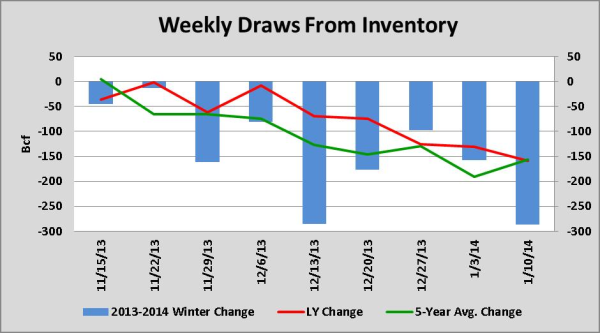

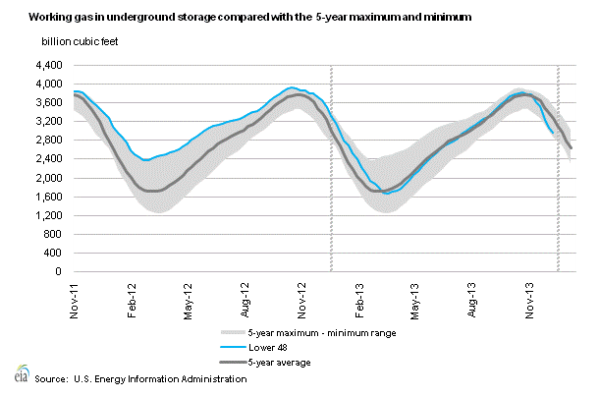

So far, the 2013-2014 winter has been exceptionally cold across the eastern half of the U.S. Arctic outbreaks and the bitter cold winds from the Polar Vortex have spilled across major natural gas consuming regions. Massive draws from inventory have been needed to meet surging demand for heating from the residential, commercial and electric power sectors. This season has been characterized by withdrawals that have been much larger than average.

Natural Gas Market Supplies Tighten On Higher Than Normal Draws- Are You Protected Against Price Spikes?

Posted by Jennifer Chang on Jan 21, 2014 10:18:00 AM

Topics: Heating Season\, Polar Vortex, energy risk management, energy sourcing, Acclaim Energy Advisors, energy management consulting, risk management, energy, energy procurement, demand response, energy regulations, energy reliability, energy costs, power generation, Weekly Energy Insights, natural gas, energy management, energy management consultants, energy price spikes, Price Spike, energy blog, Natural Gas Supply, energy supply, U.S. energy, capacity markets, refueling season

More Nuclear Power Plants to Refuel in 2014 Compared to 2013: How Could This Affect Natural Gas Prices?

Posted by Jennifer Chang on Jan 17, 2014 1:34:00 PM

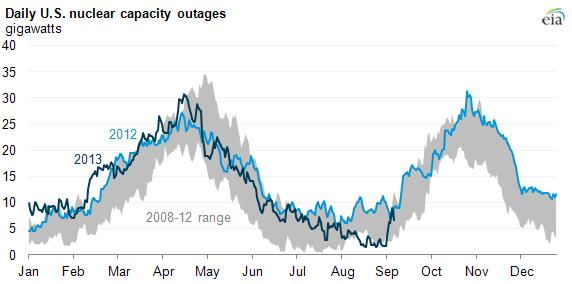

Platts recently reported that the 58 U.S. nuclear power plants totaling almost 60,000MW are expected to refuel in 2014, compared to 54 units totaling over 55,000MW in 2013. The analysis is based on historical refueling data from the US Nuclear Regulatory Commission.

