reserve margin to address resource adequacy concerns. At this time, ERCOT’s board does not plan to take action on proposed changes to the target reserve margin until the PUCT provides further direction. In the meantime, ERCOT has been working on revamping its load forecasting assumptions and its methodologies are being re-examined and may be more important than ever. ERCOT’s staff has also been working to refine its load forecast models and process, and will update the board on these proposed changes on December, 10,2013. Therefore, the release of the next Capacity, Demand and Reserve report will be postponed.

Topics: ERCOT, energy risk management, Acclaim Energy Advisors, energy management consulting, energy, energy procurement, energy regulations, energy savings, reserve margin, PUCT, forecasting

ERCOT RT Prices Hit New High: Energy Risk Management Questions Raised

Posted by Dennis Vegas on Sep 12, 2013 11:59:00 AM

While the 2013 summer months were relatively mild by Texas standards, the first week of September produced one surprise. On 9/3/2013, the Electric Reliability Council of Texas (ERCOT), reported a 15 minute interval Real Time price spike, which neared the current $5,000/MWh price cap. The market clearing price at 4:30pm (or 1630) was $4,900/MWH or $4.90/kWh when temperatures and power usage were high. While the $4,900/MW price only lasted one 15 minute interval, the simple average price across all load zones for hour ending 5:00pm was $2,333/MWh, or $2.333/kWh.

Topics: ERCOT Heat Rates, ERCOT, energy risk management, energy sourcing

Demand Response Is Booming: Are You Leaving Money On The Table?

Posted by Dennis Vegas on Sep 11, 2013 7:05:00 AM

Too often, energy risk management professionals focus on one side of the energy equation, specifically the supply contract. While this is certainly a critical piece of any procurement or strategic energy sourcing approach, it can lead to real value being left on the table for the end user through too much focus on the supply side. A thorough energy risk management strategy will account for the possibility of generating additional revenues through participation in various demand response programs. Of course, the value of those demand response programs will vary based on the type of consumer, their ability to curtail usage, availability of back-up generation and which of the various demand response programs they choose or are able to participate in . With these factors in mind, it is important to evaluate the options for demand response based on each customer’s unique profile.

Basics of Demand Response

Topics: ERCOT, energy risk management, demand response, energy reliability, PJM