Topics: energy risk management, Acclaim Energy Advisors, energy management consulting, energy procurement, reliable energy, energy regulations, energy reliability, energy costs, power generation, Weekly Energy Insights, energy management, energy price spikes, Price Spike, power outages, U.S. energy, capacity markets, nuclear units, power plants, refueling season

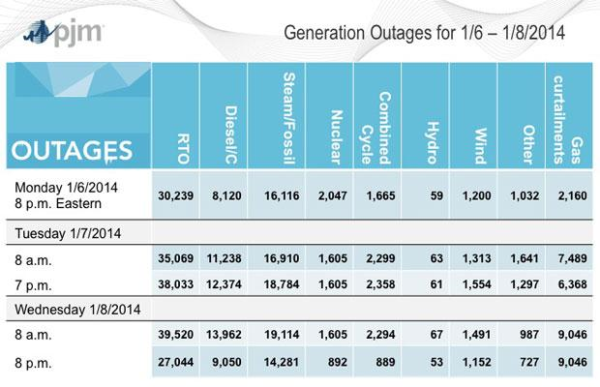

Arctic Blast Shuts Down 20% of PJM's Installed Capacity-Conservation, Demand Response and Power Imports Save the Day

Posted by Jennifer Chang on Jan 12, 2014 10:49:00 AM

PJM is the largest regional transmission organization (RTO) in the U.S. and coordinates wholesale operations in all or parts of Delaware, Illinois, Indiana, Kentucky, Maryland, Michigan, New Jersey, North Carolina, Ohio, Pennsylvania, Tennessee, Virginia, West Virginia and the District of Columbia.

Topics: ERCOT, energy risk management, Acclaim Energy Advisors, energy management consulting, risk management, energy, Energy Solutions, energy procurement, weather outlook, reliable energy, energy regulations, energy reliability, PJM, energy savings, energy costs, Weekly Energy Insights, energy management, energy price spikes, energy blog, power outages, Winter Weather, U.S. energy, load generators, RTO

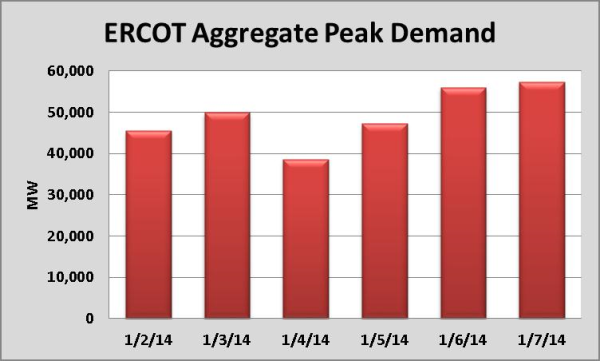

ERCOT Sets New Winter Peak Demand- Real Time Prices Hit $5,000/MWh Cap on January 6, 2014

Posted by Jennifer Chang on Jan 8, 2014 12:59:00 PM

Topics: Heat Rate, REP, ERCOT, Acclaim Energy Advisors, energy management consulting, risk management, energy, Energy Solutions, energy procurement, weather outlook, energy regulations, energy reliability, energy savings, energy costs, Weekly Energy Insights, Event, energy management, energy management consultants, energy price spikes, Price Spike, Winter Weather, U.S. energy, Peak Demand, Emergency

Winter Storm Hercules-Boosts Near-Term Demand for Natural Gas

Posted by Jennifer Chang on Jan 3, 2014 12:59:00 PM

Midwest and Northeast residents have not experienced an arctic blast of this magnitude in more than a decade. The system has moved eastward from Illinois through New England. The all-time record low in Chicago of -11˚F was recorded in 1994 and temperatures on January 6 are expected to be -6˚F, very close to such record. Not only is the storm dumping considerable amounts of snow (5” - 12”), but it is also bringing frigid, below normal temperatures with the coldest air so far this season. Temperatures are expected to be between 20˚F - 40˚F below average in large parts of the continental U.S. through next week. Moreover, sustained 15-50MPh winds are expected, so blizzard warnings have been issued in Cape Code and Long Island. An additional storm behind Hercules will keep temperatures well below normal through early next week.

Topics: energy sourcing, Acclaim Energy Advisors, energy management consulting, risk management, energy, Energy Solutions, energy procurement, weather outlook, reliable energy, energy regulations, energy reliability, energy savings, energy costs, power generation, Weekly Energy Insights, energy management consultants, Texas, dynamic load optimization 365, DLO 365, Winter Weather, U.S. energy, exports

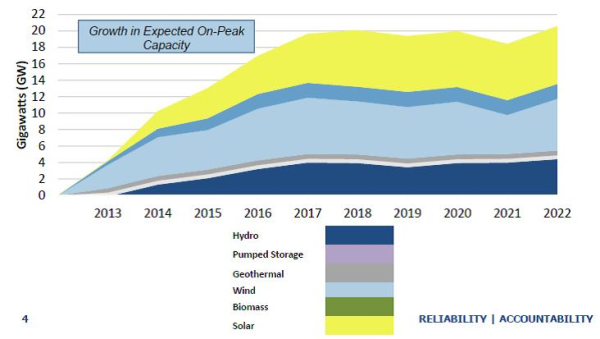

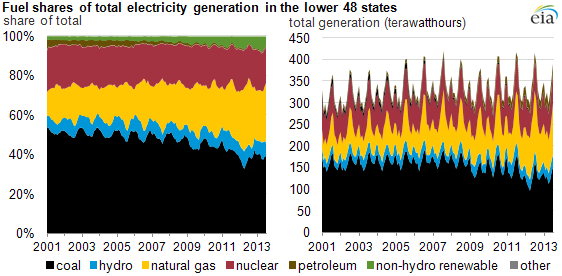

A great deal has been made out of the need to shift away from coal fired power plants and toward renewable energy sources, such as wind and solar in the U.S. While this is certainly a laudable goal, the full impact of a move to renewable power generation has consequences beyond simply reducing emissions and finding alternative power sources. Specifically, determining how to effectively integrate these new power sources, particularly wind and solar, which are highly variable and can go from zero to full production almost instantaneously, pose significant challenges for grid operators.

Topics: system operators, coal, energy risk management, energy sourcing, Acclaim Energy Advisors, risk management, energy, energy procurement, demand response, energy regulations, energy reliability, energy savings, energy costs, power generation, Weekly Energy Insights, natural gas, economic demand response, energy management consultants, strategic energy sourcing, energy price spikes, renewable energy, energy supply, U.S. energy, load generators

The Negawatts Evolution: The Maturation of Demand Response

Posted by Jennifer Chang on Dec 9, 2013 12:06:00 PM

Several decades ago the term “negawatt” gained notoriety; however, as deregulated markets have developed and with the rise of Demand Response (DR) programs, the concept of reducing energy spend through the deployment of more energy efficient technologies has evolved into something larger. The negawatt concept has expanded from its foundation with the growth in utility and Independent System Operator (ISO) DR programs. Another important, and more recent, development has been the growth of economic price response, which is the ability to add capacity to the grid or shed load when real-time market conditions create financial incentives. The combination of flexible distributed generation, access to real-time price data, and ”structural incentives” in deregulated markets have enabled end-users to profit from these programs andactivities. In ERCOT for example, these incentives include price scarcity mechanisms (Operating Reserve Demand Curve) and system-wide offer caps that will increase to $9,000/MWh on June 1, 2015. Aside from generating revenues for end-users, these measures will contribute to improve balance between supply and demand, and support overall grid reliability.

Topics: Negawatt, ERCOT, energy risk management, Acclaim Energy Advisors, energy management consulting, energy, Energy Solutions, energy procurement, demand response, energy regulations, energy savings, energy costs, Weekly Energy Insights, energy management, dynamic load optimization 365, DLO 365, curtailment

Liquified Natural Gas Exports: What This Means for U.S. Consumers

Posted by Jennifer Chang on Nov 22, 2013 11:36:00 AM

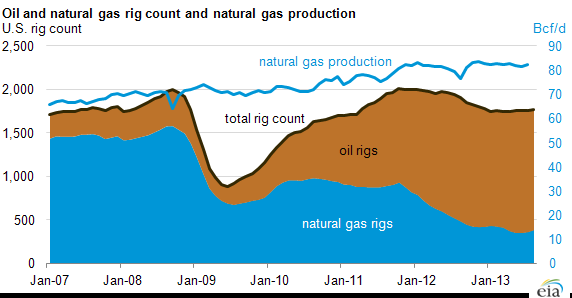

The rise of fracking has shifted the U.S. natural gas market at fundamental levels that are not yet fully understood or appreciated. In fact, there is a strong argument to be made that as fracking and other recovery technologies continue to improve, the U.S. will become a major energy provider. By exporting copious amounts of liquefied natural gas (LNG), the U.S. will achieve greater energy independence by cutting back on imports of foreign crude oil products. A massive shift in the global energy markets is neither that far-fetched nor far off and will likely take place over the next decade. As discussed in greater detail below, natural gas has the potential to become a globally traded commodity like crude oil.

Topics: energy risk management, Acclaim Energy Advisors, energy, Energy Solutions, energy procurement, energy regulations, energy reliability, energy savings, Weekly Energy Insights, energy management, exports

For years, coal has been the dominant fuel source for power generation in the U.S.. However, recent changes in the market place, including tighter emissions restrictions imposed by the Environmental Protection Agency (EPA) and low natural gas prices from abundant shale gas suppliers, threaten coal’s dominance as the leading fuel source for generation. An analysis conducted by the Department of Energy (DOE) was published in August and predicted that between 35 and 60 gigawatts of coal-fired electricity generation in the eastern half of the country will be retired within the next five years. Therefore, new generation, transmission investments and reliability must run (RMR) contracts will be needed to maintain grid reliability. Natural gas fired generation will most likely fill the bulk of the gap left by the coal retirements. The impact of retirements and the higher operation costs of the remaining coal plants will trigger an increase in prices. This effect will be magnified in regions that are more dependent on coal fired generation, like the Midwest.

Topics: coal, energy risk management, Acclaim Energy Advisors, energy, Energy Solutions, energy procurement, energy regulations, Weekly Energy Insights, energy management, U.S. energy

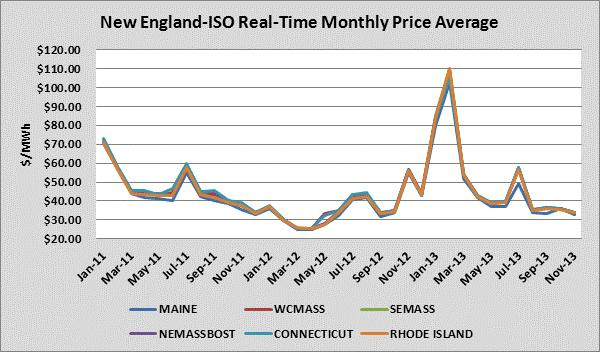

New England (NE) Market- Reasons Behind Winter Energy Price Spikes

Posted by Jennifer Chang on Nov 12, 2013 8:56:00 PM

The U.S. 2011/2012 winter was the fourth warmest on record. NE energy end users who were exposed to the spot market were rewarded with very low prices. Nevertheless, the U.S. 2012/2013 winter was significantly colder despite being the twentieth warmest winter on record. Despite a mild winter start, last January had a large number of days below freezing and February was the fifth snowiest on record. Consequently, natural gas and electricity end users in NE who were exposed to index prices, found themselves facing significantly higher energy costs on the spot market. During these two months, unusually cold temperatures triggered price spikes due to forced plant outages, which caused reliability problems within the grid. To circumvent these issues, the entity responsible for maintaining electric reliability, the New England Independent System Operator (ISO-NE), was forced to dispatch higher cost power plants. The chart below shows historical monthly Real-Time prices across multiple Load Zones. Across these Load Zones, the average prices for the months of January 2013 and February 2013 were $83.54/MWh and $107.49/MWh. These prices were significantly higher than this period the previous year.

Topics: Acclaim Energy Advisors, energy management consulting, energy, weather outlook, Weekly Energy Insights, energy management consultants, Winter Weather, new england